The EUR/USD currency pair continued to trade higher on Tuesday. The price has successfully overcome the moving average line, so the trend has changed to an upward one. However, it is still quite difficult to even guess how long the upward movement will continue. Recall that the results of the meetings of the ECB and the Bank of England will be summed up tomorrow. The market reaction should follow these two events. In addition, several important reports will be published in the States, which should also affect the movement of the two main pairs. However, now we are trying to figure out what happened over the last two trading days. Namely: the euro currency and the pound sterling rose quite a lot on Monday and Tuesday, without having any fundamental and macroeconomic reasons for this. If the euro currency had risen by 60-70 points in total in two days, then there would be no questions. Just because of such a weak movement in market noise. However, when, for no reason at all, the euro currency is growing by 100 points per day, without having any reasons for this (even technical), it makes you ask questions. Moreover, on Monday, the European Union published a report on GDP for the fourth quarter, which turned out to be worse than even the weakest forecasts. Therefore, the euro currency absolutely should not have become more expensive either on Monday or on Tuesday. Thus, we can associate this upward movement of the pair only with the upcoming announcement of the results of the ECB meeting. Perhaps traders are 100% sure that the results will be "dovish" and on Thursday, in this case, the sale of the euro currency will follow. Thus, the pair needs to be pre-adjusted before a new fall.

It makes no sense for the ECB to raise the rate. Inflation may start to slow down by itself.

Well, today we really should focus exclusively on the ECB meeting. Although there is very little hope for the "hawkish" rhetoric of Christine Lagarde, and even more so for any "hawkish" decisions on monetary policy, such an event cannot remain without the attention of the market. Market participants even put about a 20% probability that by the end of this year the ECB will raise the key rate once. However, the probability of 20% is practically nothing. We believe that if today's report on inflation in the Eurozone shows a slowdown, it will be practically a verdict for the euro currency. After all, at the moment, inflation in the EU has accelerated to 5% and it is its further growth that can serve as an impetus for raising the rate at least next year. However, if inflation starts to slow down by itself (without any action by the ECB), this will confirm the words of Christine Lagarde, who just recently said that inflation will begin to decline, and the regulator is not going to raise the rate shortly. It will also confirm what the market has known for a long time: the European economy is now too weak to tighten monetary policy. Inflation can very quickly return to 2% at this rate, and in this case, why would the European Central Bank raise the rate? By the way, such a sharp discrepancy between the States and the EU proves once again that much more money was poured into the economy in America under the QE program than in the EU, which we wrote about all last year. However, this is what is playing a cruel joke with the Eurozone. The economic recovery is rather weak, unemployment is quite high, and inflation may begin to slow down as early as January, which generally makes any tightening of monetary policy meaningless. Therefore, the gap between the ECB and the Fed rates may continue to widen in 2022, which will provide long-term support for the US currency. And the euro currency can only count and hope that the buyers of the dollar will sooner or later get enough and playoff all the factors of raising the rate and unloading the balance of the Fed in advance. Therefore, the dollar will not rise in price throughout 2022.

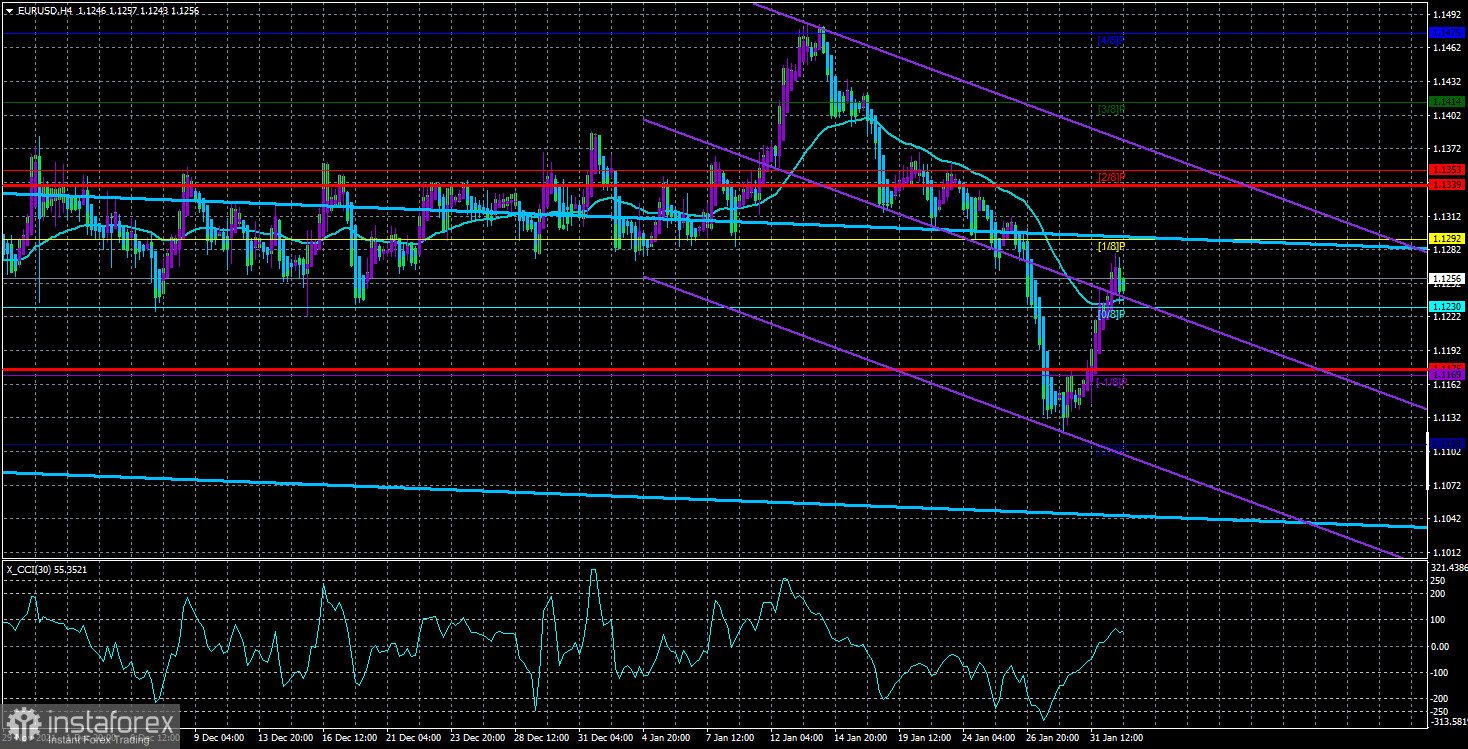

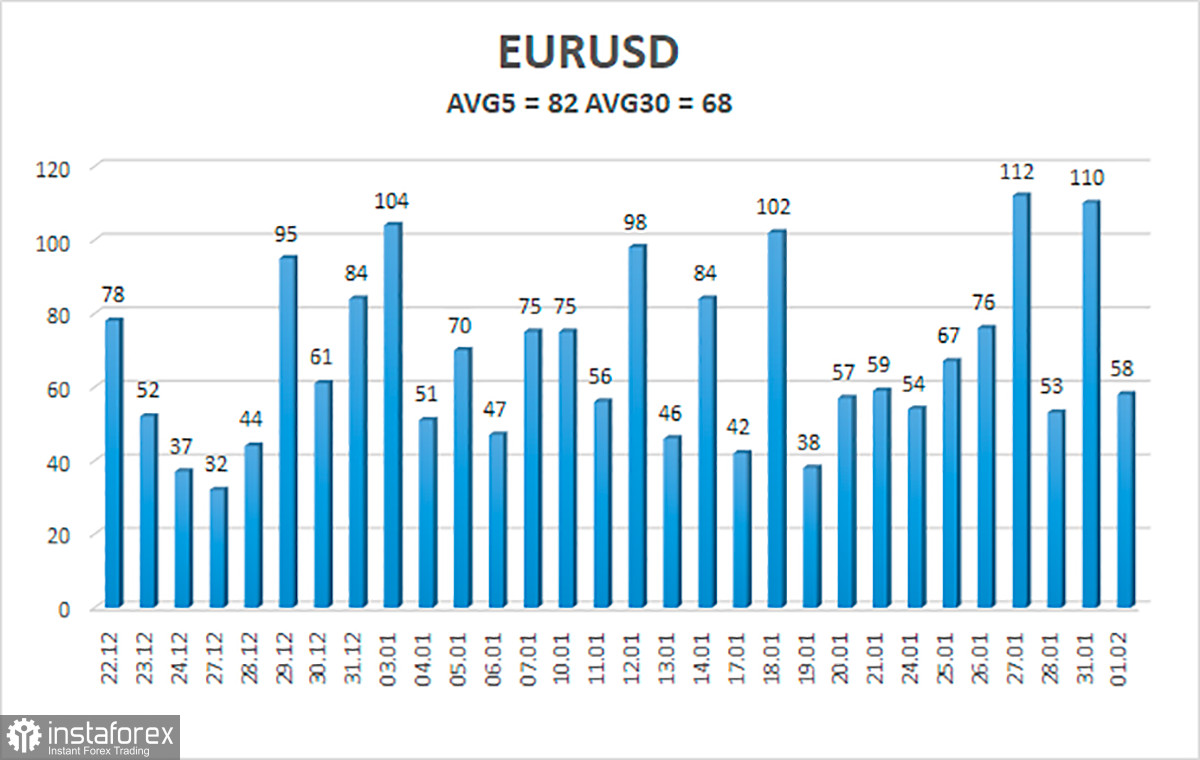

The volatility of the euro/dollar currency pair as of February 2 is 82 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1175 and 1.1339. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.1230

S2 – 1.1169

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1353

R3 – 1.1414

Trading recommendations:

The EUR/USD pair has consolidated above the moving average line. Thus, now it is necessary to stay in long positions with targets of 1.1292 and 1.1339 until the price is fixed below the moving average. Short positions should be opened no earlier than the price-fixing below the moving average line with a target of 1.1175.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română