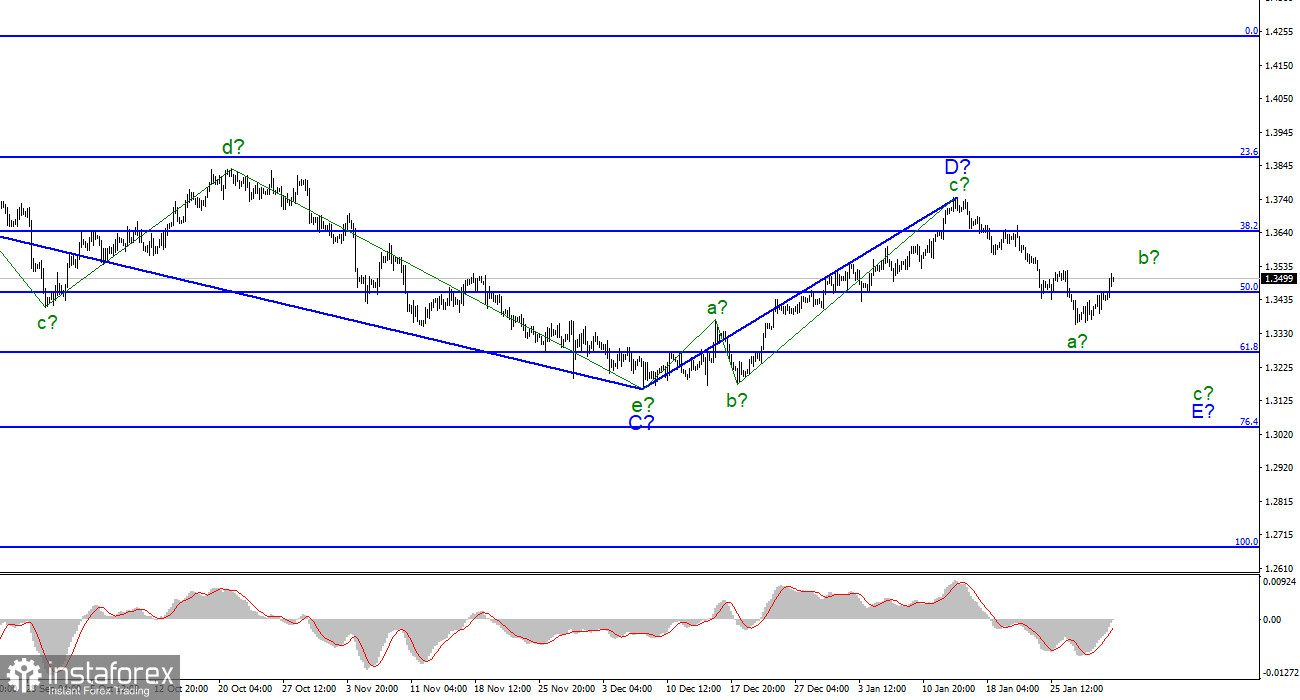

For the pound/dollar pair, the wave markup continues to look comprehensive. In the last few weeks, the pair has been building a new downward wave, which is currently interpreted as wave E of the downward trend segment. There is an increase inside this wave, which may be wave b in E. If this is true, then the pound sterling is likely to resume a downward movement in the next few days. Internal waves are hardly visible inside wave E. Therefore, three waves may also be inside wave b in E. In this case, the pair may continue to rise until Friday as it will take time to build the entire wave b. However, after its completion, the quotes are likely to decline within wave C in E with the target level located around the 30 level.

UK PM Boris Johnson apologizes for attending the lockdown party. However, he is not going to resign

The pound/dollar pair increased by another 60 pips on February 1. Thus, over the last two days, it has gained about 110 pips. Notably, it climbed higher lacking any drivers. Yesterday, the economic calendar for the UK and the US was uneventful. Today, only a couple of hours ago, the US ISM Manufacturing Index was unveiled. The reading was almost in line with market expectations. Economists forecast that the figure would be 57.5 or 58.0. The actual reading totaled 57.6. Therefore, this data did not affect the pound sterling.

At the same time, in the UK, the opposition gave up hopes of getting rid of Boris Johnson. They wished he would resign without the procedure of declaring a vote of no confidence. The Labour Party and its leader Keir Starmer called on Johnson to resign amid scandals with parties in Downing Street during the lockdown. Boris Johnson simply apologized for his behavior and the behavior of his colleagues. He said that he did not know about the ban on such parties during quarantine. He also informed that investigation into parties took place. After that, he immediately shifted attention to the growing tensions in Ukraine. Market participants are now anticipating the Bank of England meeting this Thursday, as well as important economic reports on the labor market and unemployment in the United States on Friday. These events may help the pound sterling climb higher or push it down. The economic calendar was empty on Monday and Tuesday but the British currency had been rising all those days. Apparently, trading activity is likely to be quite high.

Conclusion

The wave pattern of the pound/dollar pair shows the construction of wave E. At the moment, the construction of an internal corrective wave has begun, which may end in a few days. I still expect the resumption of a decline on Thursday evening or Friday. Besides, short positions can be quite gainful now. Yet, it is better to wait for the results of the Bank of England meeting.

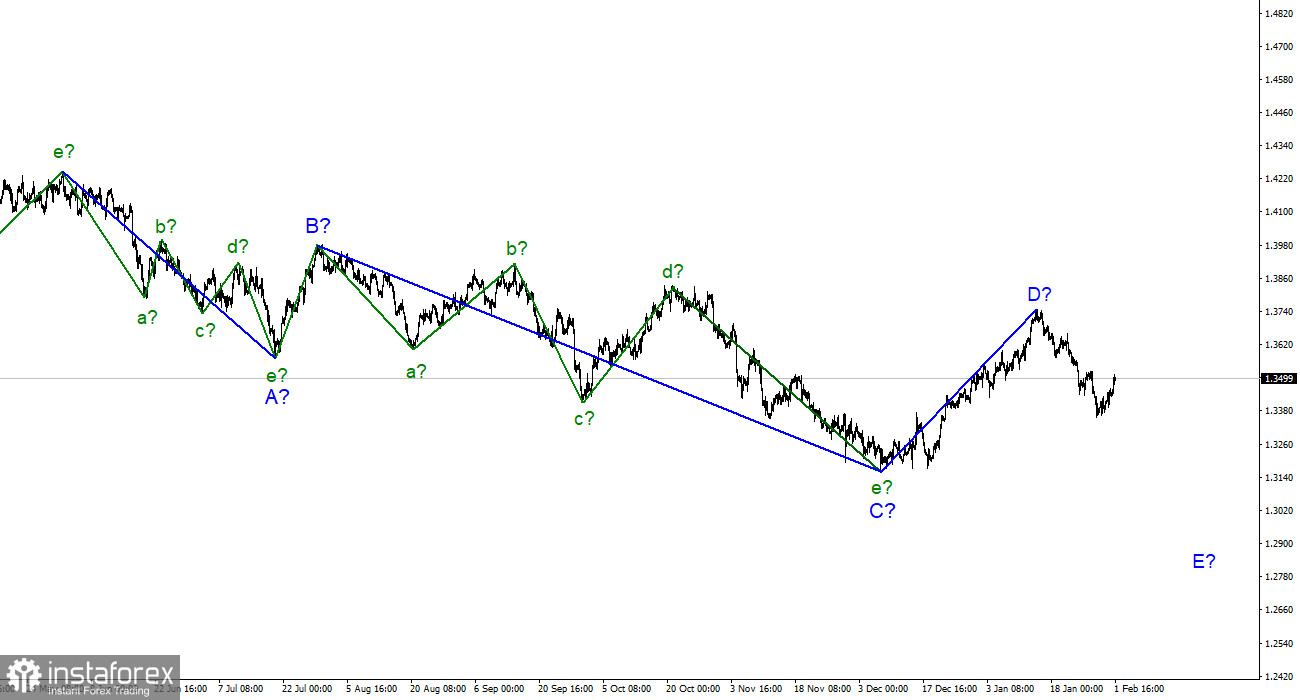

On the larger timeframe, wave D also looks complete, while the entire downward trend section, on the contrary, looks incomplete. Therefore, in the coming weeks, I expect a resumption of the downward movement of the pair with the target levels below the low of wave C. Wave D turned out to be three-wave, so I cannot interpret it as wave 1 of a new upward trend segment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română