JPMorgan research report says Bitcoin's biggest problem is its volatility and boom-and-bust (alternate periods of high and low levels of activity) cycles that hinder further institutional adoption.

Analysts led by Nikolaos Panigirtzoglou wrote that based on the volatility ratio of Bitcoin and gold, the bank's estimate of the fair value of Bitcoin has declined by about four times, or to $38,000.

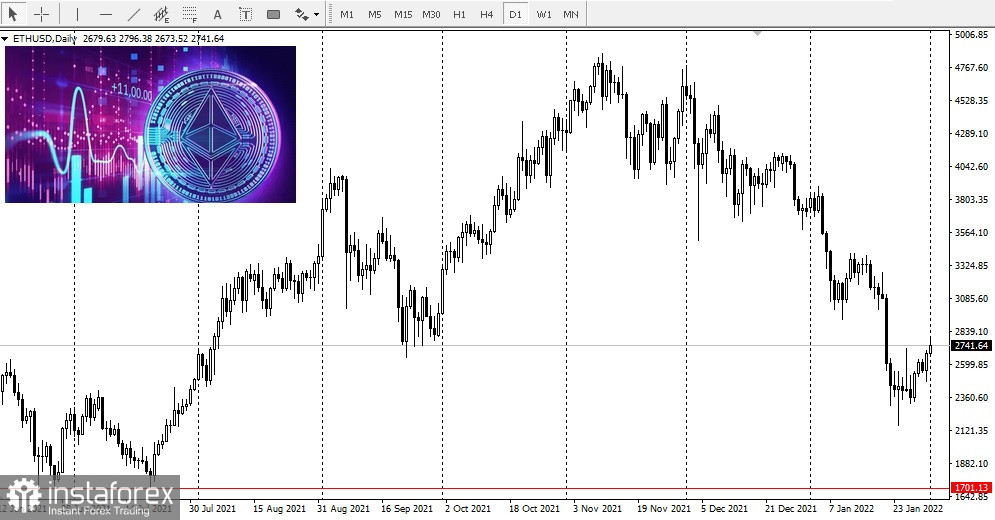

JPMorgan said its previous forecast of roughly halving the bitcoin-to-gold ratio now seems unrealistic. The bank sees significant hurdles for both Bitcoin and Ethereum.

JPMorgan said its previous forecast of roughly halving the bitcoin-to-gold ratio now seems unrealistic. The bank sees significant hurdles for both Bitcoin and Ethereum.

The investment bank also noted that the mission of Ethereum (ETH) is different from Bitcoin since its value is derived not as a form of digital gold, but as a decentralized application currency.

According to the bank, the Ethereum blockchain is facing challenges due to declining market share in the decentralized finance (DeFi) and non-fungible token (NFT) sectors. They also added that during the market correction this month, Ethereum failed to win market share from its main competitors, with its prices falling by a similar amount compared to smaller alternative coins (altcoins).

The bank also said that the collapse of futures contracts with leverage has played a vital role in the correction of the crypto space over the past two weeks, as in May last year, but the collapse of positions this month seems less serious.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română