On Monday, Bitcoin ended a rough month, as January's slumps forced the digital coin to adjust to its worst start of a year since the 2018 "crypto-winter"

According to Bloomberg, the largest cryptocurrency by market value was rising for 11 days in January, i.e bitcoin was declining 65% of the month. Besides, other digital tokens suffered heavy losses, with Ethereum dropping about 30% since late December.

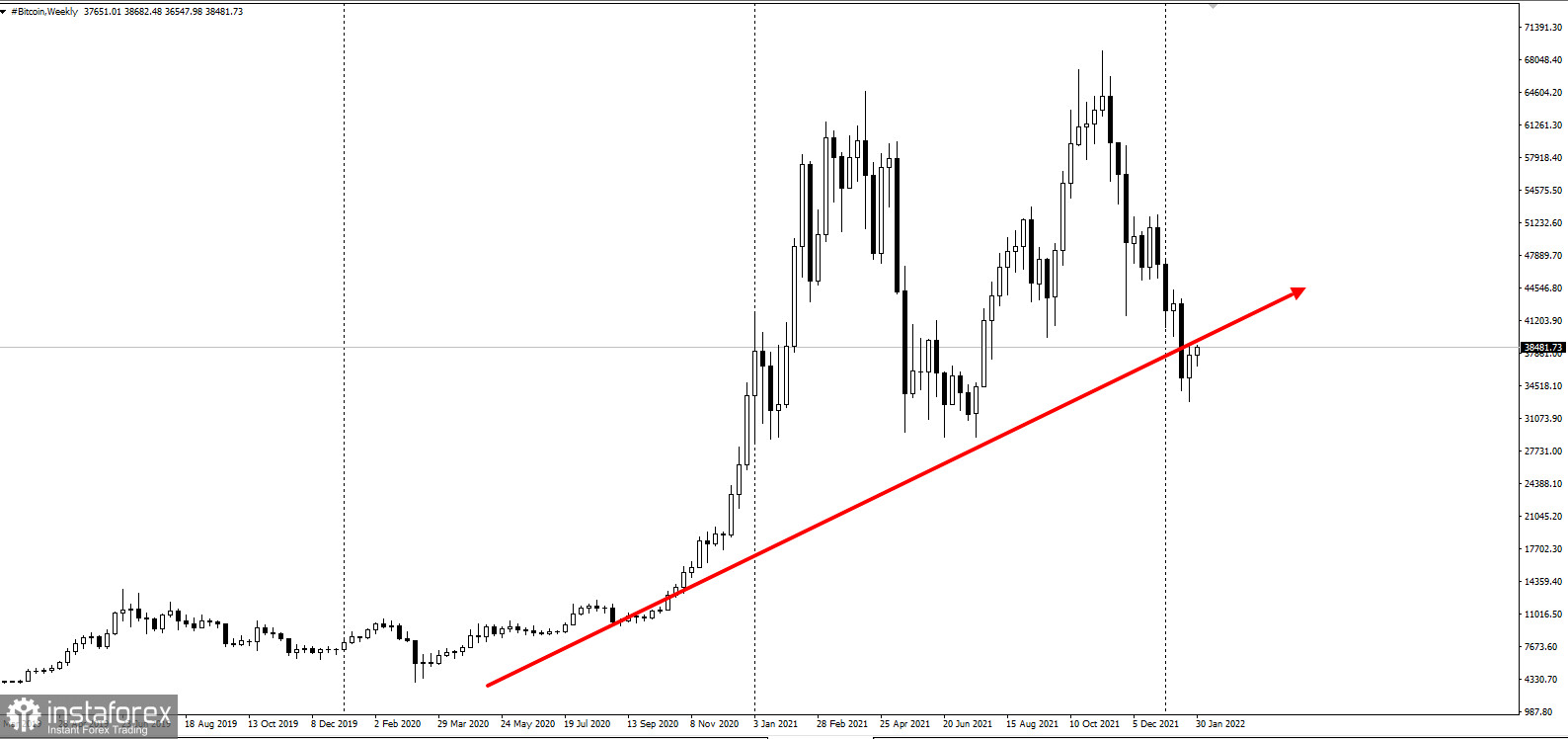

Bitcoin fell to $33,000 in January from a record high of nearly $69,000 less than three months ago amid a broader sell-off in risky assets. The reason for its decline was growing confidence that the Federal Reserve will soon raise interest rates as it tightens its dovish policy. The plunge has affected the whole crypto market from bitcoins and meme coins to public crypto exchanges and miners.

"Cryptocurrency is a very volatile asset class — and I hope that everyone participating in that market is aware of the volatility potential. It's a much trickier environment than it was six months ago, 12 months ago, 18 months ago where it was "green light go". Now it's "yellow-light caution"", chief market strategist at FS Investments Troy Gayesky said.

"I've always said if you're uncomfortable waking up to a 30%, 40%, even 50% decline for whatever reason, you probably shouldn't own," Gayeski said.

On Monday, Bitcoin fell by 2.9% and traded at around $36,680 before recouping losses. Its monthly decline is now more than 18%, the worst start to a year since a 29% drop in 2018 and a dismal follow-up to December's 19% slump.

"Macro sentiment around risk assets has been the leading narrative in the markets with expectations of significant tapering of quantitative easing after a string of hot inflationary prints", analysts wrote in the report. They said that digital-asset investment products had seen outflows for the first time since August, with weekly outflows averaging $88 million in January. Analysts added that total assets under management for Bitcoin products had fallen by 23% since December.

Bitcoin lost nearly 50% from its November peak to its January lows. According to Goldman Sachs strategists Zach Pandl and Isabella Rosenberg, this decline puts it at "the low end of a range" of big drawdowns. It is estimated that there have been five previous major pullbacks of the coin from all-time highs since 2011, with an average peak-to-trough of 77%. On average, the decline lasted seven to eight months. However, Bitcoin's largest cumulative drop of 93% occurred in 2011.

While the market's recent turbulence may not be as rattling to cryptocurrency veterans who are accustomed to its volatility, many investors entered the market relatively recently, making the rapid decline particularly painful.

Memories of the last "crypto-winter"— a phrase endemic to the digital-asset space that refers to a sharp downturn followed by months of stagnation — are renewing fears that a repeat could occur currently. The last such decline happened in 2018, when bitcoin fell roughly 80% and it subsequently took more than a year to reach a new high.

"While the sell-off in Bitcoin has been relatively muted going into this week, the outlook for the cryptocurrency market as a whole remains negative with heavy losses seen across a range of once-popular altcoins. If the market as a whole is looking to Bitcoin to lead the way higher, it is most likely to be disappointed", strategist at DailyFX Nicholas Cawley said.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română