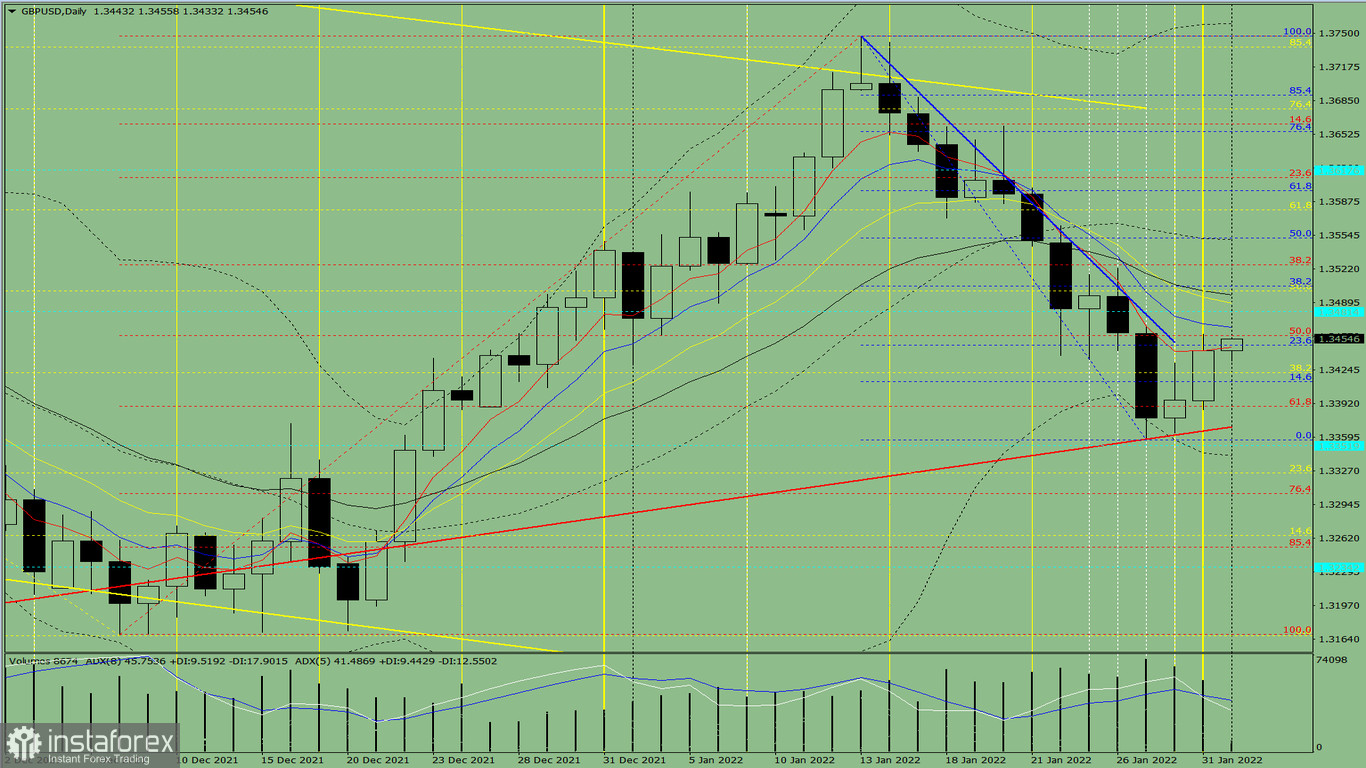

Trendy analysis (picture 1)

On Tuesday, GBP/USD is going to try to extend its upward move from 1.3443 that matches the level of yesterday's closing daily candlestick. The target for today is 1.3505 that is the 38.2% Fibonacci retracement plotted by the blue dotted line. If this level is tested, we could trade the pair upwards with the target at 1.3552 that matches the 50.0% Fibonacci retracement plotted by the blue dotted line.

Picture 1 (daily chart)

Complex analysis

Indicator analysis – up

Fibonacci levels – up

Trade volume – up

Candlestick analysis – up

Trendy analysis – up

Bollinger bands – up

Weekly chart - up

Bottom line

Today, GBP/USD is going to try to extend its upward move from 1.3443 that matches the level of yesterday's closing daily candlestick. The target for today is 1.3505 that is the 38.2% Fibonacci retracement plotted by the blue dotted line. If this level is tested, we could trade the pair upwards with the target at 1.3552 that matches the 50.0% Fibonacci retracement plotted by the blue dotted line.

Alternative scenario

The currency pair might try to continue its upward move from 1.3443, the level of closing yesterday's daily chart. The target is seen at 1.3481 that is the historic resistance level plotted by the blue dotted line. If tested, we could trade GBP/USD downwards with the target at 1.3458 that matches the 50.0% Fibonacci retracement plotted by the red dotted line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română