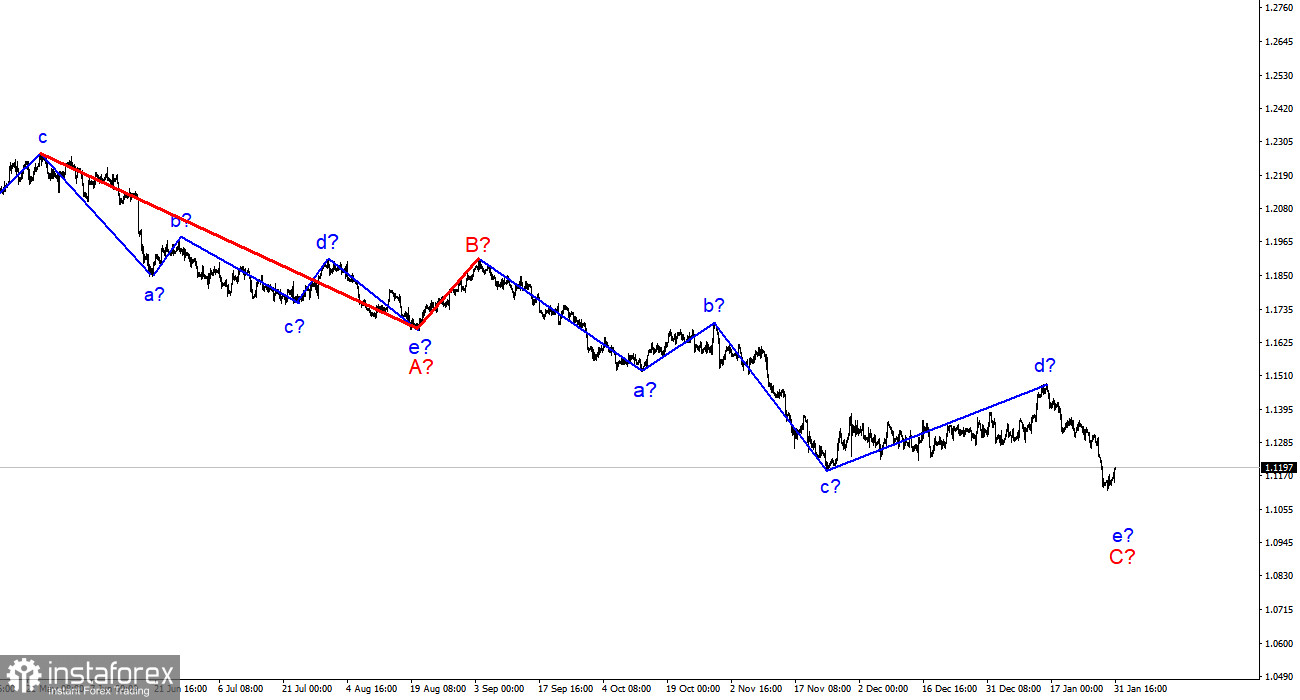

The wave marking of the 4-hour chart for the euro/dollar instrument still looks convincing. Wave d turned out to be longer than I originally expected, but this does not change the essence of the wave marking. The decline in the quotes of the instrument in the last week led to the fact that the low of the wave c-C was broken, so the current descending wave is the wave e-C, as I assumed earlier. Consequently, the entire wave C has assumed a five-wave form, and no internal waves are visible inside its wave e yet. Thus, this wave can also take a five-wave and much more extended form than it is now. A successful attempt to break the 1.1152 mark, which corresponds to 127.2% Fibonacci, will indicate that the market is ready to sell the instrument even without a break. At the moment, it is unsuccessful, so a correction wave can still be built as part of e-C. An alternative option involves completing the construction of wave C and moving to the construction of a new upward trend section or wave D.

The euro started the week on a positive note.

The euro/dollar instrument rose by 50 basis points on Monday, which is not so small in the current circumstances. The departure of quotes from the reached lows can mean both the completion of wave C and the construction of an internal corrective wave. Interestingly, the news background today in no way contributed to an increase in demand for the euro currency or a decrease in demand for the dollar. The only important report of the day on GDP in the Eurozone in the fourth quarter was weaker than market expectations. Instead of growth of 0.4% q/q and 4.7% y/y, the markets saw +0.3% q/q and +4.6% y/y. However, during the day, they still found the strength to buy some euro currency. Unfortunately, the news background remains very negative for the euro, and this week the situation for it may only get worse. The results of the ECB meeting will be announced on Wednesday and it is unlikely that the market will get at least one reason to buy euros after this event. The same applies to the European inflation report, which will be available on Tuesday. It is expected that inflation will begin to slow down, which is not good for the European economy, which itself slowed down seriously in the fourth quarter. Let me remind you that the ECB sees a clear correlation between inflation and economic growth. If inflation decreases again, then the economy will slow down. And in such a situation, the chances of tightening monetary policy become even less. Although the markets are laying down a 20% probability of an ECB rate hike in 2022. While the Fed may raise its rate 5 or 7 times.

General conclusions.

Based on the analysis, I conclude that the construction of the ascending wave d is completed. Now it is necessary to sell the instrument for each MACD signal "down" in the expectation of building a wave e-C with targets located near the calculated mark of 1.0948, which is equivalent to 161.8% Fibonacci. An unsuccessful attempt to break through the 1.1152 mark may lead to the construction of an upward correction wave in the composition of e-C.

On a larger scale, it can be seen that the construction of the proposed wave e-C is now continuing. This wave may turn out to be a five-wave, or it may be shortened. Considering that all the previous waves were not too large and were approximately the same size, the same can be expected from the current wave. I think there is a better chance that this wave will complete its construction soon, but it is unlikely this week.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română