Bitcoin and Ethereum rebounded slightly over the weekend, but volatility remains low after the massive sell-off seen in the second half of January. The correction is due to macroeconomic factors, in particular, the expected increase in U.S. rates and reduced liquidity from the U.S. Federal Reserve System. An interesting point is the fact that the 60-day correlation between BTC and the S&P 500 was almost zero at the end of 2017, but now it is over 65%. I have talked about this many times in my past reviews.

Last week, the U.S. Fed set the stage for a more rapid withdrawal of the stimulus it had used during the start of the coronavirus pandemic. Now, several major Wall Street banks, including Goldman Sachs, are expecting at least five quarter-point rate hikes this year. The first policy changes are expected to take place as early as March. On Friday, Atlanta Fed President Raphael Bostic told the Financial Times that the central bank could surprise with a rise of up to 50 basis points.

This will have a very negative impact on the technical picture of the cryptocurrency market. But before talking about it, I would like to note the good news for the metaverse and the cryptocurrency market as a whole.

Apple

Apple's CEO Tim Cook announced that the company is going to invest in the metaverse. According to Cook, the metaverse has great potential, and his company will invest accordingly in its development. "We are very interested in this," he said. Note that investment banks Morgan Stanley and Goldman Sachs said in their recent forecasts that the metaverse could bring in about $8 trillion.

When asked by a journalist about what the report for the 1st quarter of 2022 will be like and how the company relates to the metaverse, as well as the development of this direction, the Apple CEO said: ""We're a company in the business of innovation, so we're always exploring new and emerging technologies. And I've spoken at length about how this area is very interesting to us." Cook specified that there are now more than 14,000 ARKit apps in the App Store, which today provide incredible AR experiences for millions of people.

Back in December last year, Bank of America said the metaverse was a huge opportunity. However, the realization of its potential will be available only when cryptocurrencies become widely used as currencies for settlements.

As a reminder, Fidelity Investments recently filed for the Metaverse ETF, which aims to track public companies that have access to a blockchain-based 3D virtual reality network. The Fidelity Metaverse ETF will be tied to the Fidelity Metaverse Index, which tracks companies that develop, manufacture, and distribute products or services related to the creation and launch of Metaverse. However, it's worth noting that Fidelity's decision to turn its attention to the metaverse is not primary.

As for the technical picture of bitcoin:

Trading above the $33,800 support is good. There is little trading activity around $37,380 right now, which could seriously affect the prospects for Bitcoin recovery, but the $33,800 level is much more important. Only going beyond the $37,380 range will open a direct road to a high of $40,520, from which it is a stone's throw to $44,300. If pressure on the trading instrument will continue in the near future, and we will see a breakdown of $33,800, in which case it is better not to expect anything good in the near future. I advise you to be patient, waiting for the update of the lows of $29,200 and $25,700.

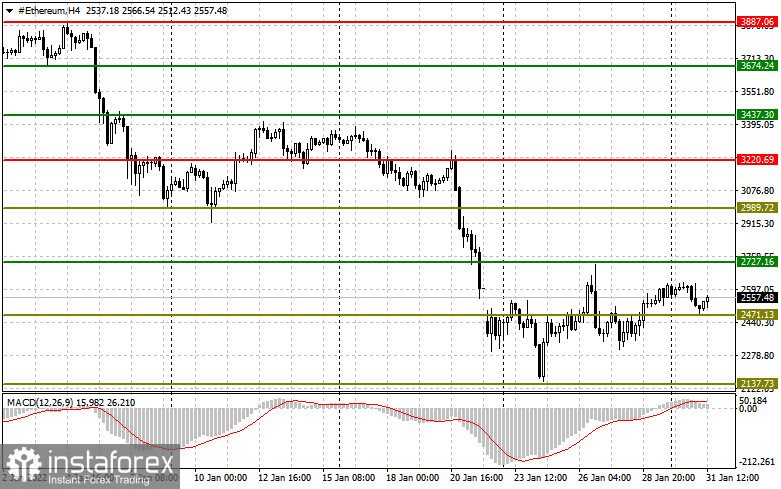

As for the technical picture of the ether:

The bulls have consolidated above $2,470, and now a re-exit to $2,720 is possible. However, more activity is needed. If purchases continue above $2,470, then a return below this level and another sale of the euro for $2,130 is not ruled out. A break of this range is a direct path to a minimum of $1,740. A break of $2,720 will open the way to the highs of $2,980 and $3,220.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română