To open long positions on EURUSD, you need:

In my morning forecast, I paid attention to the level of 1.1190 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. Low activity of buyers in the first half of the day due to a weak report on the growth rates of eurozone GDP in the 4th quarter of this year did not lead to an update of the nearest resistance of 1.1190. For this reason, no entry points were formed. For the second half of the day, the technical picture has not changed in any way and, in all likelihood, volatility will also remain quite low. And what were the entry points for the pound this morning?

During the American session, we are waiting for indicators on the Chicago PMI index, and a speech by FOMC member Easter George is also planned - which may lead to a decrease in EUR/USD in the afternoon and an update of the nearest support of 1.1142. Without her test, it is unlikely to be possible to count on a larger upward correction for the pair.

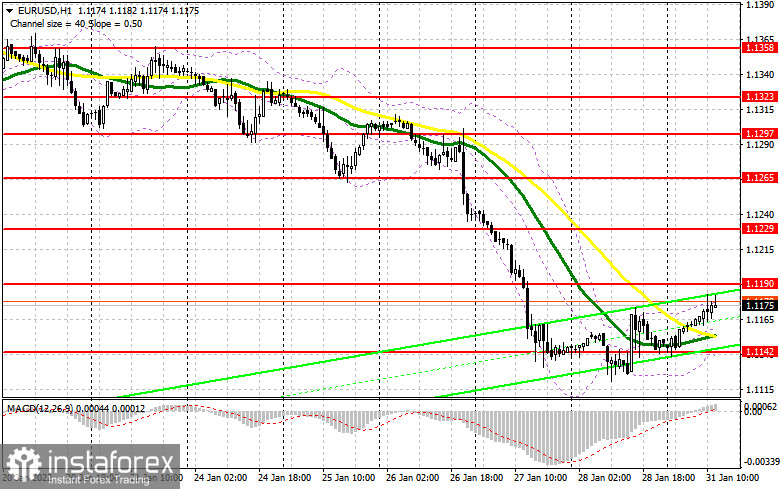

For this reason, the main task of buyers is to protect 1.1142, since it is from this level that we can expect the formation of the lower boundary of a new ascending channel, which has been begging for quite a long time. Given that the European Central Bank will hold a meeting this week– demand for the euro may return. The formation of a false breakdown at 1.1142, in addition to the first signal to buy the euro, will also be evidence of an attempt to find the bottom in the expectation of completing a short-term downward trend. An equally important task for the bulls will be to return the 1.1190 resistance under control. A breakdown and a reverse test from the top-down of this range, together with strong German inflation data, will lead to an additional buy signal and open up the possibility of recovery to the area: 1.1229. A more distant target will be the level of 1.1265, but it is possible to count on updating this range only after weak American statistics. I also recommend fixing profits there.

If the pair declines during the American session and there is no bull activity at 1.1142, namely, there are moving averages - the pressure on the euro may seriously increase. In this case, it is best to postpone purchases until the next monthly minimum of 1.1100. However, I advise you to open long positions there when forming a false breakdown. You can buy the euro immediately for a rebound from the level of 1.1034 with the aim of an upward correction of 20-25 points within a day.

To open short positions on EURUSD, you need:

Sellers continue to control the market, however, as I noted in the morning, after Friday's US data, the pressure on risky assets decreased slightly. The beginning of the week promises to be on the side of euro buyers, as many traders are counting on a more aggressive policy of the European Central Bank, which is confirmed by a small upward correction of EUR/USD in the first half of the day.

Sellers need to try very hard not to miss the initiative. An important task for the second half of the day is to protect the resistance of 1.1190. In the case of rather weak German inflation data, which may demonstrate a larger slowdown in growth, it will be difficult for bulls to offer something to break through this level. The formation of a false breakout at 1.1190 will return pressure on the pair and form the first entry point into short positions to further reduce EUR/USD to the area of 1.1142.

A breakdown and a bottom-up test of this range will give an additional signal to open short positions already with the prospect of falling to large lows: 1.1100 and 1.1034. The 1.0994 area will be a more distant target, but it will be available only in the case of very strong data on the American economy. I recommend fixing profits there. In the case of the growth of the euro and the absence of bears at 1.1190, it is best not to rush with sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1229. You can sell EUR/USD immediately for a rebound from 1.1265, or even higher - around 1.1297 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for January 18 recorded an increase in long positions and a reduction in short ones, which led to a further increase in the positive delta. This suggests that even despite the expected changes in the policy of the Federal Reserve System, the demand for the euro has not gone away. The more correction occurs in the EUR/USD pair, the stronger the demand. This week, everyone is waiting for the results of the meeting of the open market committee, at which a decision on monetary policy will be made. Some traders expect that the central bank may decide to raise interest rates already during the January meeting, without postponing this issue until March. A reduction in the Fed's balance sheet will also be announced. A lot depends on the rhetoric of Federal Reserve Chairman Jerome Powell. If he expresses concern about inflation in the US, most likely the demand for the US dollar will only increase. Currently, four interest rate hikes in the US are already predicted this year, and some major players are talking about five. Meanwhile, the European Central Bank plans to fully complete its emergency bond purchase program in March this year. However, the regulator is not going to take any other actions aimed at tightening its policy, which limits the upward potential of risky assets. The COT report indicates that long non-profit positions rose from the level of 204,361 to the level of 211,901, while short non-profit positions fell from the level of 198,356 to 187,317. This suggests that traders continue to increase long positions in the euro with the expectation of building an upward trend. At the end of the week, the total non-commercial net position remained positive and amounted to 24,584 against 6,005. The weekly closing price rose to 1.1410 against 1.1330 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates an attempt by buyers to continue the growth of the euro in the short term.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the lower limit of the indicator in the area of 1.1142 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română