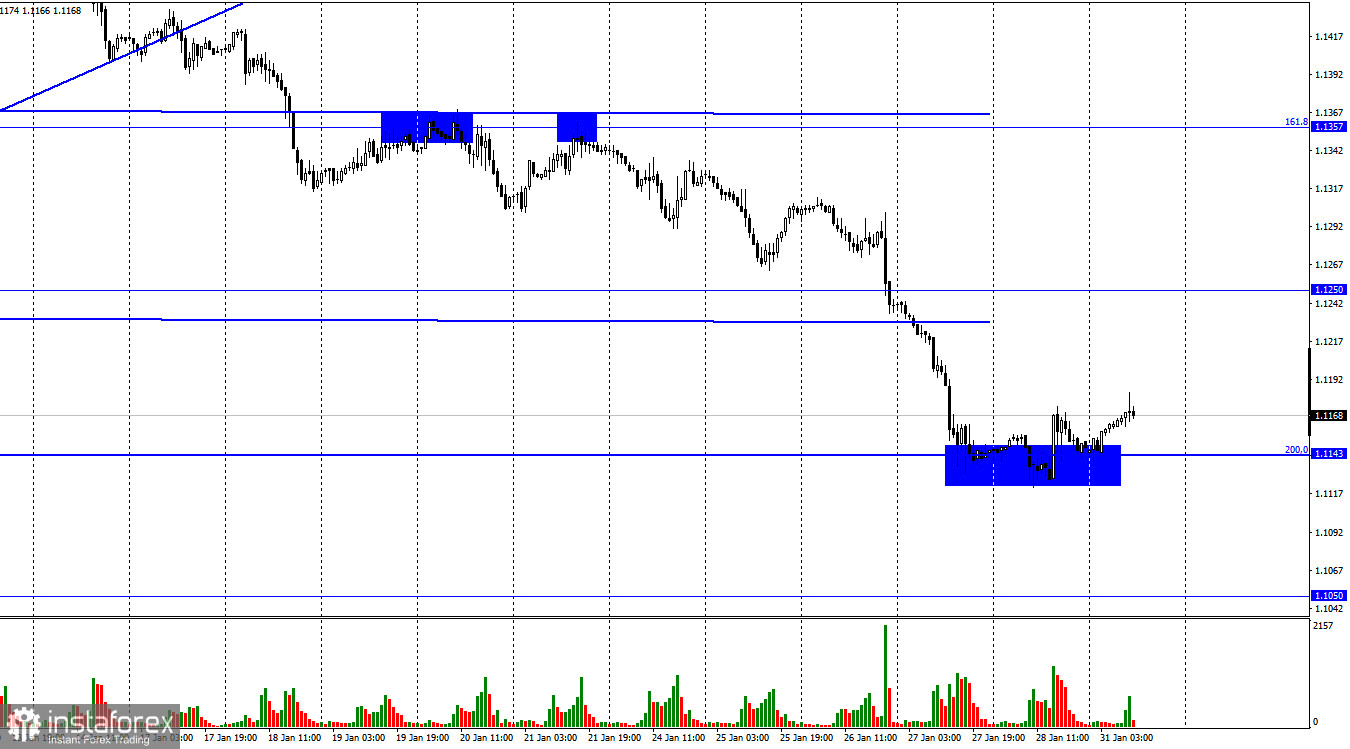

The EUR/USD pair on Friday performed a rebound from the corrective level of 200.0% (1.1143), a reversal in favor of the EU currency, and began the process of growth towards the level of 1.1250, which continues today. On Friday, the information background was not strong enough for the US currency to continue to show growth. The Fed meeting and its results have been "digested" by traders, now all attention is on the ECB meeting, European inflation, and the report on the labor market in America. All this is planned for this week, and all this news will have to affect the mood of traders. Now it is important to figure out whether bear traders will be able to continue to hold their grip. And just this largely depends on the events listed above. Many people do not expect any useful information from the ECB meeting, no changes, no change in rhetoric. At the beginning of the year, ECB President Christine Lagarde said that her department was not considering raising the interest rate yet.

However, many experts believe that this rhetoric may change in the second half of the year. Otherwise, the ECB will lag very far behind the Fed on the issue of rates, so the American central bank is going to raise its rate almost every month. Thus, traders can still hope for a slight change in Christine Lagarde's mood. Perhaps the phrase "in the near future, the regulator will begin to consider the issue of tightening the PEPP" will be heard. This will already be enough for the euro currency to cheer up. But at the same time, if we do not hear anything like this from Lagarde, then the fall of the euro/dollar pair may continue. The same goes for Friday's nonfarm report in the US. This is a very important report, and what its significance will be, it is impossible to predict now. Forecasts compared to the previous two months have been greatly reduced, and this time they will be easier to exceed. In this case, the dollar may resume its growth at the end of the week.

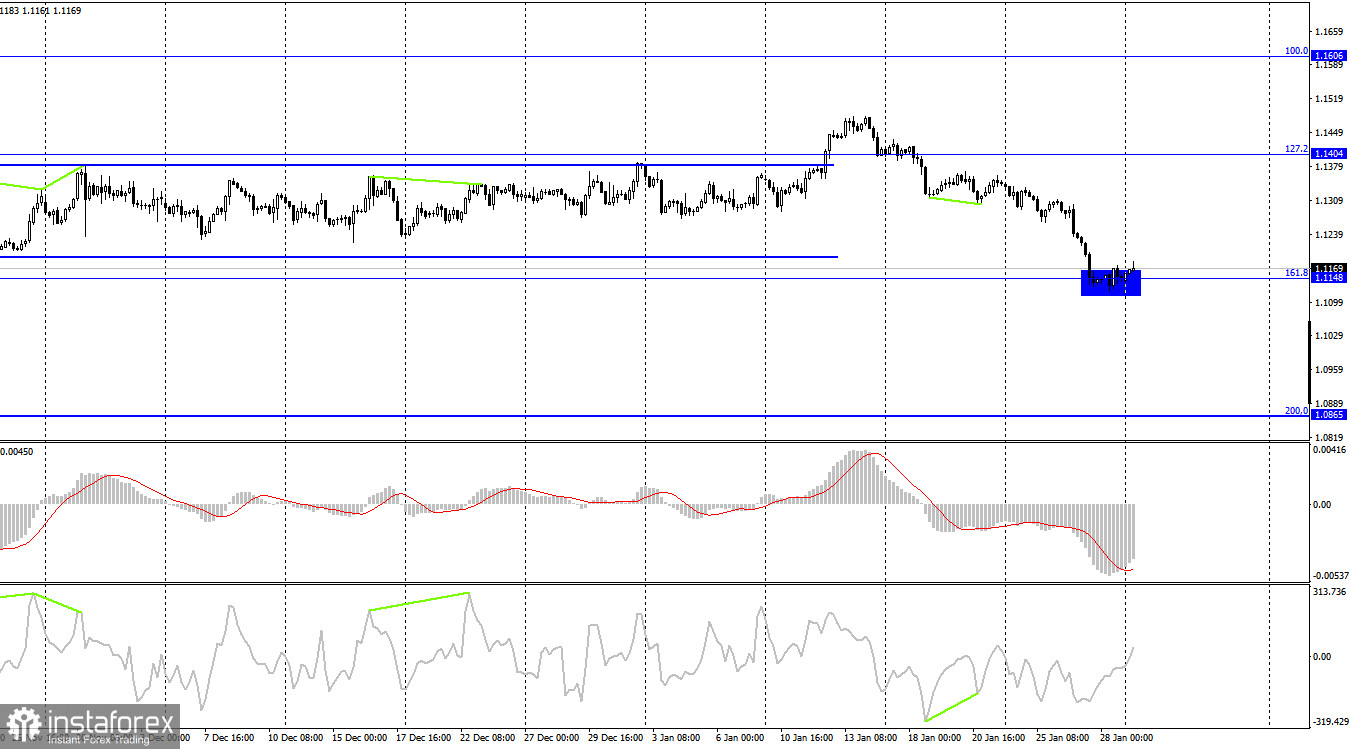

On the 4-hour chart, the pair's quotes performed a drop to the Fibo level of 161.8% (1.1148). Closing under this corrective level will work in favor of the US currency and the pair will continue to fall towards the next Fibo level of 200.0% (1.0865). Emerging divergences are not observed in any indicator today. A rebound from the level of 1.1148 will allow us to count on some growth in the direction of the corrective level of 127.2% (1.1404).

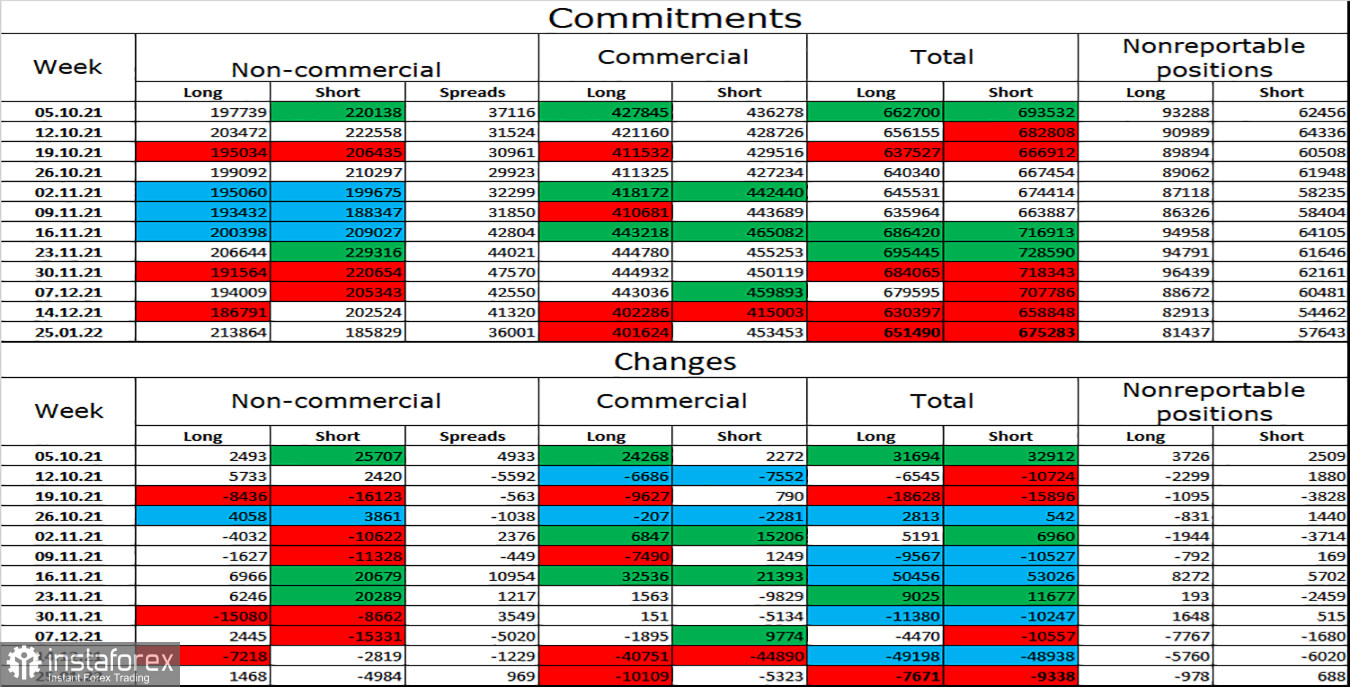

Commitments of Traders (COT) Report:

Last week, speculators opened 1,468 long contracts and closed 4,984 short contracts. This means that their mood has become more "bullish". The total number of long contracts concentrated on their hands is now 214 thousand, and short contracts – 185 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is also characterized as "bullish". Consequently, the euro currency can count on a certain growth, but the days when traders worked out the Fed meeting and when they will work out the ECB meeting have not yet been taken into account, and they can have a very strong impact on the mood of traders. The figures for the "Non-commercial" category can change a lot.

News calendar for the USA and the European Union:

EU - change in GDP (10:00 UTC).

On January 31, the calendar of economic events of the European Union contains one report that has already been released. GDP in the fourth quarter grew by only 0.3%, which is worse than traders' expectations. This report did not affect their mood. In the USA, the calendar of macroeconomic events does not contain a single interesting entry.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair with a target of 1.1050 if a close is made below the level of 1.1143 on the hourly chart. I recommended buying the pair if a rebound from the 1.1148 level is performed on the 4-hour chart. The target may be the 1.1250 level on the hourly chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română