The USD/JPY pair continues to move sideways in the short term. The price action signaled exhausted sellers so that the buyers could take the lead. Still, the currency pair could develop a new leg higher only if the Dollar Index develops a new leg higher.

The pair was trading at 139.51 at the time of writing, which seems undecided. Fundamentally, the Japanese data came in worse than expected while the US reported mixed data. Today, the Japanese Trade Balance came in at -2.30T far below the -1.93T expected.

Later, the US data could be decisive. Philly Fed Manufacturing Index could be reported at -6.0 points versus -8.7 points in the previous reporting period, Unemployment Claims could jump from 225K to 228K in the previous week, Building Permits may drop from 1.56M to 1.51M, while Housing Starts could be reported at 1.41M below 1.44M in the previous reporting period. Better-than-expected US data could lift the greenback, while worse-than-expected figures could weaken the USD.

USD/JPY Range Pattern!

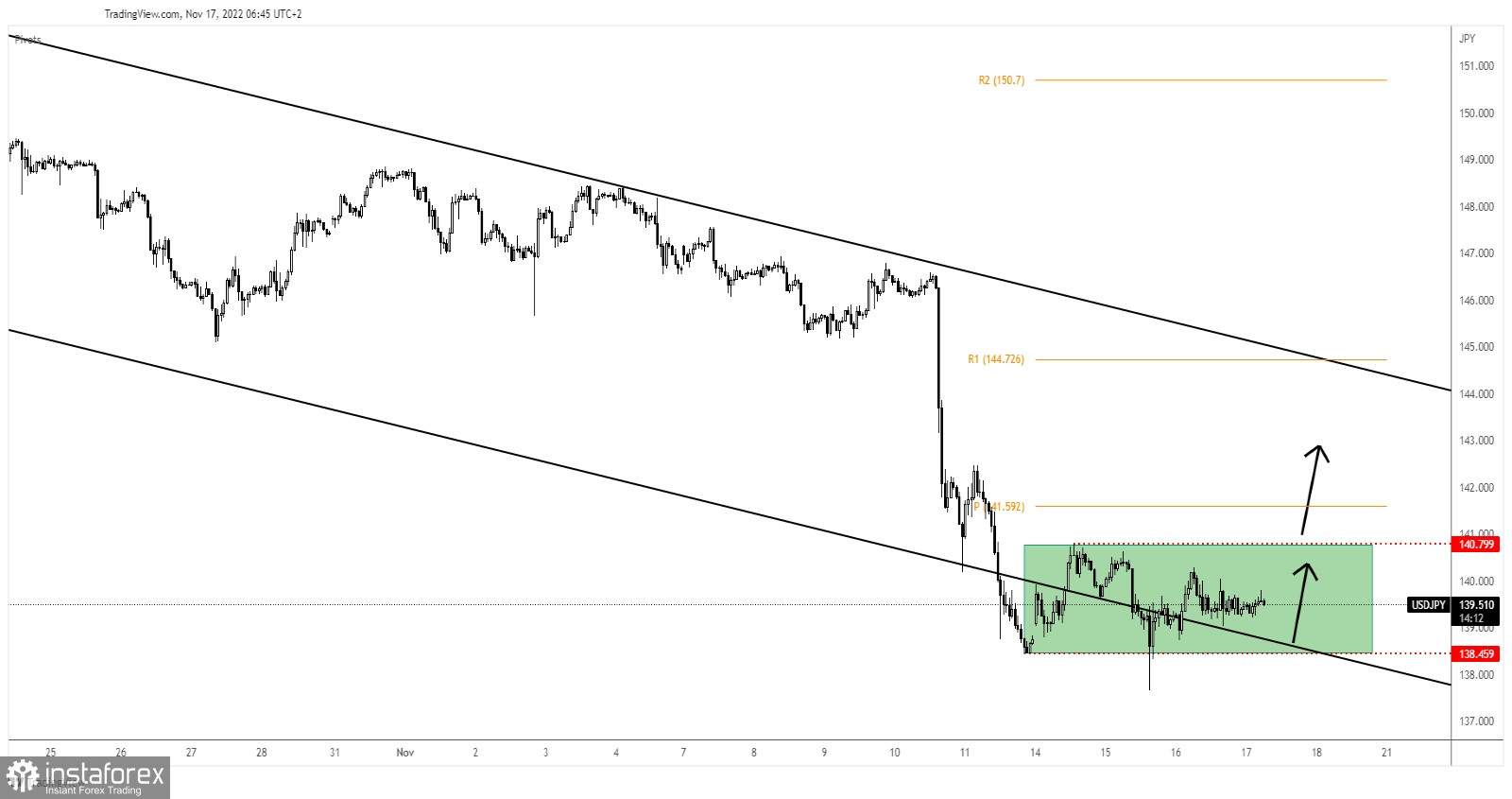

As you can see on the H1 chart, the pair is still trapped between 138.45 and 140.79 levels. Escaping from this range could bring us new trading opportunities. The price failed to reach 140.79 resistance, so it could come back down to test and retest the 138.45 and the channel's downside line before developing a new bullish momentum.

USD/JPY Forecast!

False breakdowns through the immediate downside obstacles may announce a bullish momentum. This could represent a first buying opportunity. Also, a new higher high, a valid breakout through 140.79 could bring new longs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română