Hello!

Last week, the USD/CHF pair made a breakout towards the north direction. The reasons for the US dollar's significant strengthening have already been mentioned. Therefore, in this article we will focus on the technical component of the trading instrument. Besides, first external background and this week's key event will be discussed. Mass protests against restrictions caused by the Omicron variant of the coronavirus are taking place in a number of the EU countries, while the current situation is stable in Switzerland. For example, the protests are not subsiding in Belgium. People are protesting against the imposed COVID-19 restrictions or the restrictions that are about to be introduced. The US labour market report, which is scheduled this Friday, will certainly be the key event for the USD/CHF pair, as well as for the Forex market. These most significant releases will most likely exert great influence on the outcome of five-day trading. Now, the price charts will be observed.

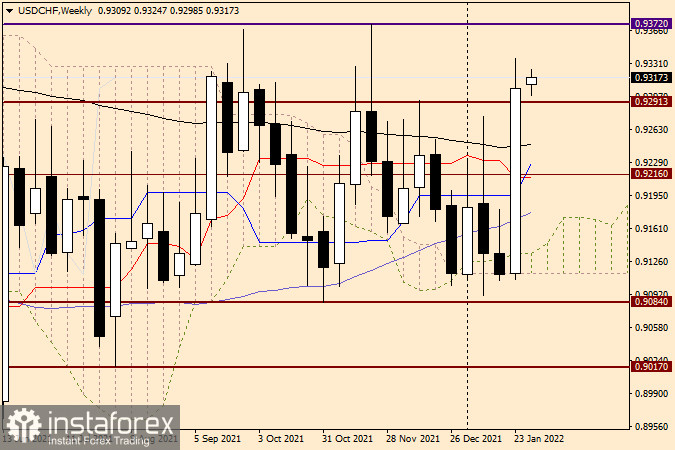

Weekly

The USD/CHF pair managed to overcome the downward indicators due to the strong upward movement and closed the session on January 24-28 at 0.9305. I believe it was favourable for bulls as all the passed resistances, as well as a strong technical level of 0.9300 were risky concerning the reversal to the south. At the same time, it would be early to assume that all problems for the upside players have been resolved. As shown on the chart, the key resistance level is 0.9372. Besides, the orange 200 exponential moving average, located at 0.9418, is above it. Another significant resistance of sellers is also indicated at 0.9472. Moreover, it is necessary to overcome the mentioned obstacles to reach it. As for bears of the USD/CHF pair, their objectives are currently difficult to achieve after the strong rebound demonstrated last week. However, it is indispensable to break support at 0.9084 to resume the downtrend.

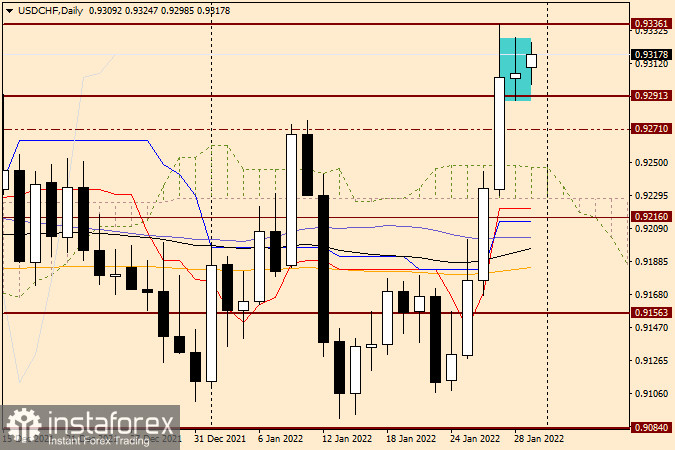

Daily

On the daily chart of the USD/CHF pair, it is possible to see a Doji candlestick formed last Friday after two-day rally. It can be considered as a reversal candlestick. However, it is not clear if the market will change its chosen northward direction. The situation will be clarified today or tomorrow. Bulls' current target on USD/CHF is to absorb Friday's growth of the highlighted candlestick, as well as to break the resistance at 0.9336 with the highs of January 27 trading. Despite the strong growth of the previous week, the current positioning of the USD/CHF pair is not clear. It is technically incorrect to buy under resistance. Besides, there are no clear sell signals. Friday's highlighted candlestick should be confirmed during the subsequent decline. Currently, it is advisable to await the breakout of the sellers' resistance at 0.9336, and then try to buy with the targets at 0.9372 and (or) 0.9400-0.9420 on the pullback to this level.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română