Anything is possible

Hello, dear colleagues!

The US dollar has strengthened considerably against major currencies during trading on January 24-28. Besides, the EUR/USD pair closed the last five trading days at 1.1147, while it opened the weekly session at 1.1341. Therefore, the losses are significant. This strong demand for the US currency was caused by the Fed's hawkish rhetoric, as well as by the strong US GDP data for the fourth quarter. At the end of his January meeting, Fed Chairman Jerome Powell mentioned the possibility of raising the interest rates faster than expected. Powell was positive about the US economy growth, focusing on the labor market and employment in the country.

The Fed Chair also noted that amid high inflation the most effective tool is further tightening monetary policy. Unlike the European Central Bank's more dovish monetary policy, it is certainly the Fed's tough rhetoric that makes the US dollar a favorite in the major currency pair. However, this Thursday, February 3, the ECB meeting is scheduled. Based on its results, the decision on interest rates will be made. Then, there will be a press conference of ECB President Christine Lagarde. The ECB will unlikely adopt the same tough stance as the Fed did last week. However, even a slight tightening of the ECB strategy might limit or even stop the decline of the euro against the US dollar.

As there is enough time till Thursday, it is better to discuss today's macroeconomic reports which might affect the EUR/USD price dynamics. Therefore, the main releases today will be preliminary data on euro zone GDP for the fourth quarter, German Consumer Price Index and Chicago Purchasing Managers' Index. Read the economic calendar for more details concerning the release time and outlook for these and other events. Besides, it is time to discuss the price charts, beginning with the weekly timeframe.

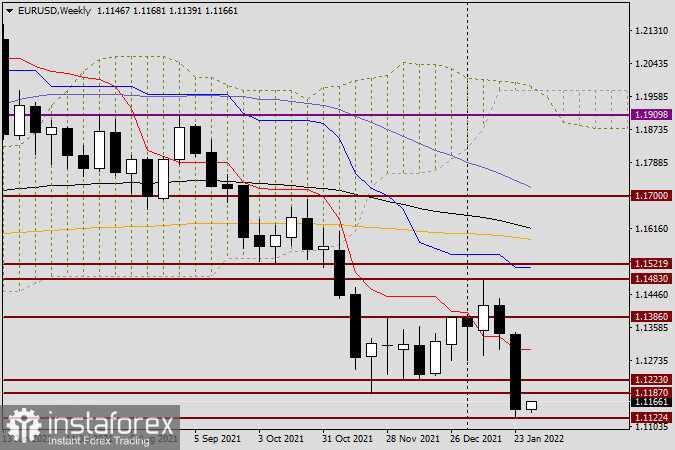

Weekly

Last week's strong downward momentum shows that the last big bearish candle has no shadows. This factor indicates almost no resistance between the rivals and that bears in the EUR/USD pair assume complete control of trading. Notably, a strong downward movement broke the key support level of 1.1187, following the red Tenkan line of the Ichimoku indicator as well as the support level of 1.1273. If this strong bearish sentiment on the EUR/USD continues, the pair will most likely encounter the landmark historical, technical and psychological level of 1.1000. Euro bulls need to close the weekly trading with gains, preferably near the significant level of 1.1300 or even above it to improve the situation. Moreover, this outcome is doubtful. However, if the ECB hawkish rhetoric could shock the market, anything is possible.

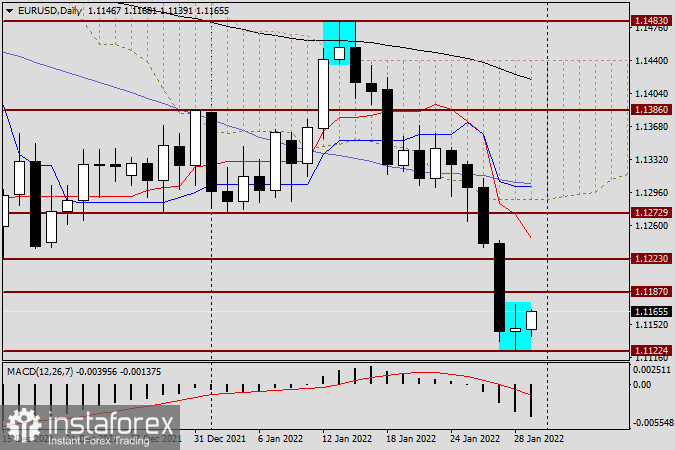

Daily

On the daily chart, it is possible to see the long-legged Doji candlestick formed on Friday after a strong two-day drop. Notably, it is a reversal candlestick pattern. However, it does not back a strong bearish trend, started recently. Will the market work it out in the current situation? I suppose that today, at the close of trading it will be possible to answer this question. It is often common that the market does not take into account the reversal signals against fresh and strong trend and continues to move in the previously chosen direction

Trading recommendations for EUR/USD

Considering the ECB and the Fed's differences in the monetary policy, as well as significant changes in the technical picture, the main trading recommendation for the EUR/USD pair are sales. However, taking into account the breakout of several significant levels, as well as technical indicators, I suggest trying to open short positions after the corrective pullbacks. Currently, I recommend to focus on the levels of 1.1170 and 1.1210. If reversal candlestick signals appear near these levels on shorter timeframes, it is advisable to sell.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română