The focus of market participants is gradually changing to the release of important consumer inflation data in Germany and the Eurozone this week, as the markets are already processing the expected start of the Fed's first interest rate hike in March amid the rising inflation.

Similarly to the Fed, it can be recalled that the ECB carried out a number of measures to stimulate the economy during the acute phase of COVID-19, which supported both the population and local businesses in the conditions of successive lockdowns. But there was still a significant difference. Unlike the US, the ECB did not scatter "helicopter money," which ultimately prevented inflation in the region from soaring to extraordinary, albeit rather high, levels, as happened in America.

According to the latest economic statistics, the US inflation surged to 7.0%, while the Eurozone only did so to 5.0%. Meanwhile, Germany is up by 5.3% in December. However, it is already expected that the Eurozone's January inflation will fall and Germany to 4.3%. If this is really the case, then this news may encourage the European economic authorities to delay raising interest rates, which will allow the local economy to receive support for some time.

If such a scenario is observed, then the euro will initially continue to noticeably decline against the US dollar, but at the same time, the local stock market will receive support. If high volatility continues in the US stock market before the start of rate hikes, then the ECB's "soft" position will eliminate the effect of volatility and stimulate investor interest in shares of companies in the euro region.

As for the general situation on the markets, we believe that investors in America have actually played back the topic of a possible 0.25% increase in interest rates, which means that it will be likely to observe a full concentration on the outgoing corporate statements of companies for the 4th quarter of last year, where positive news will push up the stock price.

In terms of the financial market, it was already mentioned above that a decrease in inflationary pressures in the eurozone could lead to a strong weakening of the euro against the US dollar due to the high probability that the ECB will not rush to increase the cost of borrowing. In this case, the EUR/USD pair may decline to the level of 1.0700 by March of this year.

On the commodity market, oil quotes seem to be steadily moving towards $100 per barrel, supported by three important factors: continued high demand for energy resources, geopolitical tensions in the Middle East, and confrontation in the consolidated West. All this will definitely support the shares of oil and energy companies.

Assessing the market situation, we believe that the pullback in the stock markets that began on Friday may become a prologue to the end of the correction and lead to an increase in demand for risky assets on the global stock markets.

Forecast for the day:

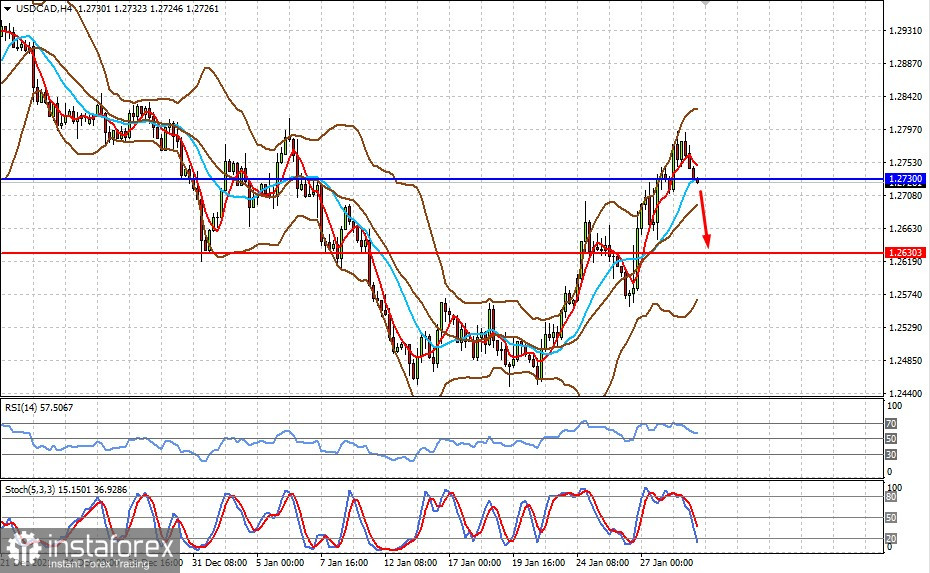

The USD/CAD pair is trading just below the level of 1.2730. Further growth in crude oil prices and a local correction of the US dollar may lead to the pair's decline to the level of 1.2630.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română