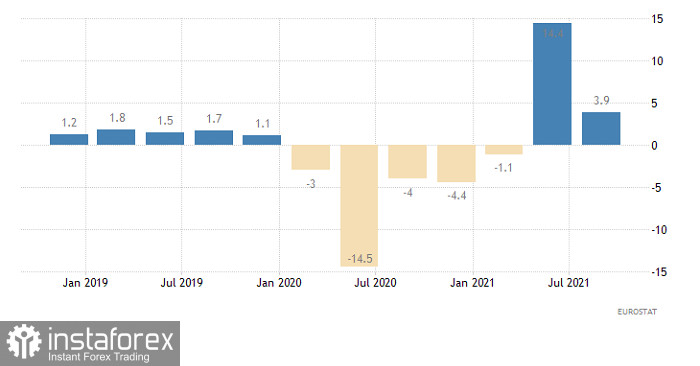

The pound has been declining for two weeks. And during this time, not a single full-fledged rebound has happened. So talking about the need for a rebound is just a statement of fact. We are talking about an unconditional local overbought dollar. However, there was no rebound on Friday. The market simply stood still. However, there was hope for a rebound on Friday. The fact is that after the opening of the US session, the forecasts for the GDP of the euro area for the fourth quarter were revised. Initially, it was assumed that the pace of economic growth would slow down from 3.9% to 2.8%. Now they are expected to accelerate to 4.2%. And if the slowdown in economic growth clearly suggested the continuation of the dollar's growth, then the acceleration of the growth of the euro area economy will clearly be the reason for a local rebound. But still, the euro's growth will be exclusively temporary, since in comparison with the United States, Europe can boast of much more modest economic growth rates. In any case, the euro will pull the pound along with it. The need for a local correction has been brewing for a long time for both currencies.

Change in GDP (Europe):

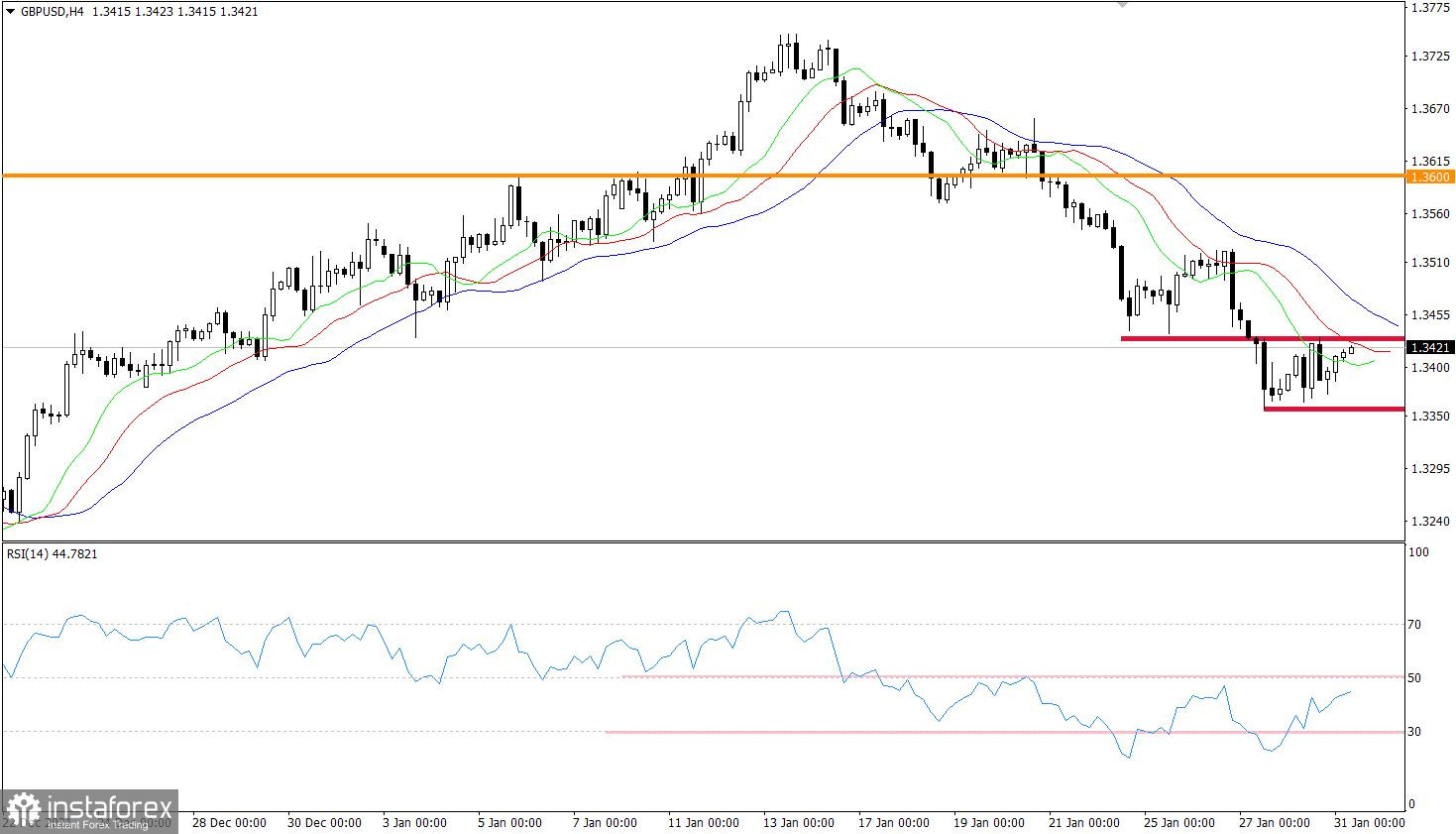

The GBPUSD currency pair slowed down its downward course around the value of 1.3357, where a pullback appeared at the beginning, after stagnation in the range of 1.3360/1.3430. Taking into account the recent weakening of the pound, a corrective move is not excluded if the current stagnation persists in the market.

The RSI technical instrument crossed the 30 line from the bottom up in a four-hour period, confirming the signal of a slowdown in the downward cycle. The Alligator indicator keeps a downward trend signal in the form of the direction of the MA moving lines in the four-hour and daily periods.

The daily chart shows a gradual process of restoring downward interest. The quote has already passed more than 60% relative to the recent upward cycle.

Expectations and prospects:

In this situation, special attention is paid to the price range of 1.3360 /1.3430, since price retention outside of one or another border may well indicate the subsequent course of the price.

Complex indicator analysis gives a variable signal based on short-term and intraday periods due to price stagnation. Technical indicators in the medium term indicate a downward cycle, signaling a sale.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română