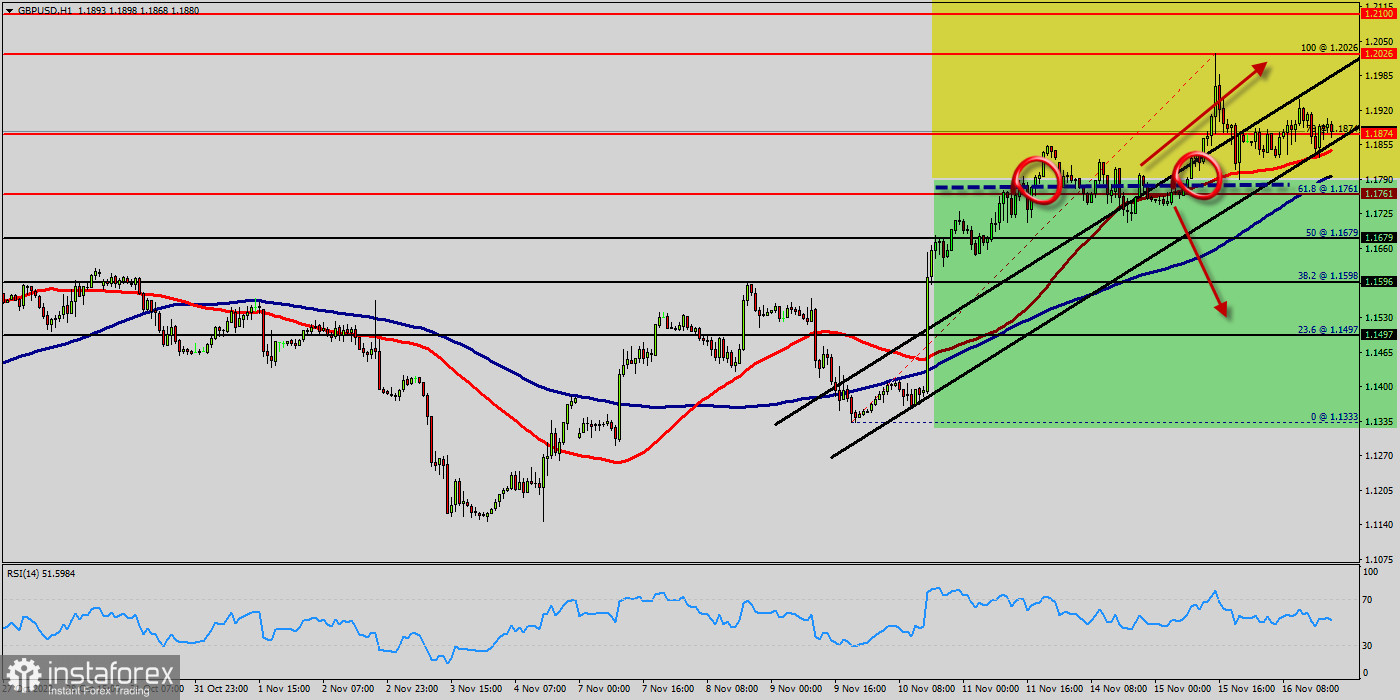

The GBP/USD pair moved higher and closed the day in positive area near the price of 1.1874. It also rose a little, having risen to the level of 1.1900. On the hourly chart, the GBP/USD pair is still testing resistance (1.2026) - the moving average line MA (100) H1 (1.1874). The GBP/USD pair continues to push higher toward 1.1900 during the American trading hours on Monday. The dollar stays under constant selling pressure after the ISM Manufacturing PMI survey showed price pressures continued to ease in August. Range trading continues in the GBP/USD pair and intraday bias stays upwards at this point. The GBP/USD pair was trading around the area of 1.1900 a week ago.

Today, the level of 1.1761 represents a daily pivot point in the H1 time frame. The pair has already formed minor resistance at 1.1900 and the strong resistance is seen at the level of 1.2026 because it represents the daily resistance 2. On the upside, above 1.1459 minor resistance will target 1.1900 resistance first. Break there will target channel resistance at 1.2026. It should be noted that volatility is very high for that the GBP/USD pair is still moving between 1.1761 and 1.2026 in coming hours.

Furthermore, the price has been set above the strong support at the levels of 1.1761 and 1.2026, which coincides with the 61.8% and 100% Fibonacci retracement level respectively. Further recovery should motivate the pair to challenge recent highs around 1.2026 to allow for extra gains to, initially, the interim hurdle at the 50-day EMA at 1.1900.

The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 50 EMA is headed to the upside Bias will be back on the upside for retesting 1.2026 high.

On the upside, above 1.1761 will resume the rebound to 1.1761 resistance turned support.

On the downside :

If The price is in a bearish channel in coming time. Amid the previous events, the pair is still in an uptrend. On the one-hour chart, the GBP/USD is still below the MA 50H4 line. Based on the foregoing, it is probably worth sticking to the south direction in trading, and while the GBP/USD pair remains below MA 50 H1, it may be necessary to look for entry points to sell at the end of the correction. Areak of 1.2026 minor support will bring retest of 1.1761 and 1.1679 low instead.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română