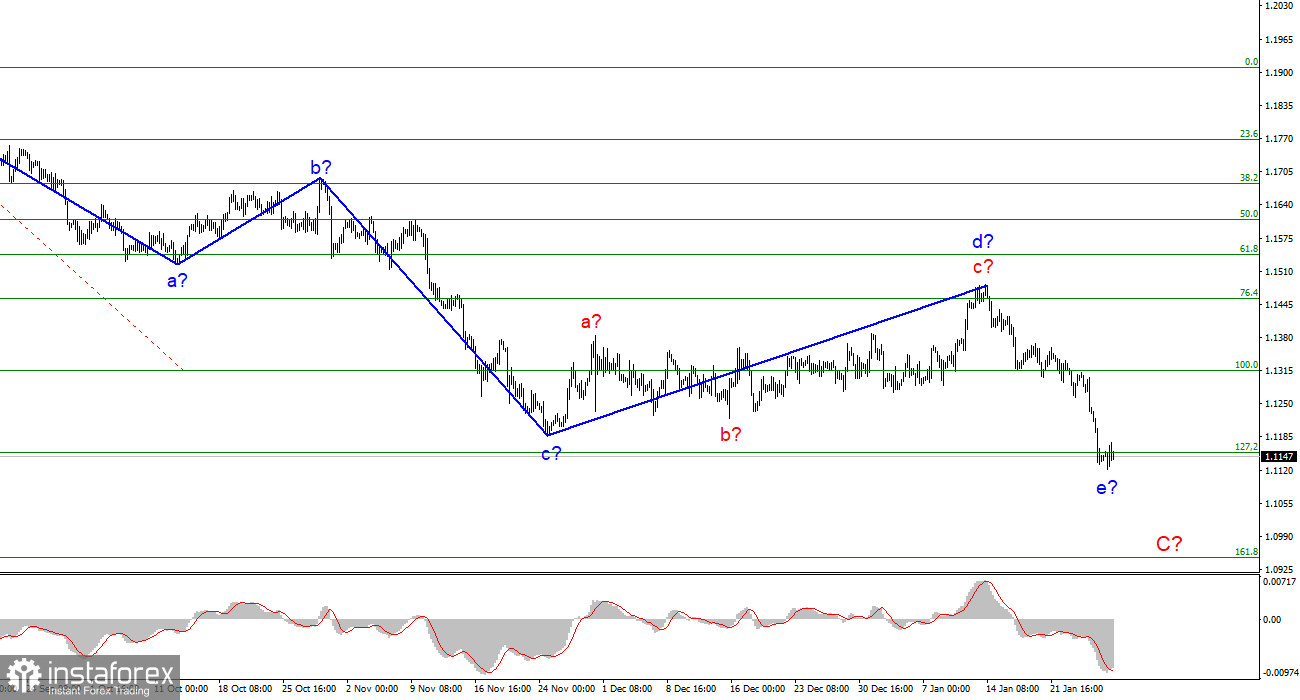

The wave marking of the 4-hour chart for the euro/dollar instrument still looks convincing. Wave d turned out to be more extended than I originally expected, but this does not change the essence of the wave marking. The decline in the quotes of the instrument in the last two weeks has led to the fact that the low of the wave c-C has been broken, so the current descending wave is already quite definitely the wave e-C, as I assumed earlier. Consequently, the entire wave C has assumed a five-wave form, and no internal waves are visible inside its wave e yet. Thus, this wave can also take either a pronounced five-wave form, or vice versa shortened. And in the second case, it is already nearing its completion. A successful attempt to break through the 1.1152 mark, which corresponds to 127.2% Fibonacci, will indicate that the market is ready to sell the instrument. But I admit that in the next week or two this wave may come to an end.

Are there any prospects for further growth in the dollar?

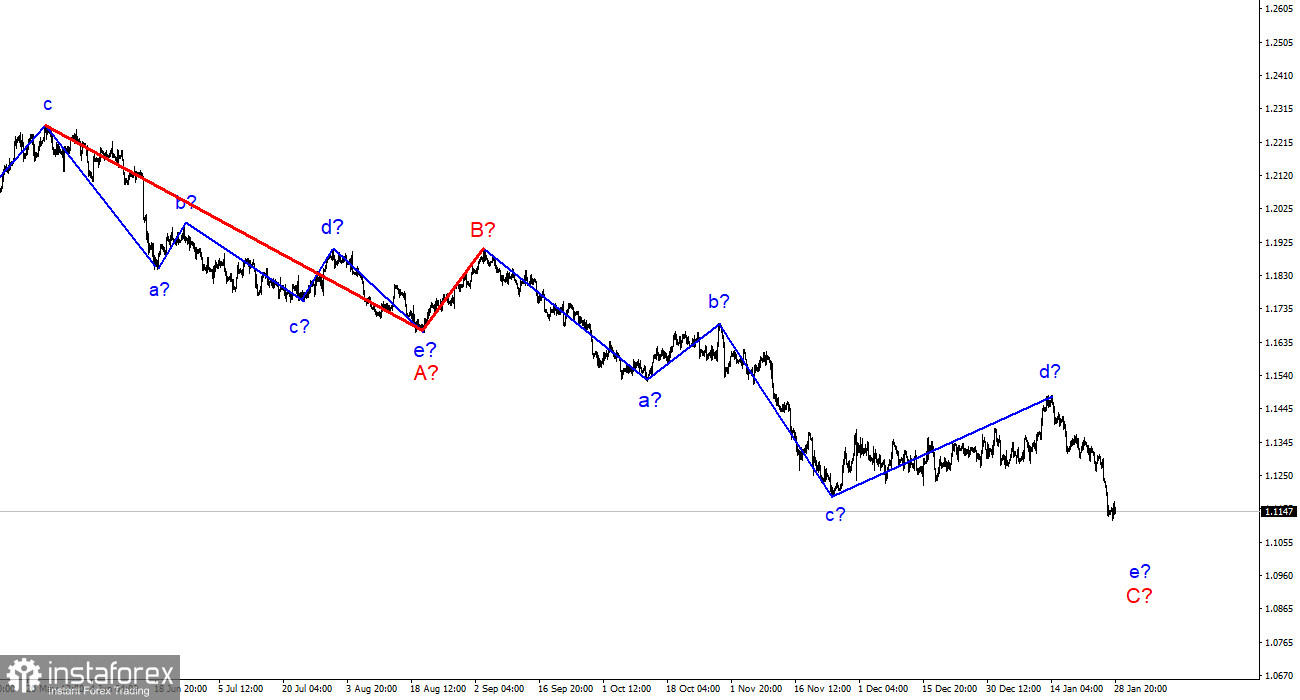

In the second half of the month, the instrument decreased by 360 basis points. After such a strong decline, I would expect to see at least an internal correction wave in the composition of e-C. However, the current wave marking is such that this wave may not be. Wave e can end very quickly and abruptly, and after it, the construction of either a new upward trend segment or a global wave D should begin, which will again be corrective. And this means that it can turn out to be of any length, three-wave, five-wave, and so on. In general, in almost any case, after the completion of wave C, I expect a certain increase in the instrument, but in global terms, it may not be so strong, in the area of 15-17 figures. The news background in January was not the strongest. The Nonfarm Payrolls report in the US turned out to be weak, inflation continued to rise and is already 7%, and the Fed announced its readiness to raise the interest rate, fully complete the QE program in March, and in the summer, perhaps, start selling off bonds that have accumulated on its balance sheet. All this may keep the demand for the US currency high in the coming months and even years. The Fed is going to normalize monetary policy next year, too. And, since we are currently building a correction section of the trend (waves A-B-C), then it can turn out to be much longer and more complicated than it is now. I would say that it is quite possible to continue its construction for most of 2022.

General conclusions.

Based on the analysis, I conclude that the construction of the ascending wave d is completed. Now, it is necessary to sell the instrument based on the construction of the wave e-C with targets located near the estimated mark of 1.0948, which equates to 161.8% Fibonacci. An unsuccessful attempt to break through the 1.1152 mark may lead to the construction of an upward correction wave in the composition of e-C.

On a larger scale, it can be seen that the construction of the proposed wave e-C is now continuing. This wave may turn out to be a five-wave, or it may be shortened. Considering that all the previous waves were not too large and were approximately the same size, the same can be expected from the current wave. I think there is a better chance that this wave will complete its construction soon.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română