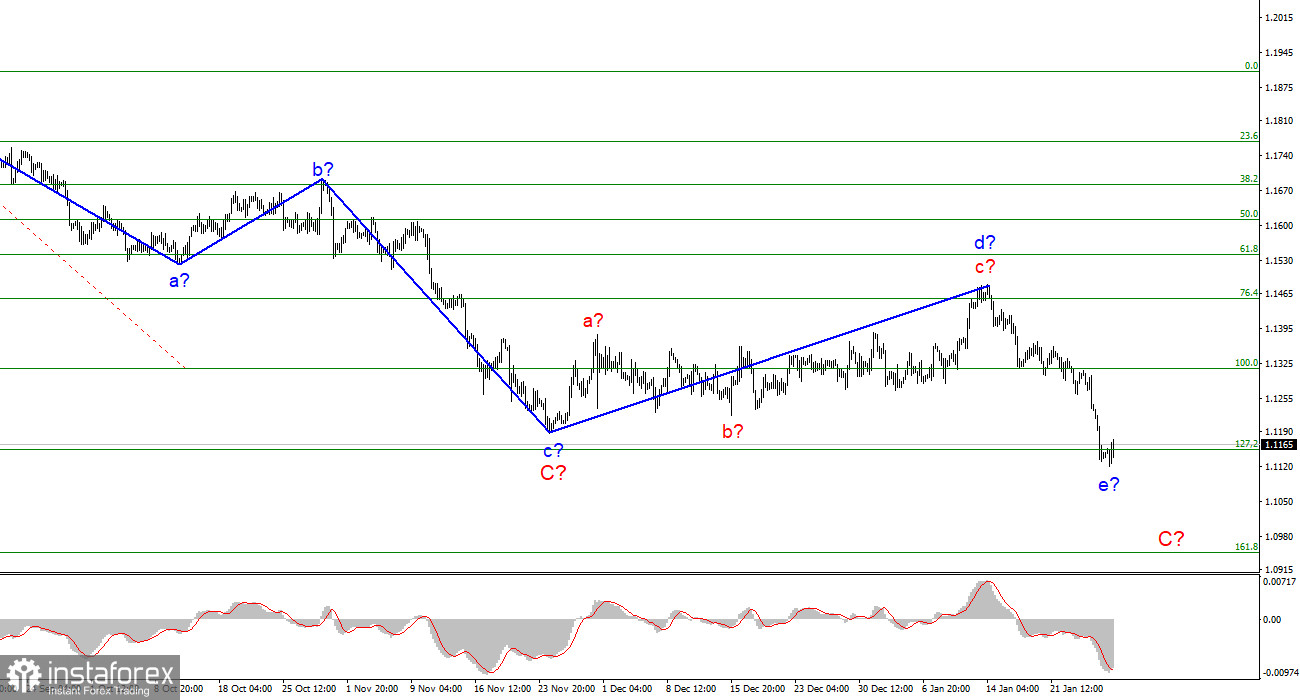

The wave picture in the 4-hour EUR/USD chart still looks rather convincing. The d wave turned out to be longer than expected. Still, it does not change the meaning of the wave structure. Last week's decline in the pair resulted in a break of the low of the c wave within C. Therefore, the current downward wave is undoubtedly the e wave within C just as I thought. As a result, the C wave consists of five sub-waves. The e wave, in turn, may also become much longer and consist of five smaller waves. A successful break of 1.1152 (127.2% Fibo) will indicate bears' readiness to continue selling EUR/USD. Still, traders decided to take a break ahead of the weekend. Today's news feed lacked any significant reports, and market participants seemed to be tired of the busy week.

Will the USD bullish trend continue?

On Friday, EUR/USD barely added 25 pips. The intraday range was also about 25 pips. So, the market was less active than yesterday or the day before yesterday. However, it is not surprising as a bunch of important reports saw the light in the United States on Wednesday and Thursday. Amid that, a new downward wave appeared which may become longer. Moreover, the general trend that started on May 25, 2021 may turn into the 5-wave structure. Currently, it is of the A-B-C type but it has every chance of becoming the A-B-C-D-E one. It may happen if the fundamental factors continue to be favorable for the US dollar. There is every indication that the year 2022 will be a rather good one for the American currency. The Federal Reserve can afford to take the most hawkish stance in comparison with other central banks, in particular, the ECB and the Bank of England. The European financial regulator has no intentions of hiking the rate this year. The most decisive action it can take is to withdraw from the emergent PEPP stimulus program and the basic APP program. In addition, the current economic indicators are rather disappointing. The EU consumer confidence index came in at -8.5 points. It is a minor report, but it clearly reflects the current state of things. Things are not going smoothly in the United States either, but inflation will continue to put pressure on the Fed until it starts to decline to 2%. And the Fed will have no other choice but to use all available tools to restrain inflation and prevent it from increasing further. These factors may last for most of this year and they are positive for the US dollar. The current wave picture indicates a further decline of the instrument. So these expectations may turn out to be valid.

General conclusion

I can conclude that the d wave has been completed. Therefore, it is reasonable to sell EUR/USD in case of the wave e within C forms with the target at 1.0948 (161.8% Fibo). If the level of 1.1152 fails to be broken, it may result in the completion of an upward corrective wave e within C.

As seen on a larger scale, the construction of the alleged wave e within C is now continuing. This wave may turn out to consist of five smaller waves, or it may become shorter. Bearing in mind that all previous waves were not too long and were of the same size, the current wave is likely to be the same. I expect this wave to get completed in the near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română