In January 2022, several major countries around the world expressed their position on cryptocurrencies. Some advocate for the total ban of digital assets, others support regulating and taxing the crypto sector. The recent market crash, coupled with a record high correlation between BTC and stock market indexes, suggest that cryptocurrencies are now becoming increasingly adopted globally. For many countries, banning such an important sector that could bring sizeable tax income is now counterproductive.

Representatives of the Russian government have declined calls for a ban on crypto assets and are set to present a roadmap for crypto market regulation. South Korea is planning to become one of the world's major crypto markets in 5-10 years. The sector is used to lax regulation and a total absence of authority, and although stringent regulation could guarantee the rights and security of investors, it could also be detrimental to cryptocurrencies.

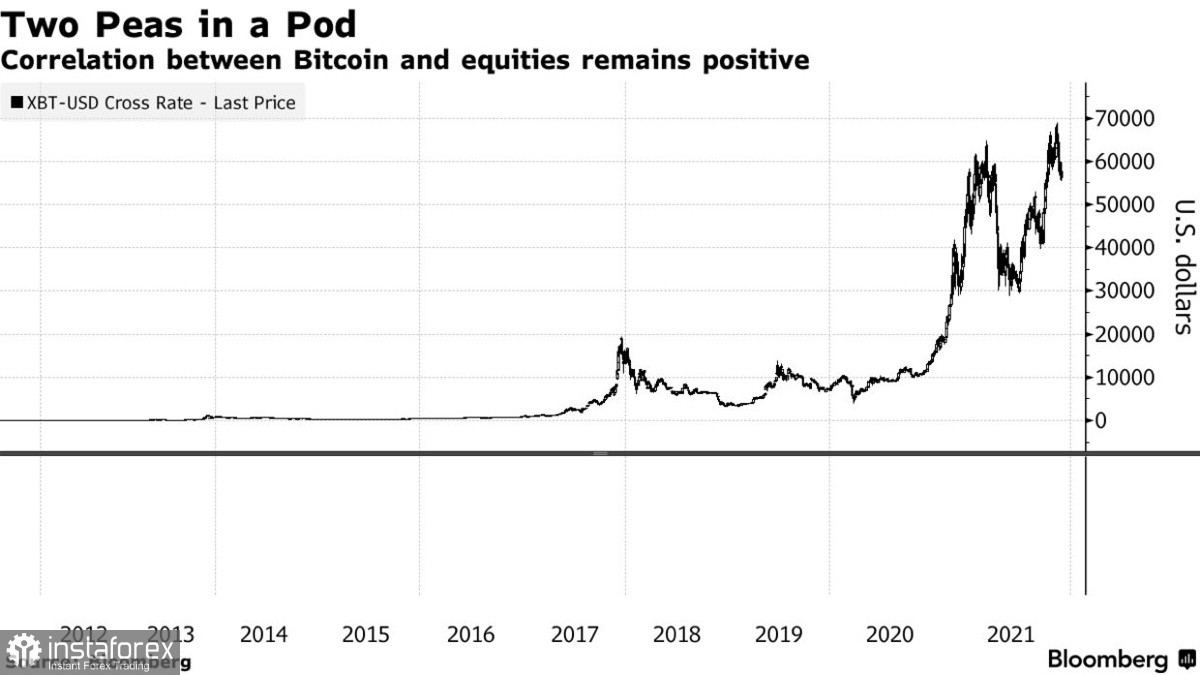

According to Goldman Sachs strategists Zach Pandl and Isabella Rosenberg, integrating cryptocurrencies into the modern financial and taxation systems could negate the main value of crypto assets. Digital assets and trading indexes are already increasingly correlated, which could be detrimental to cryptocurrencies. This would make digital assets unsuitable for diversification and risk hedging, as well as take away its status as an alternative financial instrument.

At some point, the crypto industry possibly chose to move towards total regulation, similar to the stock market. This would lead to reduced investment activity and extra taxation. These factors, coupled with the current transaction costs, could be a key factor in rejection of investments into cryptocurrencies. As crypto becomes more assimilated by the financial system, it would become more and more dependent on macroeconomic factors and national policies.

Goldman Sachs strategists believe that government regulation is unlikely to push cryptocurrencies up. However, it could bring investments from major funds and state institutions, and increased security would ensure a greater customer base for crypto assets.

The correlation between cryptocurrencies and the stock market makes them less valuable as a next generation payment system. "Over time, further development of blockchain technology, including applications in the metaverse, may provide a secular tailwind to valuations for certain digital assets," Golden Sachs strategists noted. "But these assets will not be immune to macroeconomic forces, including central bank monetary tightening," they added. Time will tell whether the recent crypto crash during the stock market correction was only accidental or a true sign of the market's dependence on Fed policy.

Bitcoin, which correlates with the SPX and the NASDAQ, is the key gauge of the current situation in the crypto market. BTC has a number of key resistance levels, the main one being located in the $39,000-40,000 area. As of January 28, the upside potential of BTC/USD and the altcoin market is largely determined by the upside potential of major stock indexes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română