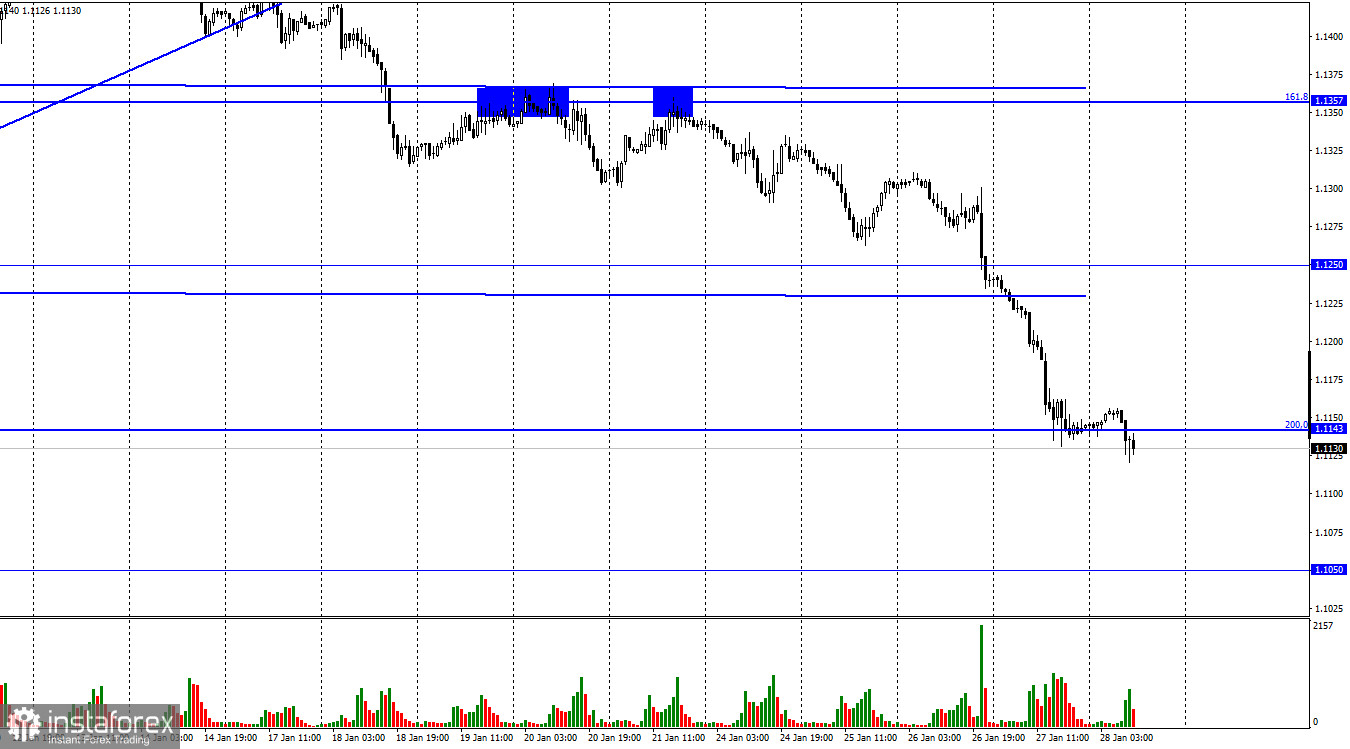

The EUR/USD pair continued the process of falling on Thursday and was near the corrective level of 200.0% (1.1143) by the end of the day. There was no rebound from this level as such, and already today the pair performed a close under the Fibo level of 200.0% (1.1143). Thus, the process of falling European quotes can now be continued in the direction of the next level of 1.1050. Let me remind you that the US dollar has been growing for two weeks. At first, its growth was technical, as the pair performed a close under the ascending trend line. But in the last few days, the information background has been providing strong support to bear traders. On Wednesday, the Fed made a series of loud statements, the essence of which is the same: in 2022, the interest rate may be raised more than 4 times, and all forces will be thrown into the fight against inflation. Naturally, such information could not but cause the dollar to rise.

And yesterday, it became known that the American economy grew by 6.9% q/q in the fourth quarter, although traders expected an increase in the range of 5.3-5.5% q/q. Such an excess of forecasts unties the hands of the Fed, which can now tighten monetary policy without regard to the growth rate of GDP or the labor market. By the way, Jerome Powell said on Wednesday evening that the labor market is in good condition, and the unemployment rate is approaching a minimum. Thus, if earlier there were concerns due to the slowdown in the labor market recovery with higher rates and a reduction in the QE program, now there are no such concerns. And if the Fed raises rates at almost every meeting starting in March, then the dollar receives excellent support from the information background for the entire current year. And the Fed plans to raise the rate not only this year but also next year. The European Central Bank cannot yet boast of a strong economy, high recovery rates, low unemployment, or the ability to raise interest rates.

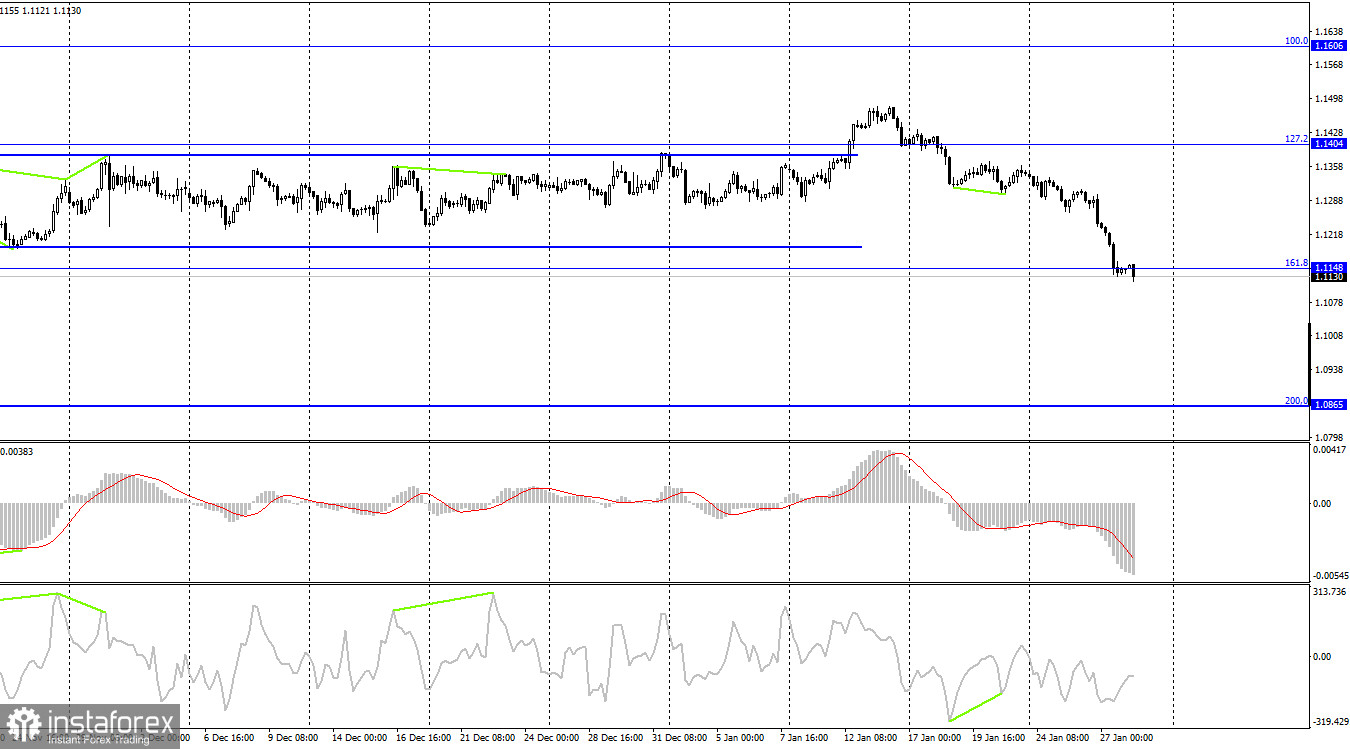

On the 4-hour chart, the pair's quotes performed a drop to the Fibo level of 161.8% (1.1148). Closing under this corrective level will work in favor of the US currency and the pair will continue to fall towards the next Fibo level of 200.0% (1.0865). Emerging divergences are not observed in any indicator today. A rebound from the level of 1.1148 will work in favor of the EU currency and some growth in the direction of the corrective level of 127.2% (1.1404).

Commitments of Traders (COT) Report:

Last week, large traders opened more than 9 thousand long contracts and closed 8 thousand short contracts. Thus, the total number of long contracts concentrated in the hands of the "Non-commercial" category of traders has grown to 212 thousand. The general mood in the market is thus "bullish" since the number of short contracts in the same category is lower. However, the trend is also important. And the trend shows that in recent months, major players are more inclined to sell the euro currency than to buy. I expect this trend to continue in the near future.

News calendar for the USA and the European Union:

US - main index of personal consumption expenditures (13:30 UTC).

US - change in the level of expenditures and incomes of the population (13:30 UTC).

US - consumer sentiment index from the University of Michigan (15:00 UTC).

On January 28, the calendar of economic events of the European Union is empty again, and several reports will be released in America, which may slightly affect the mood of traders. However, in general, I think that the information background will be weak today.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair with a target of 1.1143. Since this level has been passed, it is now possible to stay in sales with a target of 1.1050 on the hourly chart. I recommend buying a pair if there is a rebound from the 1.1148 level on the 4-hour chart. You can count on 50-60 points of growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română