Following the results of yesterday's trading, the GBP/USD currency pair showed a significant decline. However, the pound was by no means alone in its fall. After the "hawkish" Fed meeting, the US dollar continues to gain strength across the entire spectrum of the market. Yesterday's preliminary GDP data for the fourth quarter, which came out at 6.9% with a forecast of 5.5%, also significantly supported the US currency. It was not for nothing that Fed Chairman Jerome Powell praised the world's leading economy at his press conference. If you look at today's economic calendar, we won't see any British reports there. But from the United States, starting at 13:30 London time, data on personal income and expenses of Americans will begin to arrive, and the basic price index of personal consumption expenditures and the consumer sentiment index from the University of Michigan will also be published. These reports may to some extent affect the course of today's trading on the pound/dollar pair, although everything is clear.

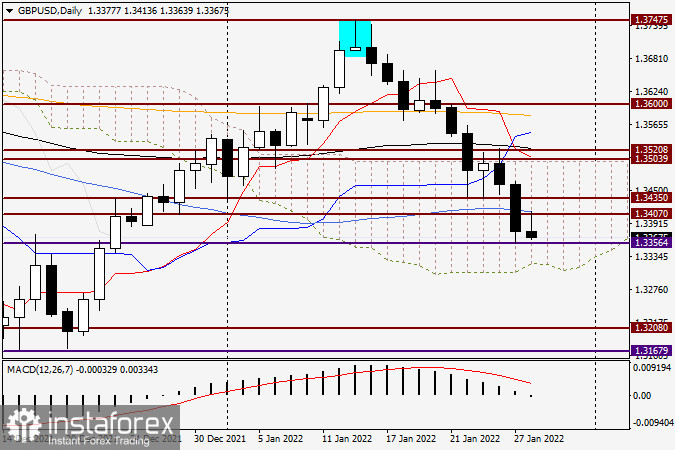

Daily

As a result of yesterday's fall (and it's hard to call it anything else), the pair broke through the blue 50 simple moving average and got even closer to the lower border of the Ichimoku indicator cloud. During trading on January 27, the minimum values were shown at 1.3356, but the strong technical level of 1.3360 confirmed its status and provoked a rebound, as a result of which yesterday's trading session ended at 1.3378. It is very noteworthy that at today's auction, the market has already given a pullback to the 50 MA that was broken the day before. However, having met strong resistance from this moving, the pair turned down and, most likely, will resume movement in the south direction. In principle, this is already happening. Now the primary task of the bears for the pound will be to census yesterday's lows at 1.3356, and in the event of a breakdown of this mark, the pair will rush to the lower boundary of the Ichimoku cloud, which today passes at 1.3321. If today's trading closes below it, it will mean an increase in bearish sentiment, as a result of which the decline will not only continue but may become even more intense. If the bulls in the British currency manage to raise the rate and close today's session above the 50 MA broken yesterday, there will be a reason to think about the further direction of the exchange rate. In the meantime, the pair is set in a bearish mood and is confidently moving in a southerly direction.

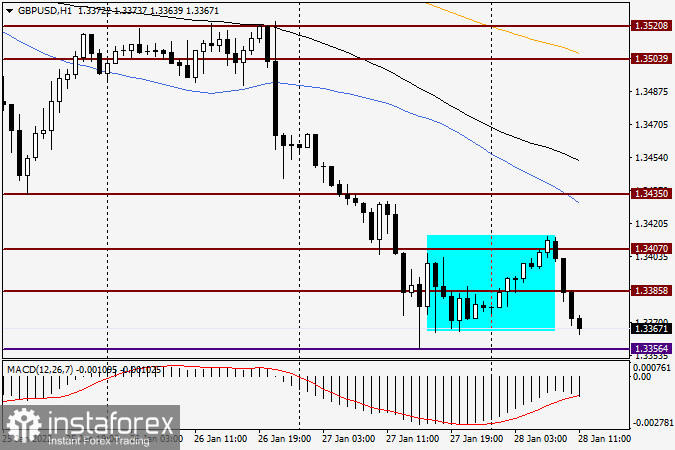

H1

Naturally, after the Fed's tough stance and excellent GDP growth data, the US dollar has every chance to continue strengthening. It follows from this that the main trading idea for GBP/USD looks like sales. However, jumping on an outgoing train, especially on the last day of weekly trading, can be extremely risky. I suggest waiting for corrections, mainly in lateral ranges, similar to the one highlighted on the chart, and only after that think about opening deals for sale.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română