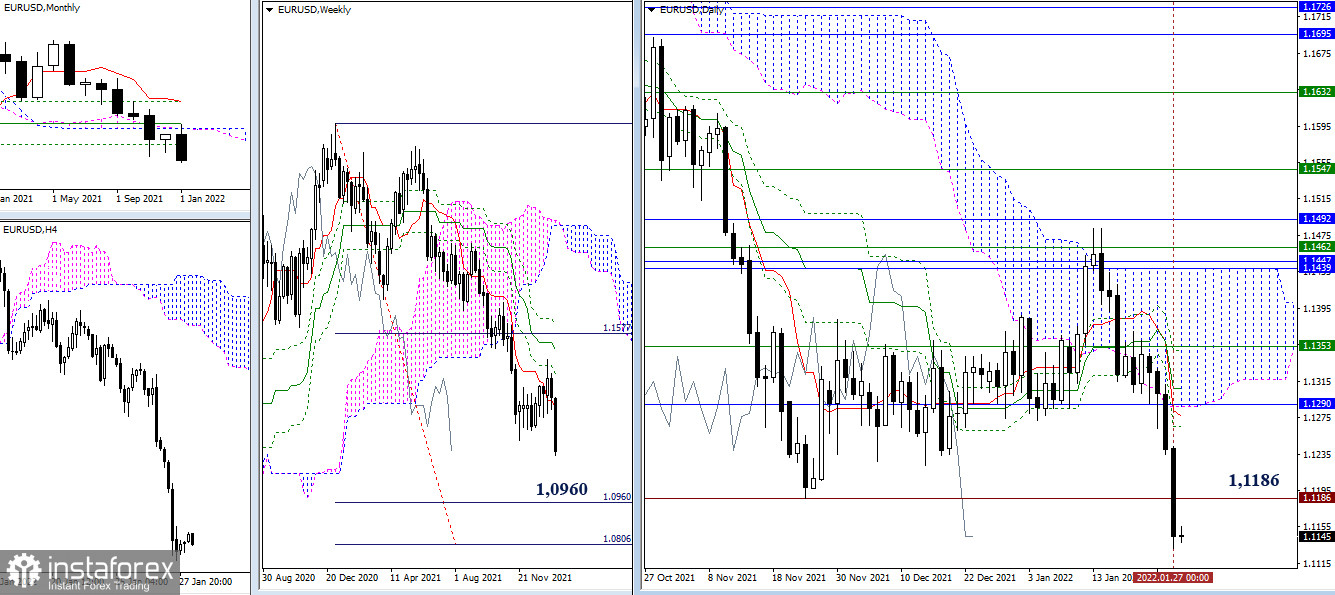

EUR/USD

The bears left the weekly correction zone and continue to decline within the weekly downward trend after updating the low (1.1186). The week will be closed today, and on Monday, January will be closing. Therefore, it's now the time to work on the result, which is especially important and noticeable. If sellers manage to maintain or strengthen their positions, then it will be possible to take a closer look at new bearish prospects later. The nearest downward pivot point is the bearish target for the breakdown of the weekly cloud (1.0960 - 1.0806).

The main advantage in the smaller timeframes belongs to the bears' side. At the same time, the pair is now in the zone of corrective slowdown. If the downward trend (1.1131) recovers, the support of the classic pivot levels (1.1103 - 1.1061 - 1.0991) will be considered as downward pivot points. But if the upward correction is implemented in the near future, then its pivot points today will be the key levels of 1.1173 (central pivot level) and 1.1271 (weekly long-term trend). The nearest resistance along this path can be noted at 1.1215 (R1).

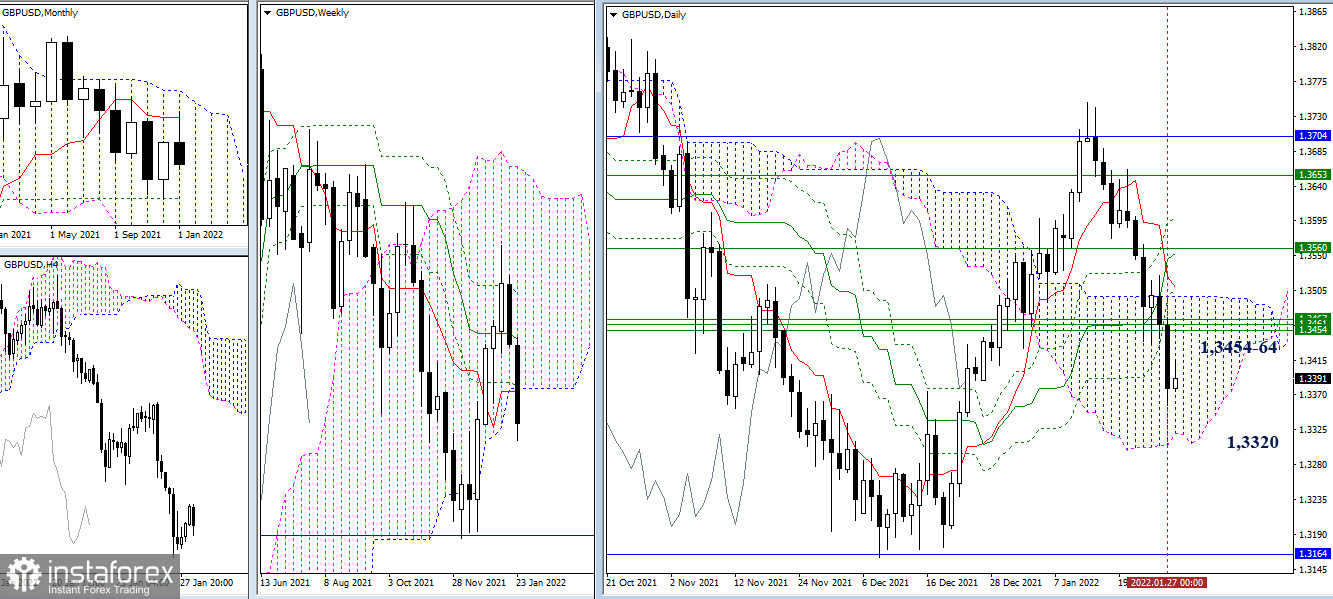

GBP/USD

As the week is ending, it should be noted that the trading result has already been indicated. The bears managed to confirm and implement the rebound formed last week. Now, at the close of the current week, the scale of the decline and retention of the achieved positions will be very important. The nearest downward pivot point is the lower border of the daily cloud (1.3320). In case of an upward trend, the accumulation of weekly levels (1.3454-64) broken the day before may act as important resistances.

At the moment, the pair is in the correction zone of the smaller timeframes, testing the strength of the first support (1.3401) of the classic pivot levels. Now, the most important pivot point for the upward correction is the weekly long-term trend (1.3480). In case of consolidation above and reversal of the moving average, it would be better to re-evaluate the balance of forces. The nearest resistance along this path can be noted at 1.3444 (R1). On the contrary, in case of exit from the correction zone and restoration of the downward trend, the downward pivot points will be the support of the classic pivot levels (1.3334 - 1.3291 - 1.3224).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română