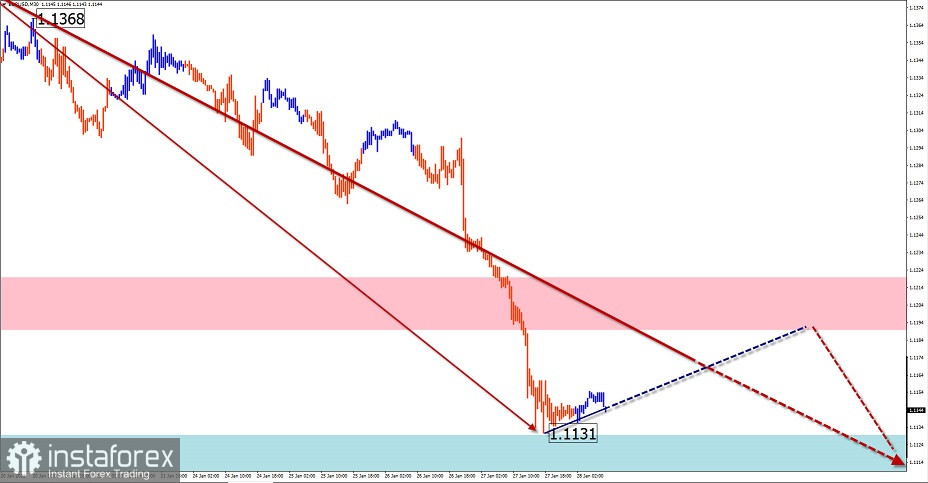

EUR/USD

Analysis:

The euro chart has been dominated by a bearish trend since the beginning of last year. As a result of the price decline, quotes have reached a potential large-scale reversal zone. At a minimum, in this zone, it is worth counting on a short-term stop of the downward movement of the price.

Forecast:

After the active phase of decline, a flat mood of movement along the support zone is expected today. Short-term price growth is not excluded, not higher than the calculated resistance.

Potential reversal zones

Resistance:

- 1.1190/1.1220

Support:

- 1.1130/1.1100

Recommendations:

Trading the euro today can lead to losses. It is recommended to refrain from entering the pair's market until the upcoming pullback is completed, tracking the reversal signals for sale at its end.

USD/JPY

Analysis:

The incomplete wave structure of the Japanese yen major coincides with the direction of the global uptrend. The wave has been counting down since November 30 last year. On January 14, the final part (C) started. Quotes are approaching the lower border of a strong resistance zone.

Forecast:

In the first half of the day today, a sideways movement along the support zone is most likely. By the end of the day, the activation and resumption of the price rise are likely, up to the calculated resistance.

Potential reversal zones

Resistance:

- 115.90/116.20

Support:

- 115.20/114.90

Recommendations:

There are no conditions for selling on the yen market. Within the framework of individual sessions, short-term purchases with a reduced lot are possible today.

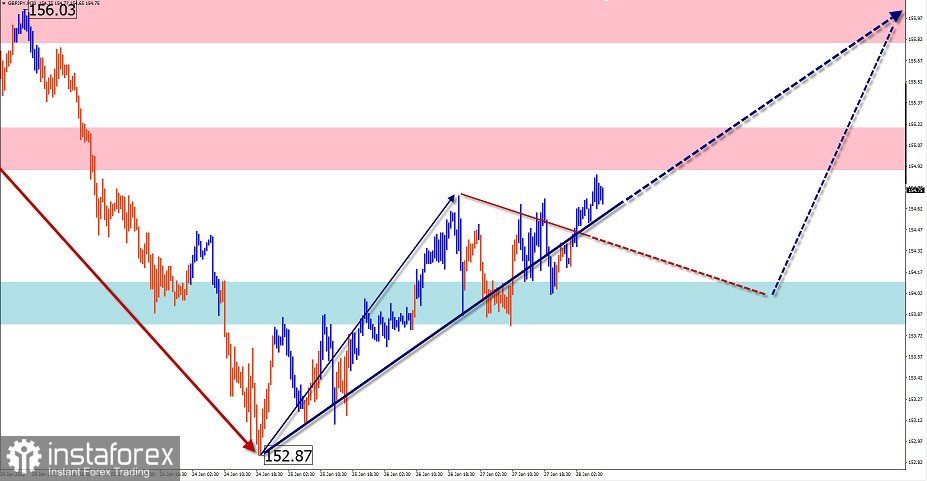

GBP/JPY

Analysis:

The current wave of the pound/yen cross has been counting since the end of November last year and is directed upwards. The ascending section from January 24 has a reversal potential. This is the signal of the end of the middle part of the wave (B) and the beginning of the final part (C).

Forecast:

In the coming trading sessions, movement in the lateral plane along the nearest resistance is expected. A short-term decline is not excluded. At the end of the day or tomorrow, you can expect a resumption of the price rise, with the price rising to the far resistance zone.

Potential reversal zones

Resistance:

- 155.80/156.10

- 154.90/155.20

Support:

- 154.10/153.80

Recommendations:

In the first half of the day, a sideways mood is expected, so trading transactions can lead to losses. It is recommended to refrain from entering the pair's market until the rollback is completed and confirmed buy signals appear.

Explanations: In simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, the dotted one shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the movements of the instrument in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română