S&P500

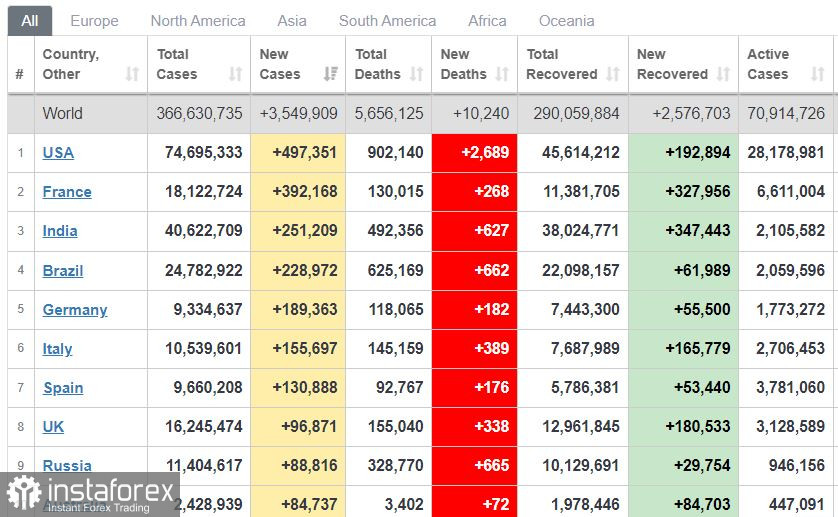

Global epidemiological situation on January 28

The US stock market dropped after the publication of a strong GDP report. The correction continues.

The US main stock indices closed with a decline. Thus, the Dow Jones declined by 0.1%, the NASDAQ Composite lost 1.5%, and the S&P500 decreased by 0.5%.

Meanwhile, Asian indices opened with a rise on Friday. Japan's index added 2% and China's index increased by 0.4%.

Oil is still trading near its high of $90.

S&P500 is at 4,326, the range is 4,300–4,360.

On Thursday, the US published its GDP report for the fourth quarter. Economists had expected a significant rise of 5.6%. In fact, the indicator surged by 6.9%, encouraging market participants. Stock indices opened with a rise, but then resumed falling. It is quite possible that the high bearish activity was caused by the fact that now the Fed does not have to support economic growth. The key issue is to cap the surging inflation by means of higher interest rates. The GDP inflation – deflation – also turned out to be very high at 6.9%. At the same time, the US durable goods orders dropped by 0.9% in December after an increase of 3.2% in November. Core durable goods orders inched up by 0.4%. Meanwhile, the number of first-time claims was quite stable showing the growth of 260K. The number of continuing claims totaled 1.67 million.

Today, the US is going to disclose its inflation report for December.

Yesterday, Tesla stocks lost 8% amid the news about a delay in the production of pickups. Stocks of IT companies lost a lot. McDonald's net profit increased 1.6 times to $7.5 billion in 2021. The Nissan, Renault, and Mitsubishi alliance are planning to invest $23 billion in the development of electric vehicles over 5 years.

Yesterday, the US reported on a record number of new Omicron cases of 500K. In France, the daily increase was 400K, in Russia – 89K, in Germany – 190K. Notably, the death toll is slightly higher compared to the previous wave.

Apple sales reached $123.9 billion in the fourth quarter, exceeding previous records. The company's CEO Tim Cook said that problems with the supply of components are being solved. Apple's shares closed with a jump of 4%.

S&P500 futures opened higher by 0.6%.

The US GDP advanced by 6.9% in the fourth quarter. On a yearly basis, the indicator grew by 5.5%, showing the best performance in the last 40 years. Experts suppose that in 2022, the economic growth will be significantly smaller.

USDX is at 97.10, the range is 96.80-97.40. On Thursday, the US dollar index surged to 97.10 from 96.45. The indicator was rising for two days in a row after the Fed's announcement about a key interest rate hike in March. The euro dropped to 1.1150 against the greenback.

USD/CAD is trading at 1.2715, the range is 1.2680-1.2760. The pair showed a rise following the US dollar. However, high oil prices are still exerting pressure on the pair.

Conclusion: the market is waiting for the US inflation report for December. The US stock market may show a new jump.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română