If in 2021 gold was a problem child and closed the year in the red zone for the first time since 2015, then in 2022 the precious metal is ready to turn into a star boy. Since the beginning of November, XAUUSD quotes have risen by 4%, and the "bulls" intend to continue in the same spirit against the backdrop of growing demand for safe-haven assets in conditions of increased volatility in financial markets. But at the end of 2021, many predicted an almost unknown death for gold. However, as often happens, the expectations of death turned out to be worse than death itself.

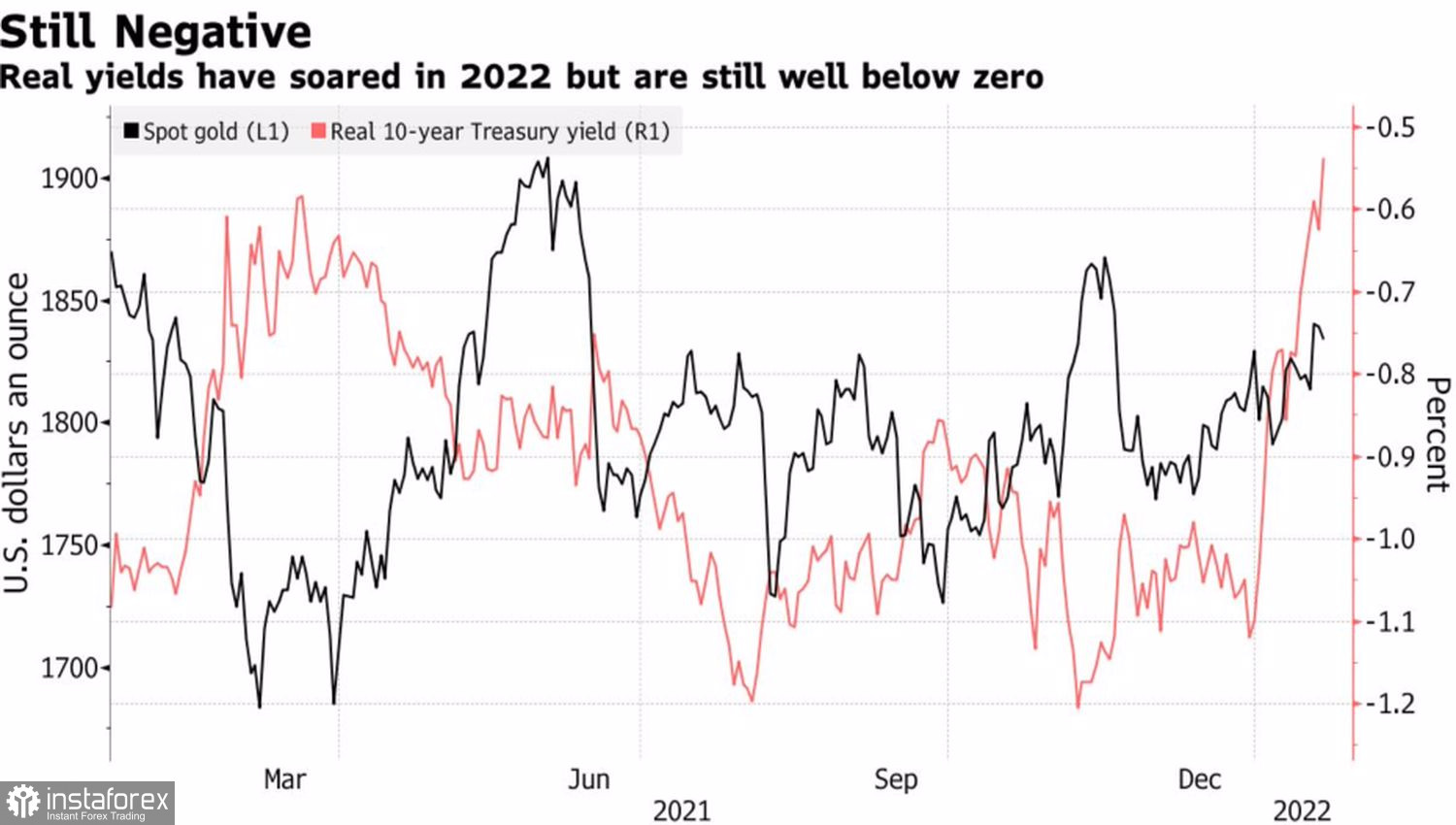

Indeed, it is one thing when investors expect the Fed to raise the federal funds rate, another when the Central Bank does it. The markets are growing on rumors, and the U.S. dollar is no exception. Last year, it became the best performer among the G10 currencies, this year, frankly speaking, it does not shine. The rising yield of Treasury bonds does not help the "bears" on XAUUSD either. Investors are paying more attention to the real rates on U.S. debt. Despite their recent growth, it is still far from leaving the negative zone, which means that the precious metal will continue to provide them with worthy competition.

Dynamics of Gold and Real Treasury Bond Yields

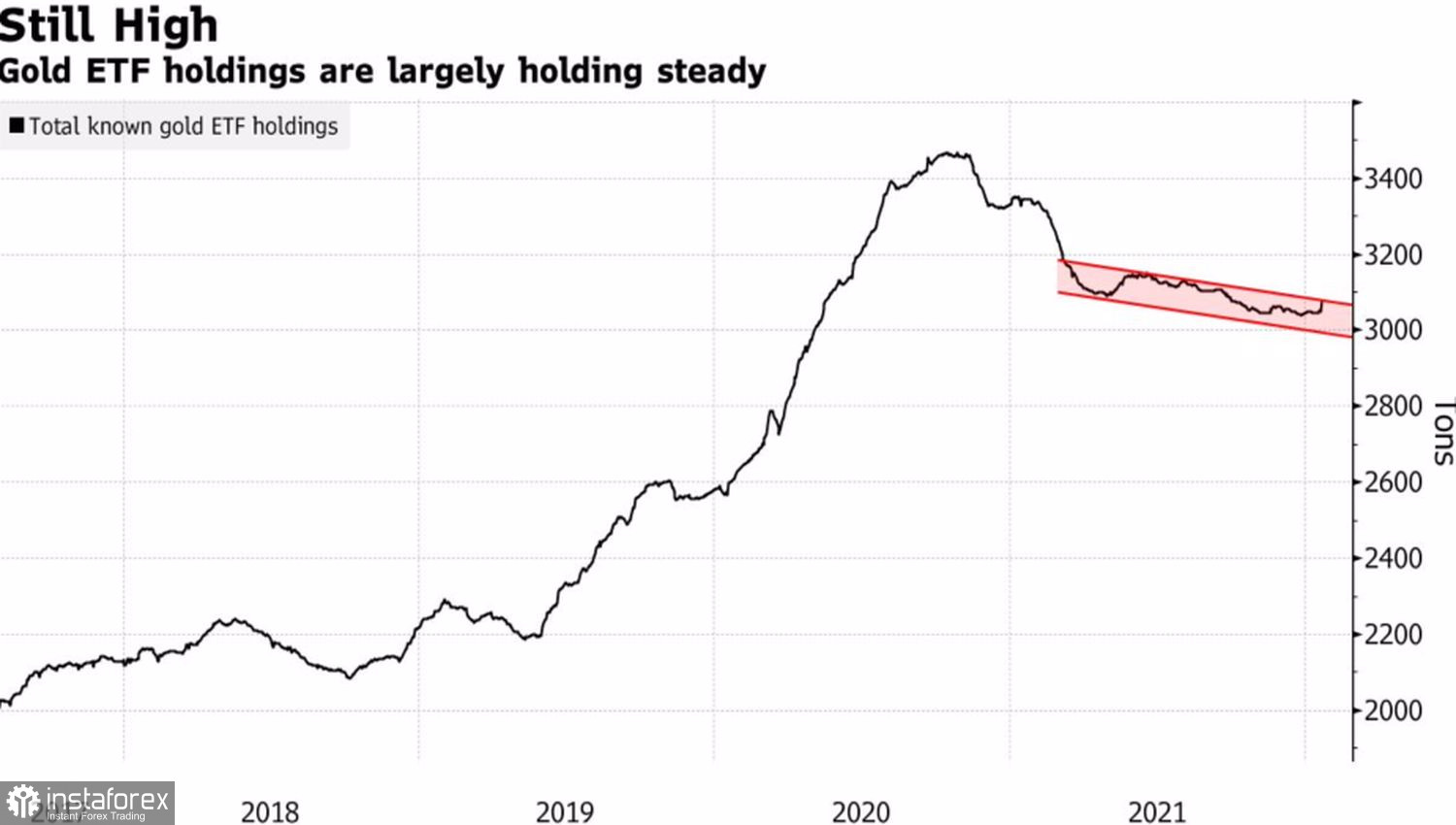

The outflow of capital from the stock markets and cryptocurrencies contributes to the gold rally. Bitcoin is currently down 50% from all-time highs, and the Nasdaq Composite has lost about 14% since the start of the year. Cryptocurrencies, often referred to as digital gold, and tech stocks have enjoyed increased traction in 2021 due to colossal monetary stimulus. In 2022, the time has come to cut them, and money is flowing from these markets to safe-haven assets, which include the precious metal. And while ETF holdings have declined over the past 6 months, at this rate of decline, it will take them about 7 years to return to early 2020 levels.

Gold ETF stock dynamics

Investors are increasing the share of gold in portfolios, insuring not only the risks of maintaining inflation at elevated levels, but also risks of a geopolitical nature. In this regard, fears about a possible Russian invasion of Ukraine are lending a helping hand to the XAUUSD bulls. Under such a scenario, Moscow's response to Western sanctions could lead to an acceleration in the growth of gas and oil prices, which will ultimately affect inflation.

Gold is also supported by the IMF's doubts about the rapid recovery of the global economy. The organization lowered its forecast for global GDP from 4.9% in October to 4.4%, citing the negative impact of high inflation, monetary tightening by the world's leading central banks, and continued supply chain problems. The assessment of U.S. GDP has undergone the greatest sharpening, including due to the inability of Joe Biden to add new fiscal stimulus to the economy. Because of this, the dollar may ultimately suffer, and the XAUUSD bulls may win.

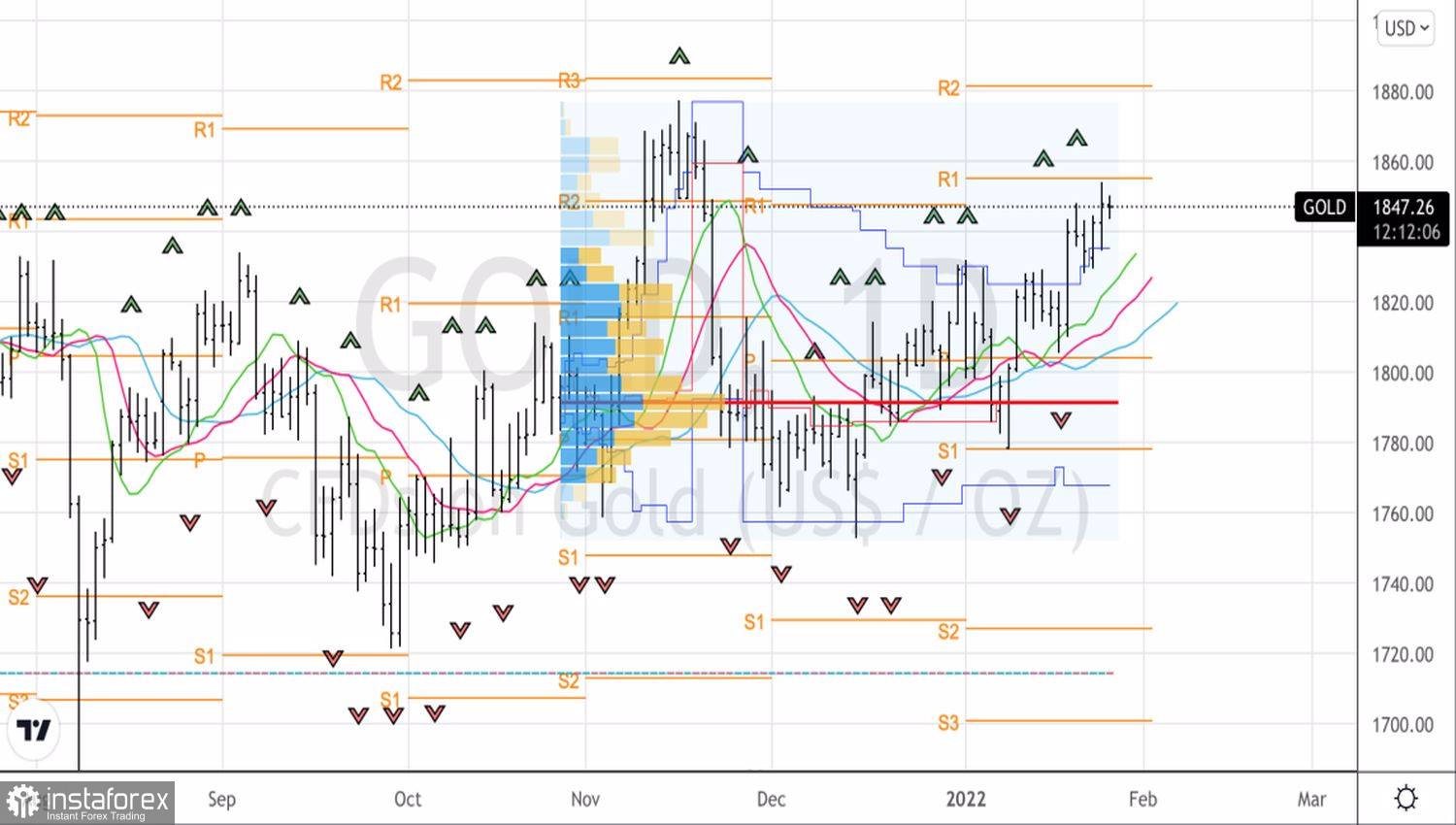

Technically, only a drop in gold quotes below the upper limit of fair value by $1,835 will trigger a correction to $1,820 and $1,805 per ounce and become the basis for sales. On the contrary, a break of resistance at $1,855 will allow the bulls to count on the continuation of the rally.

Gold, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română