The price of gold is trading in the red at 1,760 at the time of writing. After its strong rally, a temporary retreat could be natural. Still, a downside movement needs strong confirmation as the bias remains bullish.

As you already know, XAU/USD rallied after the US reported lower inflation. Fundamentally, the UK data came in mixed today. Surprisingly or not, the yellow metal slips lower even if the US Prelim UoM Consumer Sentiment came in at 54.7 points versus 59.5 points expected. As I've said earlier, XAU/USD could be overbought, that's why it has retreated a little.

XAU/USD Exhausted Buyers!

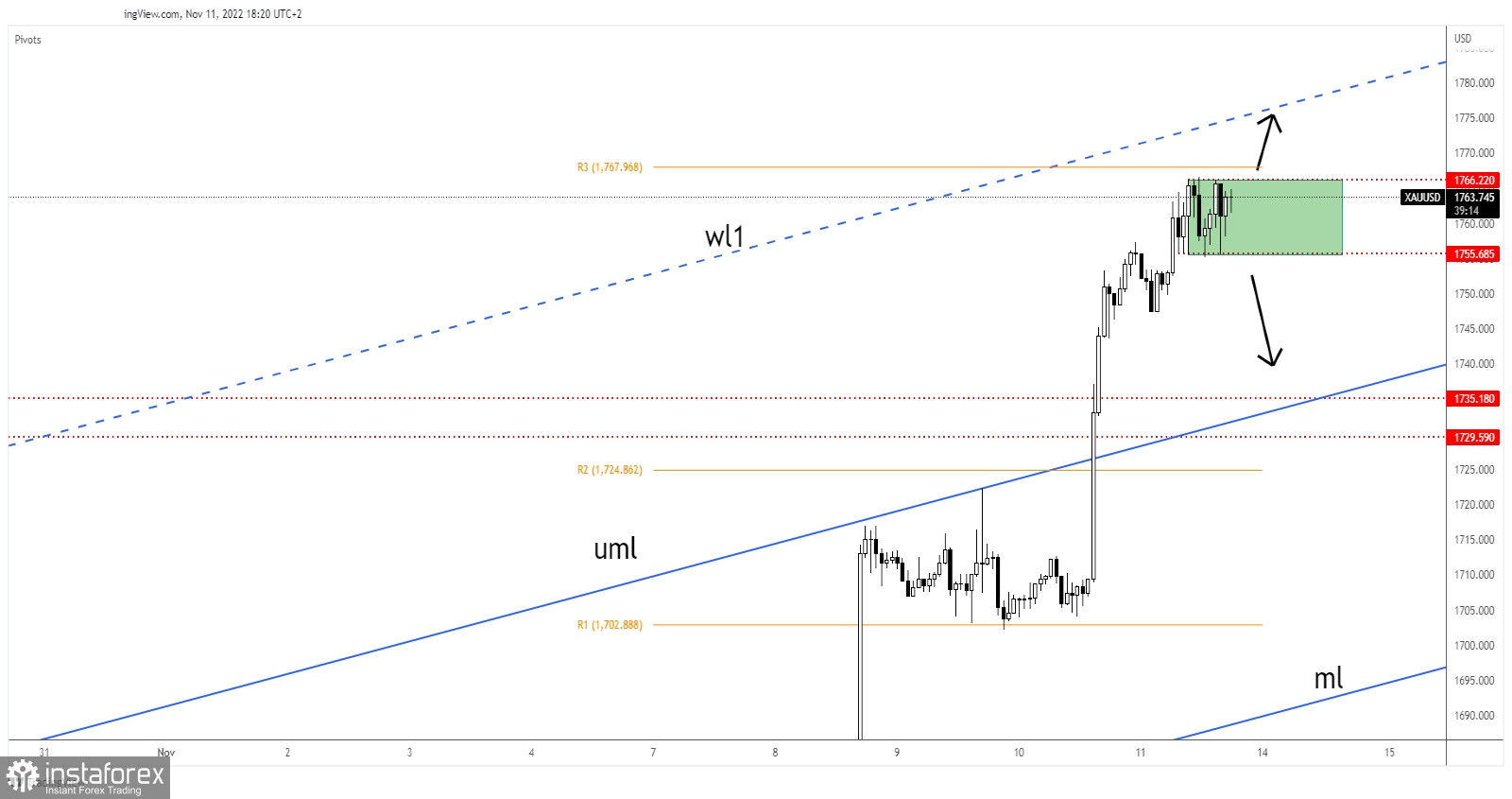

Technically, the yellow metal is trapped between 1,755 and 1,766. The bias is bullish so that the current range could represent an upside continuation pattern. Escaping from this range could bring us new trading opportunities.

The weekly R3 (1,767) and the warning line (wl1) represent upside obstacles. After testing and retesting 1,755, the price action signaled upside pressure.

XAU/USD Forecast!

A valid breakout through 1,766 activates further growth and brings new longs, while registering only false breakouts followed by a valid breakdown below 1,755 brings new selling opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română