Analysts at multinational investment bank and financial services company UBS Group AG have warned that the current Bitcoin price slump could be the beginning of a new "crypto winter."

According to an Insider report, another "winter" could be in store for crypto markets. After a series of price crashes, it will take years for Bitcoin to recover to its latest all-time high.

Analysts at UBS recently warned that the current correction could be the start of a bear market similar to the one that followed the fall in cryptocurrency prices in early 2018.

Fed's tightening monetary policy will hit the market

In a note to clients, UBS Group AG cited the Federal Reserve interest rate hike in 2022 as one of the pressures. Such an increase in the value of the U.S. dollar reduces the attractiveness of cryptocurrencies. UBS argues that rising interest rates are challenging the notion that Bitcoin is a good alternative currency or store of value.

The note also lists the technology's shortcomings, such as transaction speed and lack of scalability. In addition, according to a growing opinion, the possible introduction of regulation will hinder the development of cryptocurrency.

UBS analysts report that a combination of factors likely indicates that the current cryptocurrency price correction is a harbinger of the worst. They wrote that the central bank's efforts to curb inflation cast a shadow over Bitcoin. And the previous rise was due to the fact that in 2020 and 2021 the market received support in the form of cheap money and stimulus, which probably played a big role in the dynamics of bitcoin.

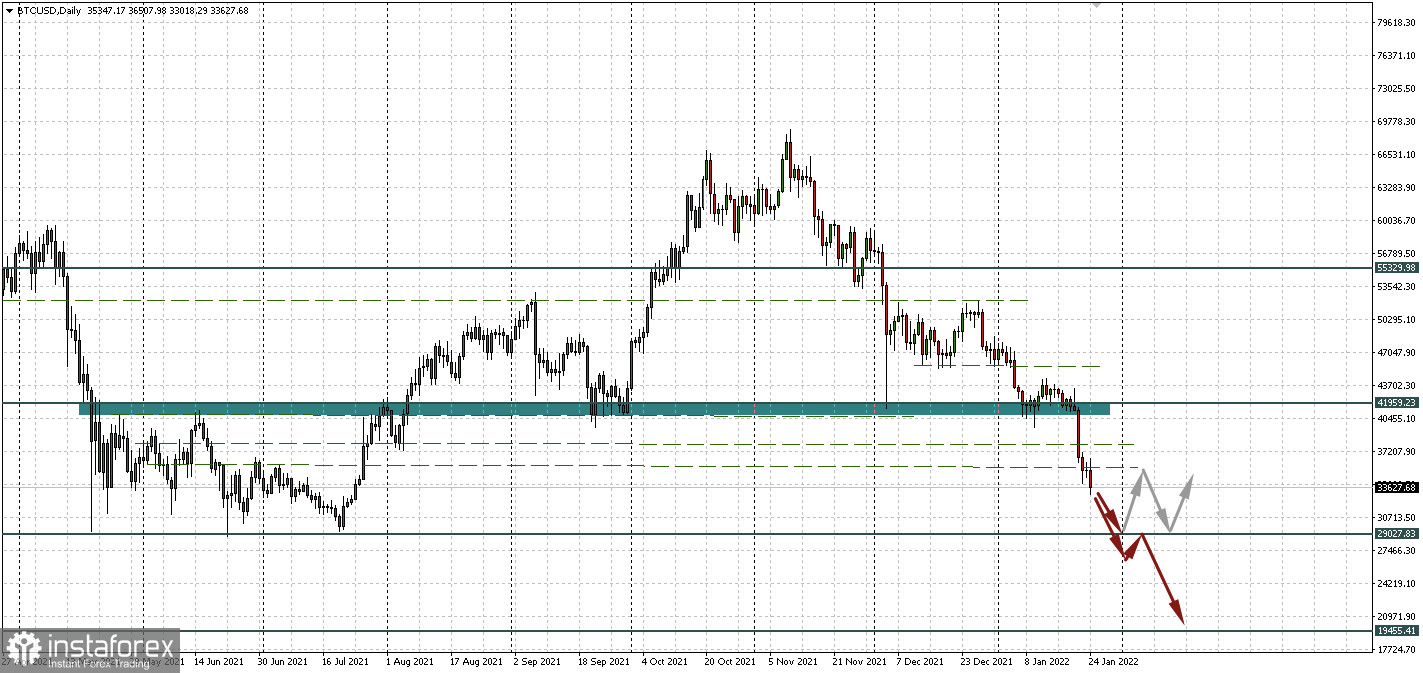

Technical factors point to a fall to the $29,000 and $20,000 area

Meanwhile, the technical picture on the chart of the main cryptocurrency no longer leaves any hope for recovery. Over the weekend, the 36,000–38,000 zone was passed, and now, after consolidation below the level of 35,915.72, Bitcoin has a direct path to the support of 29,027.83. On the way to it, there may be a situation in the area of $30,000 per coin.

As you can see, crypto bulls will have to be patient. But theoretically, the level of 29,027.83 can hold up as it did the last time in May–July 2021 at the height of the Chinese crackdown on the crypto industry.

But then fears were exhausted in this zone, and now the increase in interest rates by the Fed is just ahead, and four stages of tightening monetary policy may occur in a year.

Against this background, there is a threat of consolidation below the level of 29,027.83, which will be a much worse sign for Bitcoin. It is possible that a wave of margin liquidations will amplify the decline, and BTCUSD could drop to $20,000 per coin.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română