We continue to consider the main currency pair on the four-hour timeframe. Today, major economic news in the EU and the US are not expected.

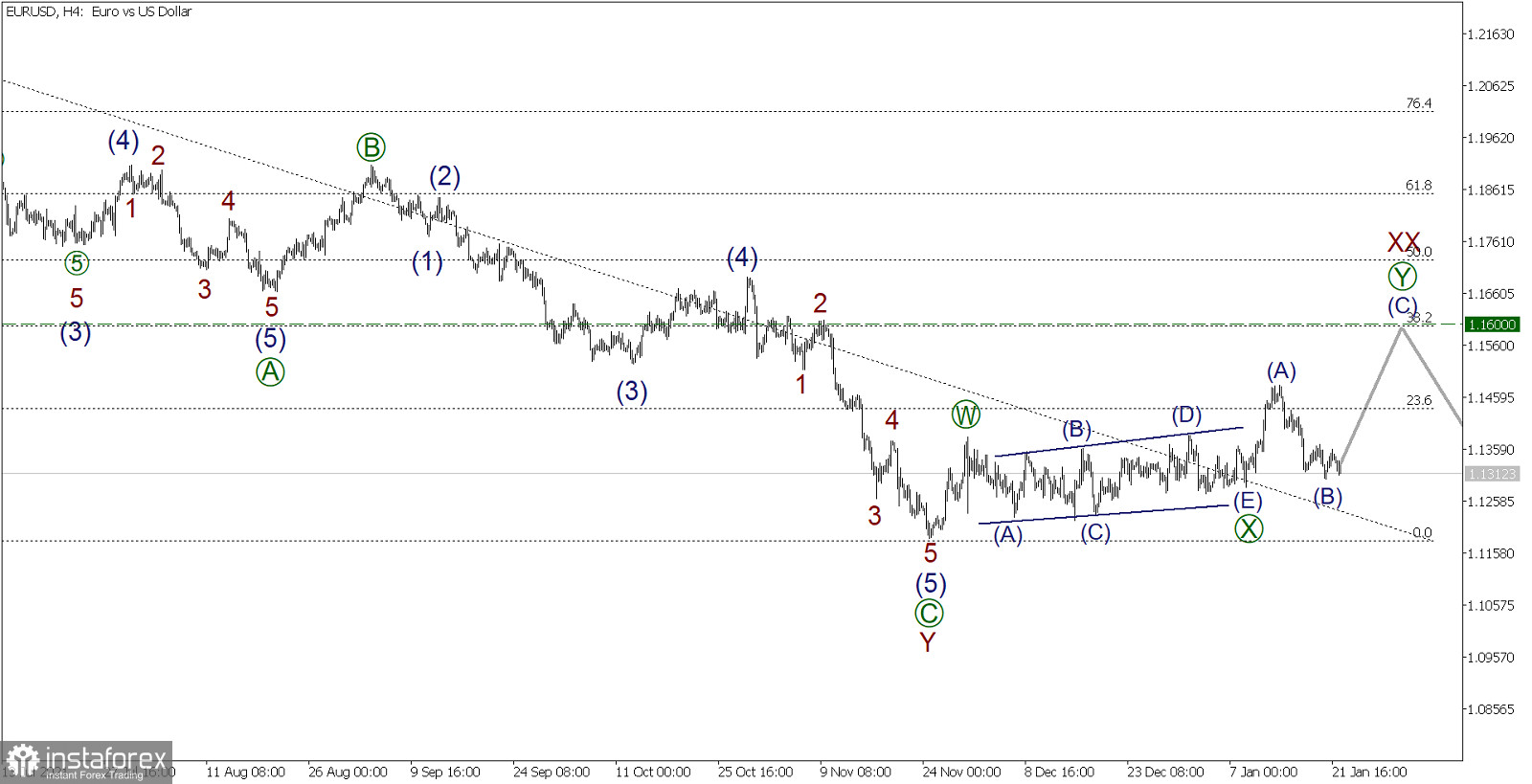

EUR/USD, H4 timeframe:

According to the Elliott theory, a global corrective trend is moving in a downward direction. This trend is likely to take the form of a triple zigzag WXY-XX-Z.

On the four-hour timeframe, it shows that the decline in the current wave Y was already over, which was followed by an upswing in the wave bundle XX.

The internal structure of wave XX hints at a double zigzag [W]-[X]-[Y], where the wave bundle [X] is an inclined triangle (A)-(B)-(C)-(D)-(E). Now, a bullish action wave [Y] is under development, which can be a standard zigzag (A)-(B)-(C).

The final impulse wave (C) is needed to complete the above zigzag. It is possible that wave (C) will take the form of a finite diagonal.

The price of quotes may rise to the level of 1.1600. At this level, the size of wave XX will be 38.2% along the Fibonacci lines from wave Y.

Trading recommendations: buy from the level of 1.1312 and take profit at 1.1600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română