In early January, EUR/USD tried to leave the trading range between 1.1260 and 1.1360 where it had been trapped for 6 previous weeks. For the first time since November, the buyers escaped from the flat market and approached the levels just below 1.15. Eventually, the brief upward move was over. The bulls failed to test the level of 1.1500 with the price peaked at 1.1483. In anticipation of the Fed's policy meeting in January, the US dollar again is enjoying buoyant demand, so the euro is not able to resist the greenback. As a result, the currency pair has again got stuck in the above-said trading range ahead of some crucial events of the month.

This week, the seesaw will swing either in favor of the US dollar or the euro on condition that the greenback weakens. Apart from the Fed's verdict that serves as a decisive fundamental factor, the economic calendar is full of other economic data. Market participants will certainly take notice of the US GDP data and personal spending. If the actual readings benefit the US dollar, EUR/USD will sink below support of 1.1260 that matches the lower border of Bollinger bands on the daily chart. The bears will try to test the level of 1.1100. Otherwise, we would expect a large-scale upward correction with the challenge of 1.1500.

Today, on January 24, traders will get to know manufacturing and services PMIs for the large European economies. According to the consensus, the fresh PMIs could reflect a negative trend as the January scores will be lower than in December. However, if the actual figures are better than expected, traders will hardly give any response. The US manufacturing PMI is also expected to edge down to 56.9 in January from 57.7 in December.

On Tuesday, January 25, market participants will find out the IFO business climate index for Germany. According to flash estimates, the index should remain flat as in December. EUR/USD could respond to the report depending on the actual figure. In any case, the response will be short-lived. During the North American session, investors will be alert to the US consumer sentiment index. The indicator has been growing for 4 months straight from September until December. It has climbed to 115.8. However, the index for January could discourage investors. It might have slumped to 111 points. This report will also be of little importance for EUR/USD. None of market participants will venture into large bets before the Federal Reserve announces its verdict.

Hence, the highlight of the week will be the Fed's policy update to be unveiled on Wednesday, January 26. Late in the trading day, the central bank is due to announce policy decisions and Jerome Powell is holding a traditional press conference. The burning question is whether the regulator is ready for the aggressive pace of rate hikes this year. Some experts think that traders have too high expectations. According to the baseline scenario, the Federal Reserve will resort to 3 rate hikes this year: in March, June or August, and December. Besides, this scenario suggests that the US Fed will begin tapering its balance sheet in July. There is a more hawkish scenario, under which the central bank will raise interest rates every other policy meeting, starting from March 2022. All in all, this scenario includes 4 rate hikes. If implemented, the regulator might announce tapering its balance sheet at the policy meeting in May. Any deviations from these scenarios towards more cautious moves are bearish for the US dollar. Importantly, some Fed policymakers agitated the market with their hawkish statements. Therefore, from my viewpoint, traders have elevated expectations. So, the Federal Reserve will hardly surpass such expectations. However, we should not discard this variant in full in the context of soaring inflation rates in the US.

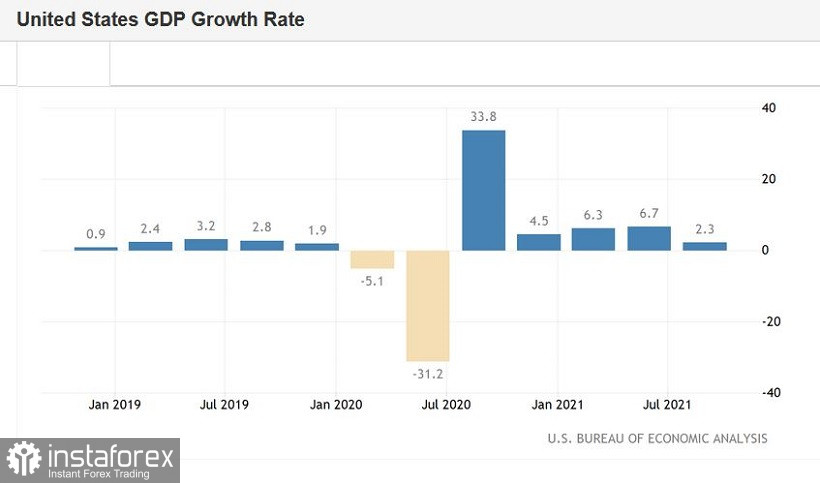

On Thursday, January 27, all eyes will be on the revised US GDP data from Q4 2021. Let me remind you that the US economy revealed dismal performance in Q3 2021. The national economic output expanded just 2.3%. Analysts expect a stronger dynamic in the final quarter with GDP reading at 5.4%. In a separate report, traders will get to know durable goods orders which are likely to be downbeat. The headline indicator could have contracted by 0.4% in December. Durable goods orders excluding transport could have grown by 0.3%.

On Friday, we will find out the PCE price index, the criterion which the US Fed gives high priority to. The index has been way above the regulator's target level for a few months in a row. It is common knowledge that the central bank is keeping close tabs on this indicator. The core PCE surged to 4.7% in November in annual terms, the fastest growth since 1989. The revised reading for October was upgraded to 4.2% from 4.1%. The index is expected to extend growth on December with an uptick to 4.8%. The report should provide the greenback with solid support, especially if it tops the rate of 5%.

To sum up, from my viewpoint, EUR/USD is set to trade in the previous range of 1.1260 to 1.1360 until Wednesday. Its further trajectory will depend on how hawkish the US Fed will be. Therefore, it would be a wise decision to take a pause with the wait-and-see mood in anticipation of the Fed's policy update because EUR/USD's prospects are very uncertain.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română