Today, we are likely to see a mirror scenario of what was happening last Friday unfolding. In the European session, the euro is expected to edge down, being pressured by the preliminary PMIs. So, the manufacturing PMI is estimated to fall to 57.1 versus 58.0, and the one in the services sector is projected to drop to 52.4 from 53.1. Meanwhile, the composite PMI could decrease to 52.6 versus 53.3.

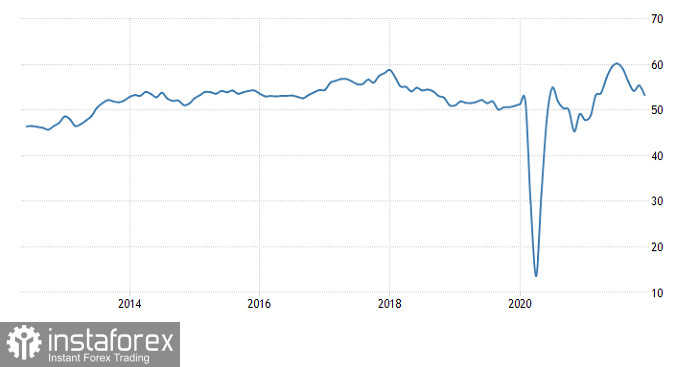

Eurozone Composite PMI:

After the opening of the North American session, the market is likely to reverse and the single European currency to return to its earlier positions. Preliminary business activity data in the United States could be the reason. So, the manufacturing PMI is forecast to drop to 57.0 from 57.7 and the services PMI to tumble to 65.0 versus 57.6. The composite business activity index could fall to 56.7 from 57.0. Generally speaking, the business activity results are expected to be disappointing in both countries.

United States Composite PMI:

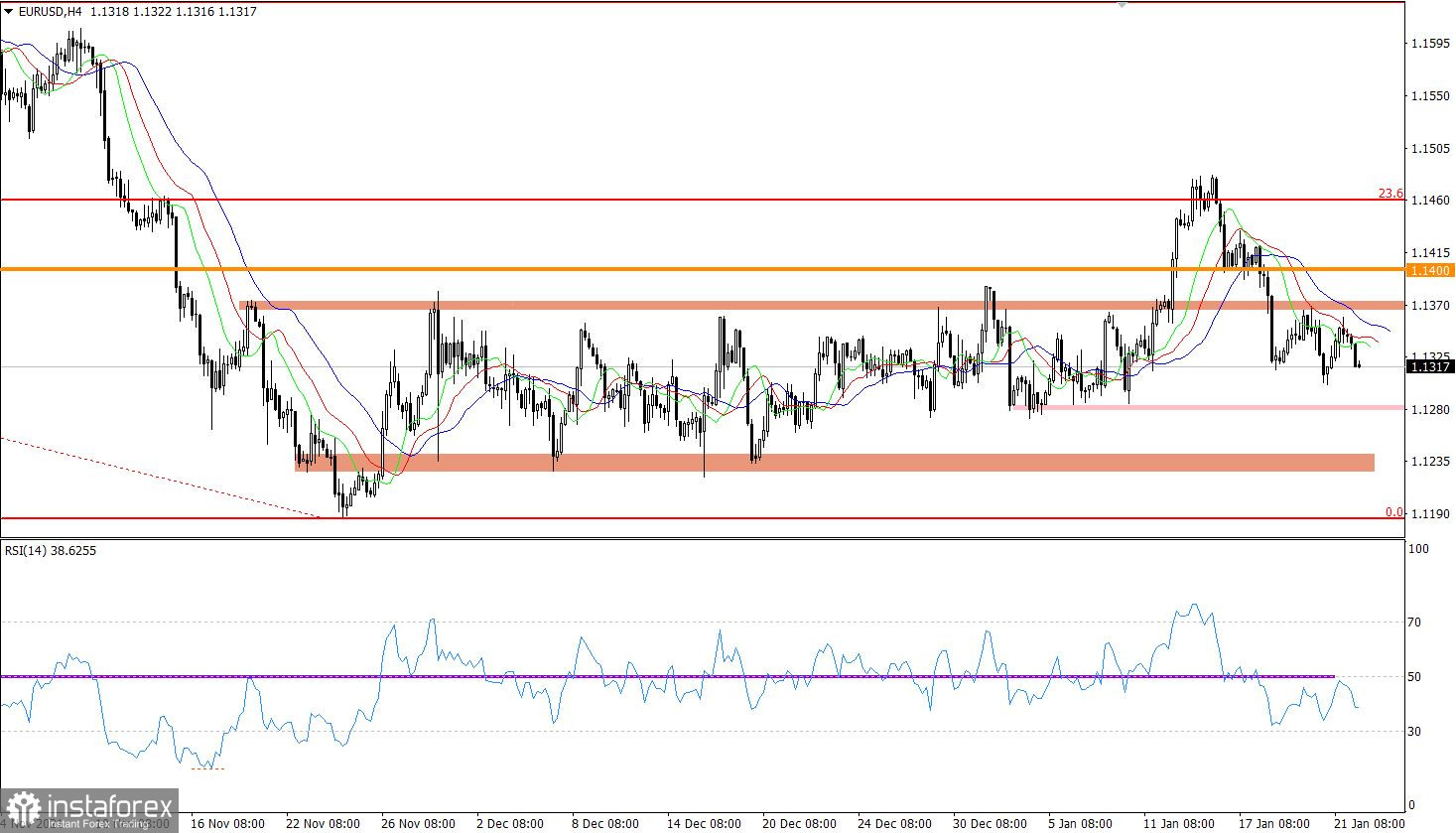

The euro/dollar pair pulled back from the resistance level of 1.1370, which was the upper limit of the sideways channel not so long ago. Consequently, the volume of short positions increased, meaning that the downtrend may extend.

The Relative Strength Index (RSI) is moving within the 30/50 range on the 4-hour and daily charts, signaling growing bearish sentiment.

The Alligator indicator on the 4-hour chart is signaling to sell the instrument as there has been no crossover of the moving averages (MA). The indicator is moving down.

According to the 1-hour chart, the pair continues retracing up after a corrective move where the US dollar managed to recoup more than half of its losses.

Outlook:

The downtrend is likely to strengthen at the beginning of the new trading week. A sell signal will be produced only in case the quote settles below the low of 1.1300. If so, the targets are seen at 1.1270 and 1.1230.

Based on complex indicator analysis, there is a sell signal for short-term and intraday trading. Technical indicators are also signaling to sell in the intermediate terms.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română