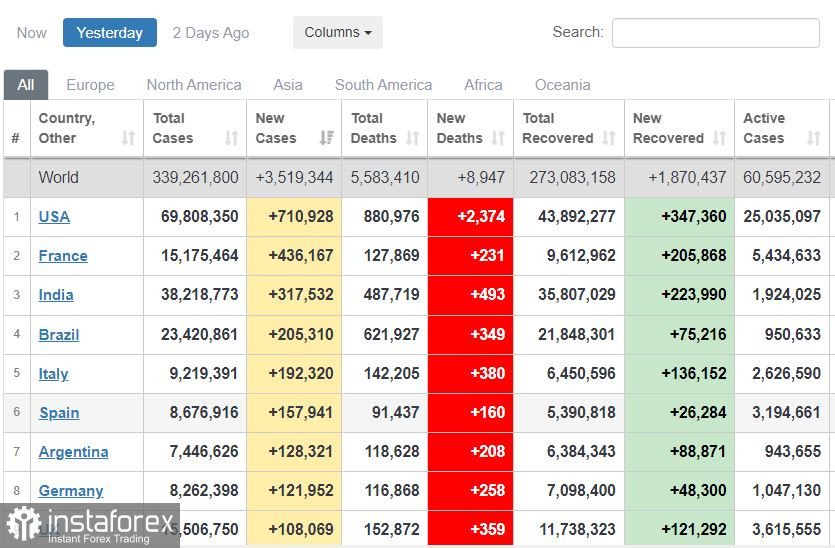

Omicron is raging across the world. Yesterday, there were 3.5 million new cases.

The US stock market has been falling for the second consecutive day. Yet, analysts assume that traders may open positions in small volumes.

The main US stock indices tumbled on Wednesday. The Dow Jones moved down by 1%, while the NASDAQ Composite dipped by 1.1%. The S&P 500 index slid by 1%.

Today, Asian stock markets rose. Japan's stock indices climbed by 1.1%, while in China, they advanced by 0.8%.

The People's Bank of China cut the one-year loan prime to 3.7% from 3.8% in an effort to boost GDP. In the fourth quarter, it slowed down by 4% on an annual basis.

After a collapse of 6% on Tuesday, Russian stock indices rose by 4% on Wednesday. They are growing by 2.5% on Thursday morning.

Thus, the sentiment is getting more optimistic in stock markets.

As for the commodity market, oil prices are holding at 5-year highs. Brent Crude is trading at $88.30 per barrel. On Thursday, oil prices did not react to a fall in the stock market.

Gas prices are gradually declining in Europe. Yesterday, natural gas futures totaled $860. Gazprom maintains gas supplies in minimal volumes. The occupancy of Germany's gas storage facilities is less than 50%. However, the weather in the EU is warm now. So, the need for heating is not so strong.

Omicron is spreading rapidly across the globe. Its cases hit a new record high yesterday, totaling 3.5 million new cases. The Us recorded 710, 00 new cases. The death toll amounted to 2,300 yesterdays. France reported 430,000 cases, while in India, there were 317,000 new cases yesterday.

Nevertheless, mortality remains at the levels of October – December. According to experts from the UK and Denmark, the Omicron outbreak is on the decline. There is hope that this will be a short-term wave.

The S&P 500 index is trading at 4,532. It is likely to stay in the range of 4,520 – 4,570. The S&P 500 index futures increased by 0.4% at the opening.

Despite a surge in Omicron cases (700,000 per day), the US government does not plan to introduce a nationwide lockdown. Notably, the market reaction to Omicron woes is muted.

Alcoa's earnings report showed a net profit of $429 million against a loss of $170 million a year earlier. Bank of America and Morgan Stanley reported record profits. Procter & Gamble presented a strong earnings report as well.

The US real estate market shows positive results. US housing starts in December turned out to be higher than the forecast reading. Building permits totaled 1.87 million versus the forecast reading of 1.7 million.

The US stock market may perform an upward reversal today.

The US dollar index is trading at 95.50. It is likely to remain in the range of 95.20 - 95.80. Yesterday, it dipped slightly. However, the bullish momentum is strong.

The USD/CAD pair is trading at 1.2490. It is likely to stay in the range of 1.2450 - 1.2540. The pair slid down due to high oil prices. Besides, inflation in Canada hit 4%, while economists had expected the reading to total 3.5%. It may force the Bank of Canada to raise the key rate.

Conclusion: the correction in the US stock market continues. However, today and tomorrow the equity market is likely to grow after a strong fall in the previous days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română