The euro lost more than 100 pips in a few days. EUR/USD developed a nonstop downward move. Then, it became obvious that the time was ripe for a bounce. Though the euro managed to regain its footing, we could hardly call it an upward correction because of a minor growth.

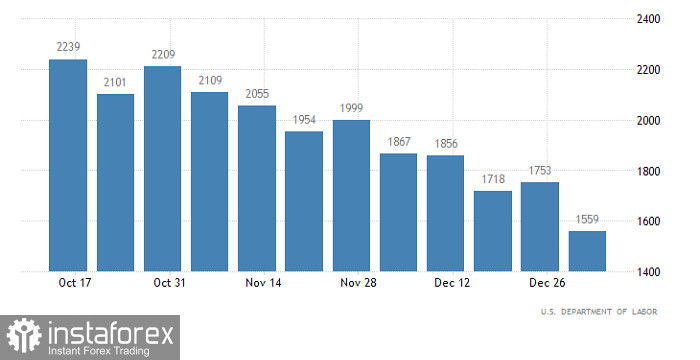

Today, the greenback could extend weakness due to macroeconomic data. The thing is that the forecast of unemployment claims is clearly negative. The number of initial jobless claims could have edged up by 2K last week, so it should remain roughly the same. The number of continuing claims for unemployment benefits could have jumped by a whopping 91K. This is a notably rise that indicates worsening conditions in the US labor market. In other words, a growing number of Americans living on the dole is an entirely negative factor. Hence, the US dollar has no fundamentals for its further advance.

US Continuing Unemployment Claims

Today, traders will neglect statistics from Europe. Certainly, inflation data is always of major importance. Today, investors will find out the revised CPI data which is expected to match the flash estimate. Analysts foresee an uptick to 5.0% in December from 4.9% in November. So, the market has already priced in this factor.

EU CPI

EUR/USD is going through an upward retracement following a rapid downward move earlier in the week. The interim support was spotted at 1.1315 from where the price retraced nearly 50 pips. From the technical viewpoint, the currency pair is returning to the previous trading range.

The RSI technical instrument is moving in the lower part of the indicator. It signals that traders are poised to open short positions. On the daily chart, the RSI crossed the 50 line downwards, thus signaling a slowdown in the upward move.

The Alligator indicator is moving below 1.1400 on the 4-hour chart. Moving averages suggest selling sentiment among traders.

On the daily chart, the price is dropping off 23.6%, the Fibonacci medium-term correctional level. It could mean that the upward correction is coming to an end.

Outlook for EUR/USD

Under the current price action, the upper border of the previous range at 1.1370 could serve as resistance, thus arousing interest in short positions. In this case, the price might return to the interim support of 1.1315. If the price settles below 1.1310 on the 4-hour chart, the market will consider this to be a signal of a further downward move.

Complex indicator analysis suggests selling opportunities for the short term. Meantime, we still could buy EUR/USD intraday during the ongoing upward correction. Technical indicators are generating a sell signal in view of the downtrend in the medium term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română