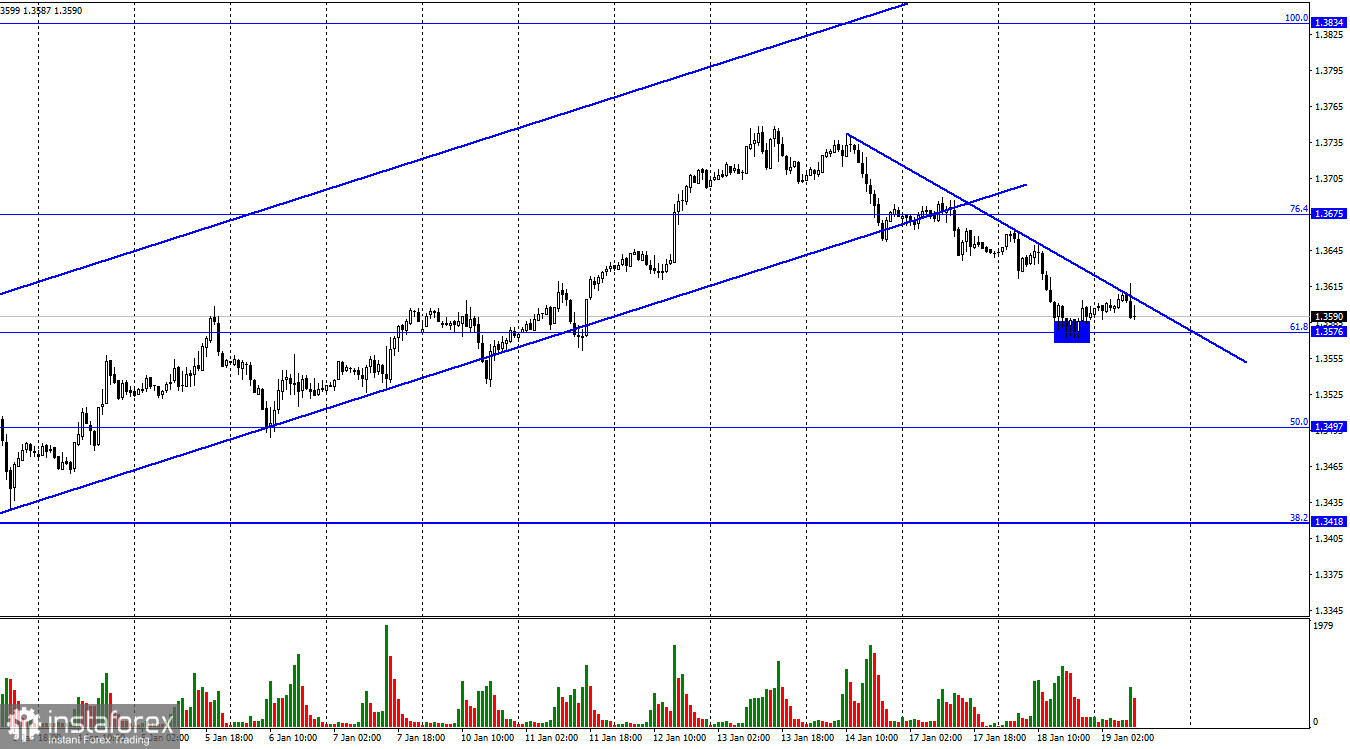

On the hourly chart, GBP/USD dropped to the retracement level of 61.8%, 1.3576, rebounded from it and reversed in favor of the British currency. The upward trend was short-lived. By the moment, the pair has risen to the downtrend line, which characterizes the traders' mood as bearish. However, the trend line itself is very weak so far, as quotes have been falling for only three days. Therefore, the pair might make a close above it and then resume its downwards process. The information backdrop for the British currency has been quite tangible, but did not affect the mood of traders. They did not pay attention to the unemployment and payrolls reports yesterday. Today they ignored the inflation report. Thus, despite the fact that inflation in the UK continues to rise and already stands at 5.4%, the pound is not optimistic. I believe that bull traders have simply exhausted their options. They have been buying the pound for a month, but now it is time to take a little break.

The Fed and the Bank of England meetings will take place next week. These events could have a major impact on the mood of traders. The focus will be on the Bank of England meeting. The US central bank's plans are now clear to traders. However, the Bank of England could once again raise its rate or, for example, reduce the amount of asset purchases under the stimulus program. Anyway, if that happens, the British currency could start its rally again. By the way, there are very few economic events this week which could influence the mood of traders. There is only one report on retail trade in the UK. In the US, there are no major events scheduled for this week.

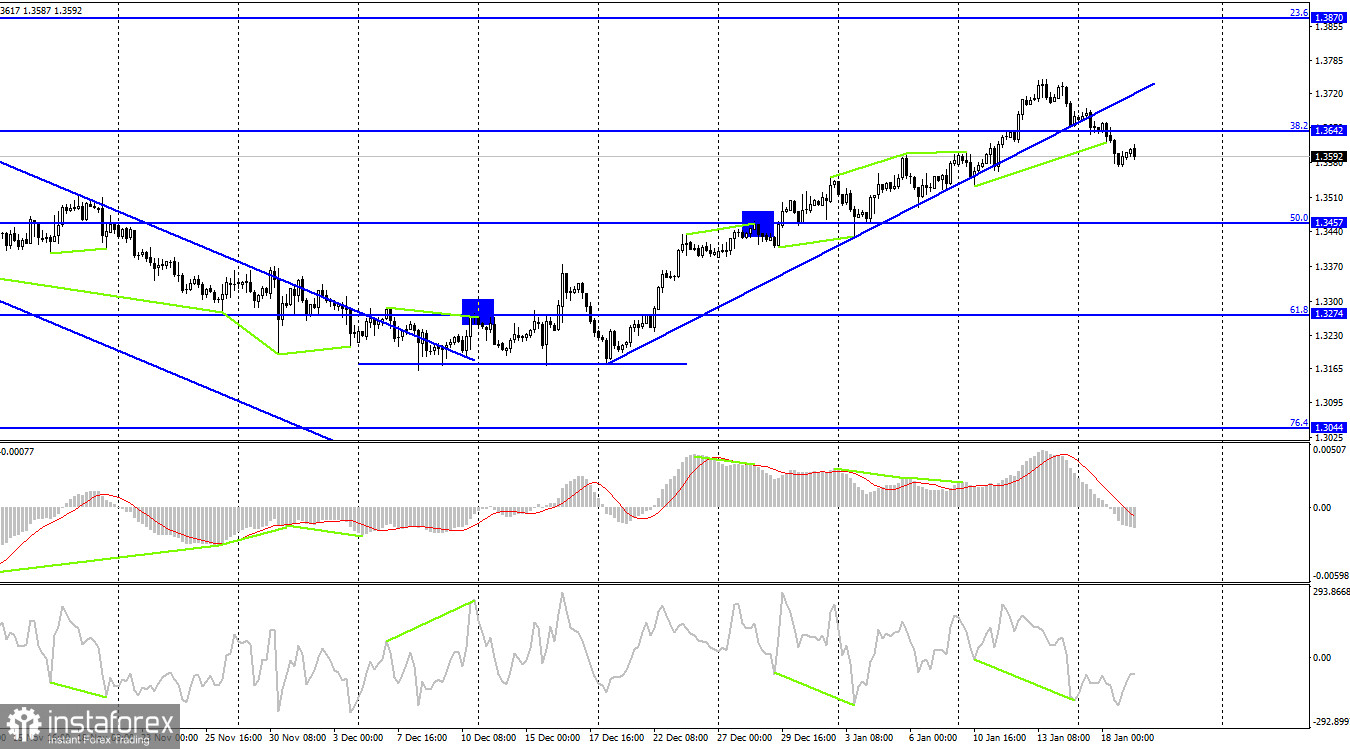

On the 4H time frame, the pair consolidated below a key trendline which has been acting as resistance for quite a long time. The price is likely to keep falling towards the retracement level of 50.0%, 1.3457. The bullish divergence was cancelled and failed to stop the fall of the pound. There are no new emerging divergences in either indicator today.

Economic calendar for US and UK:

UK - Consumer Price Index (07-00 UTC).

US - Building Permits Issued (13-30 UTC).

Wednesday's most important report of the day (UK inflation) has already been released and had no effect on traders' mood. The US Building Permits and New Foundations reports are expected. However, I do not think that this data will be of any serious interest to traders.

GBP/USD forecast and trading tips:

I recommend selling the pound when the price closes below the ascending trendline on the 4-hour chart with the target at 1.3497. Now, the pound can be sold when the price closes below 1.3576 on the hourly chart with the same target. I would not advise you to buy the pound as the pair may have just started to develop a new descending trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română