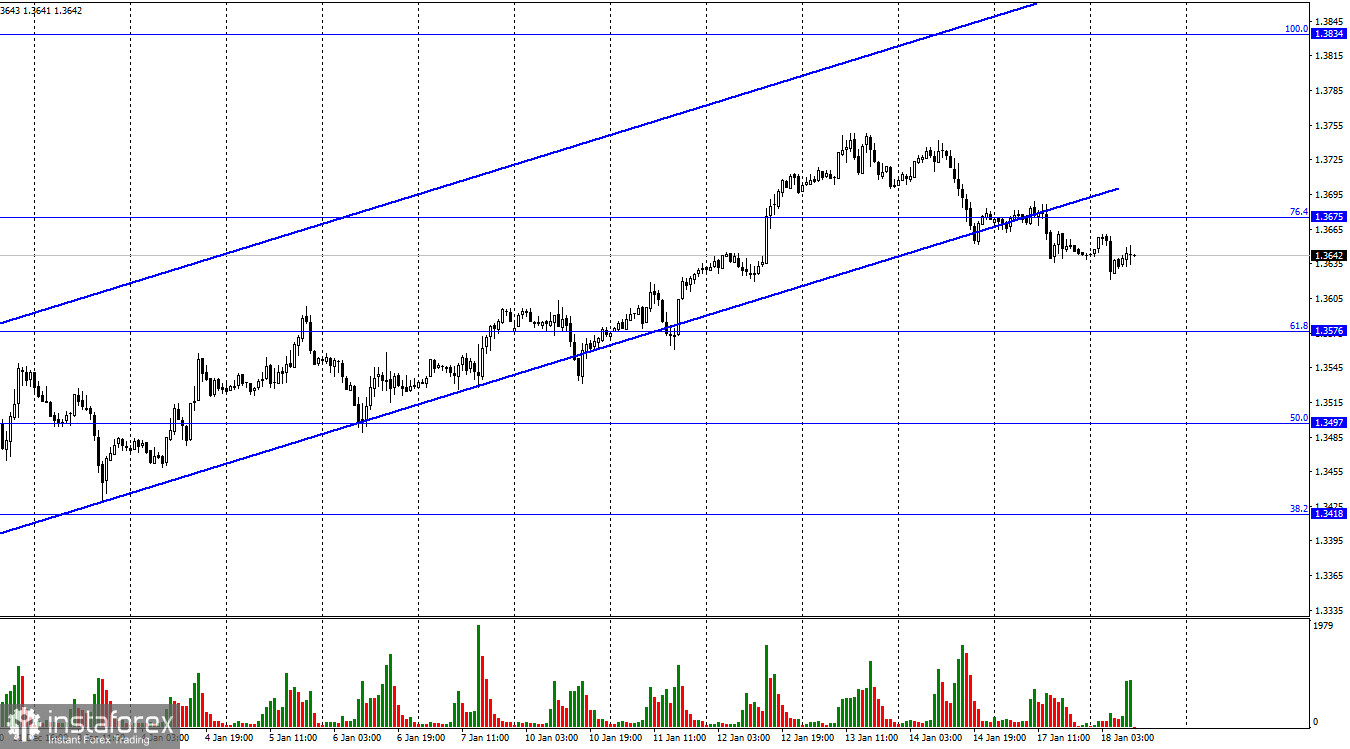

On the 1-hour chart, the GBP/USD pair closed below the 76.4% Fibonacci retracement level of 1.3675 and the ascending channel, which has long served as a confirmation of a bullish trend. However, the sentiment has changed to bearish, and the pair is now heading for the 61.8% Fibonacci retracement level of 1.3576. No other scenarios are possible at the moment. Meanwhile, the UK was the first to publish macroeconomic data this week. On Tuesday morning, three important reports were published. The unemployment rate fell to 4.1% from 4.2% in November. The number of initial jobless claims dropped by 43,000, while wages increased by 4.2%. All three reports either exceeded traders' expectations or met them. Surprisingly, instead of getting support, the British currency faced a sell-off wave. On Tuesday, it lost nearly 20 pips.

Apparently, traders have downplayed this important statistics from the UK. There are no more events in the economic calendar for today. This means that traders will have to rely entirely on technical analysis. The current technical picture fully confirms a new decline in the pound/dollar pair. Notably, this downtrend is likely to continue for a week or two. The fall may last at least until the Fed's meeting next week. How can the US regulator influence the markets? I think that this meeting will become a bearish factor for the pair. The US central bank is expected to double the pace of tapering its monthly bond purchases in January to $30 billion, but it will hardly raise the interest rate this time. So, the US dollar may receive moderate support. The meeting of the Bank of England will be of more importance to the pound as it may surprise investors with another rate hike. However, the UK regulator is unlikely to raise the rate for the second month in a row.

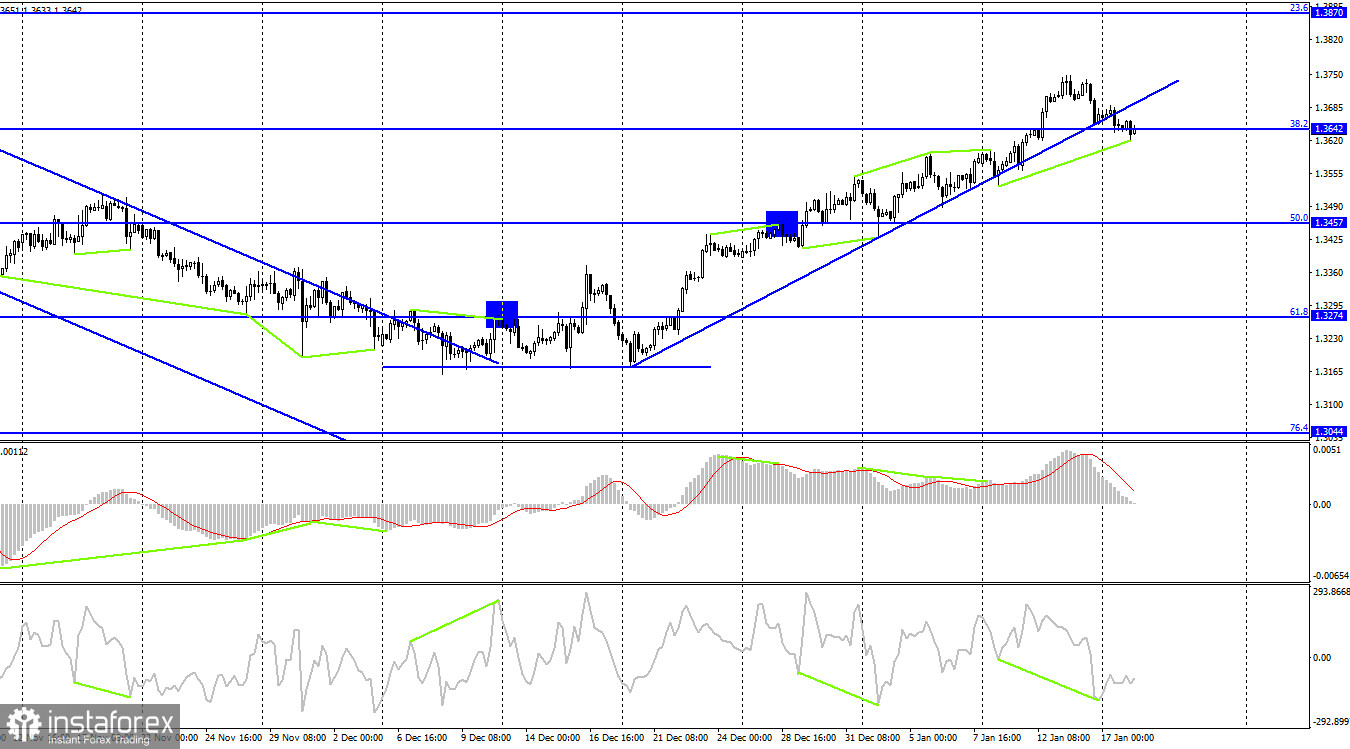

On the 4H time frame, the pair consolidated below a key trendline which has been acting as resistance for quite a long time. The price is likely to keep falling. However, we can see that a bullish divergence has been formed near the CCI indicator. This divergence hints at a possible upside movement of the pair. But I still believe that the price will extend its decline towards the 50.0% Fibonacci retracement level of 1.3457. A clear close below the 38.2% Fibonacci level of 1.3642 will confirm the continuation of a downtrend.

Economic calendar for US and UK:

UK – Claimant Count Change (07-00 UTC).

UK – Unemployment rate (07-00 UTC).

UK – Average Earnings (07-00 UTC). On Tuesday, all reports have already been published without any significant impact on the market. As for the US, there are no significant reports today. Therefore, the information background will be weak for the rest of the day.

GBP/USD forecast and trading tips:

I recommend selling the pound when the price closes below the ascending trendline on the 4-hour chart with the target at 1.3497. For now, you can keep these positions open. I would not advise you to buy the pound as the pair may have just started to develop a new descending trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română