The gold market is not picking up even though US consumers expect inflationary pressures to remain elevated throughout 2022. That is what was reported in the University of Michigan's survey last week.

Preliminary showed results that consumer sentiment fell to 68.8 points, from a December reading of 70.0 points. But according to some market analysts, it was inflation expectations that attracted the most attention.

Reportedly, inflation expectations rose to 4.9%, slightly higher than the 4.8% value in December. 5 to 10-year expectations also rose from 2.9% to 3.1%.

Much attention has been paid to reports regarding inflation, and earlier last week, the consumer price index showed an increase of 7.0% y/y.

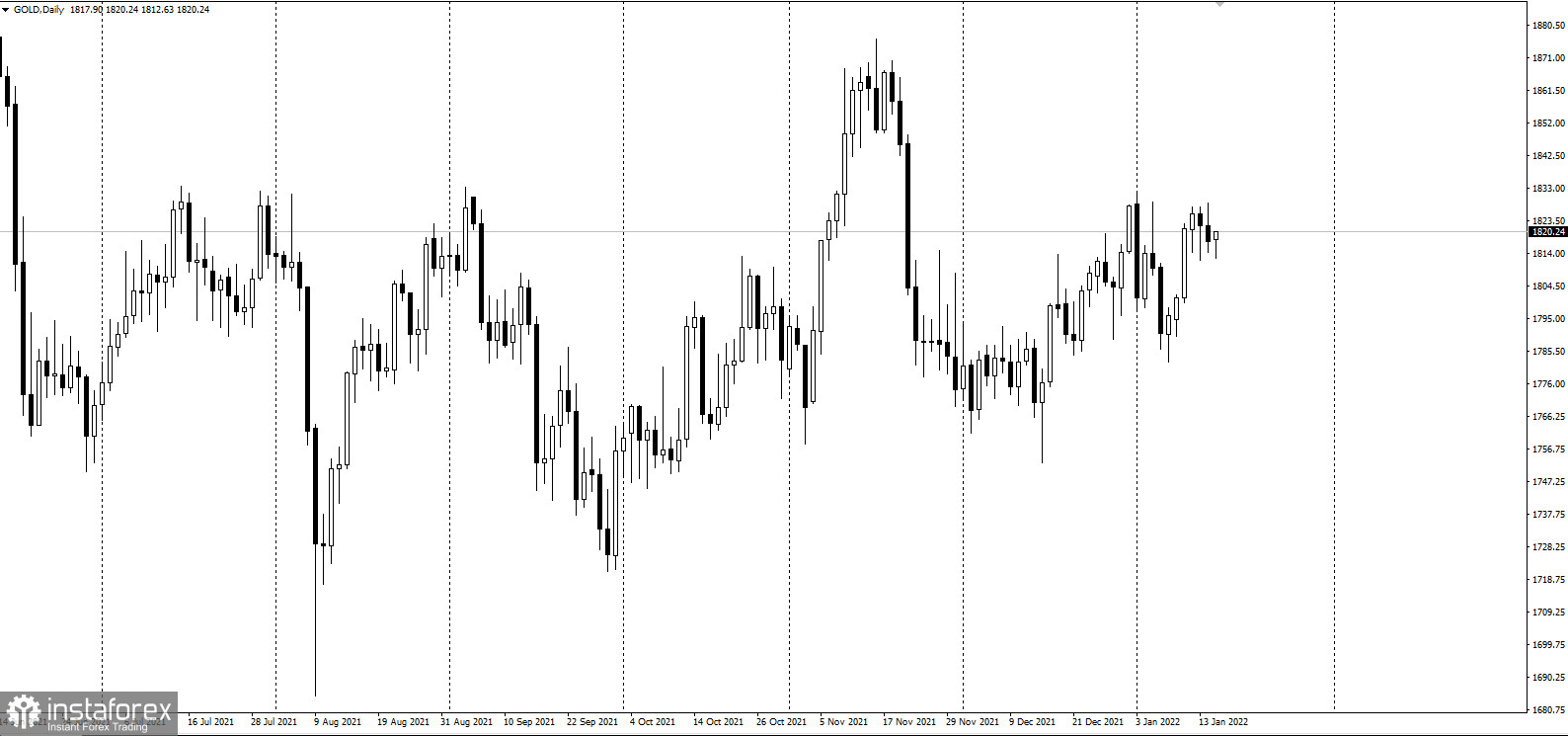

But that figure did not have much impact on gold, which fluctuated around 10% throughout the year.

Andrew Hunter, senior economist at Capital Economics, said rising inflationary pressures could prompt a slowdown in economic activity. After all, the sharp slowdown in real consumption, marked by the December retail sales data, is driven by rising prices and is unlikely to end any time soon. Long-term consumer inflation expectations also rose in January to almost an 11-year high of 3.1%. This may be the reason why the Fed's hawkish turn is not derailed by weaker economic growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română