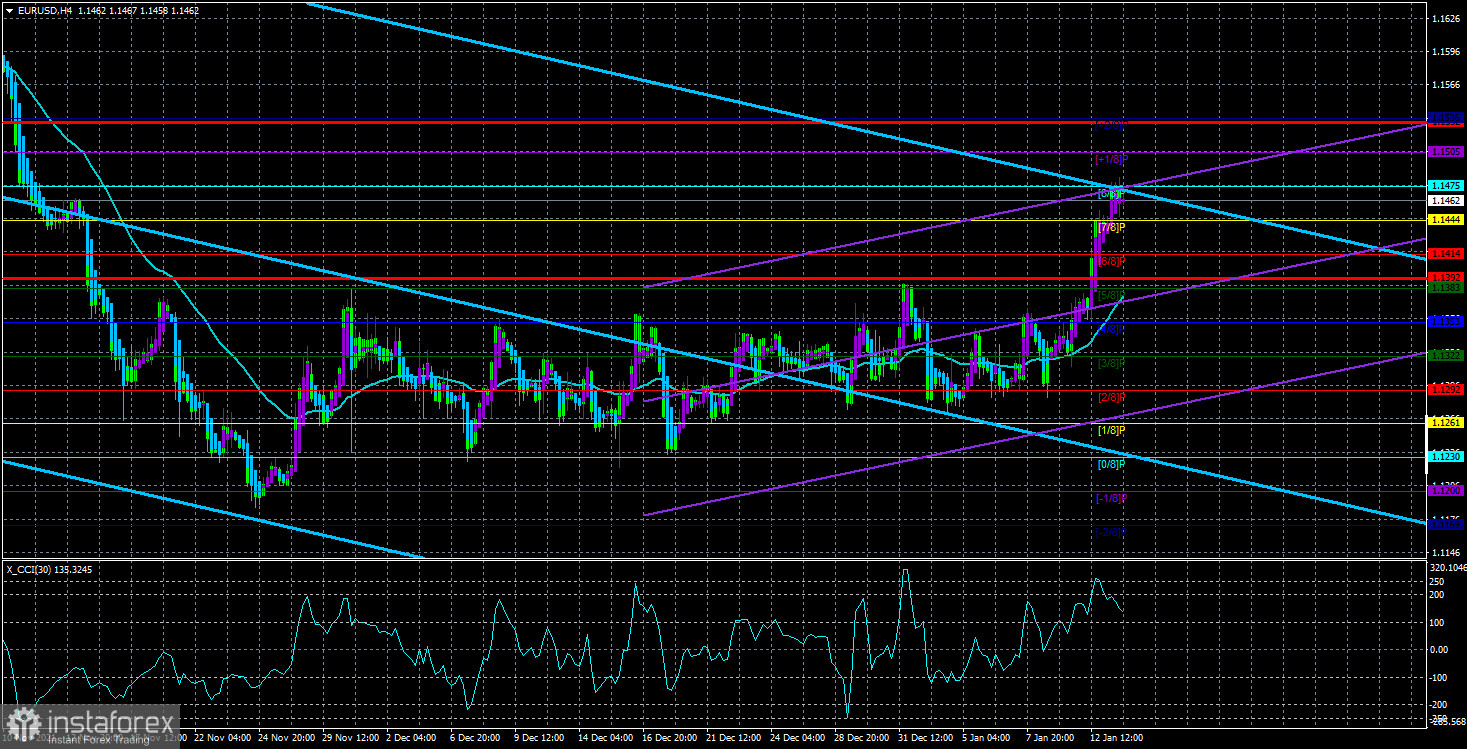

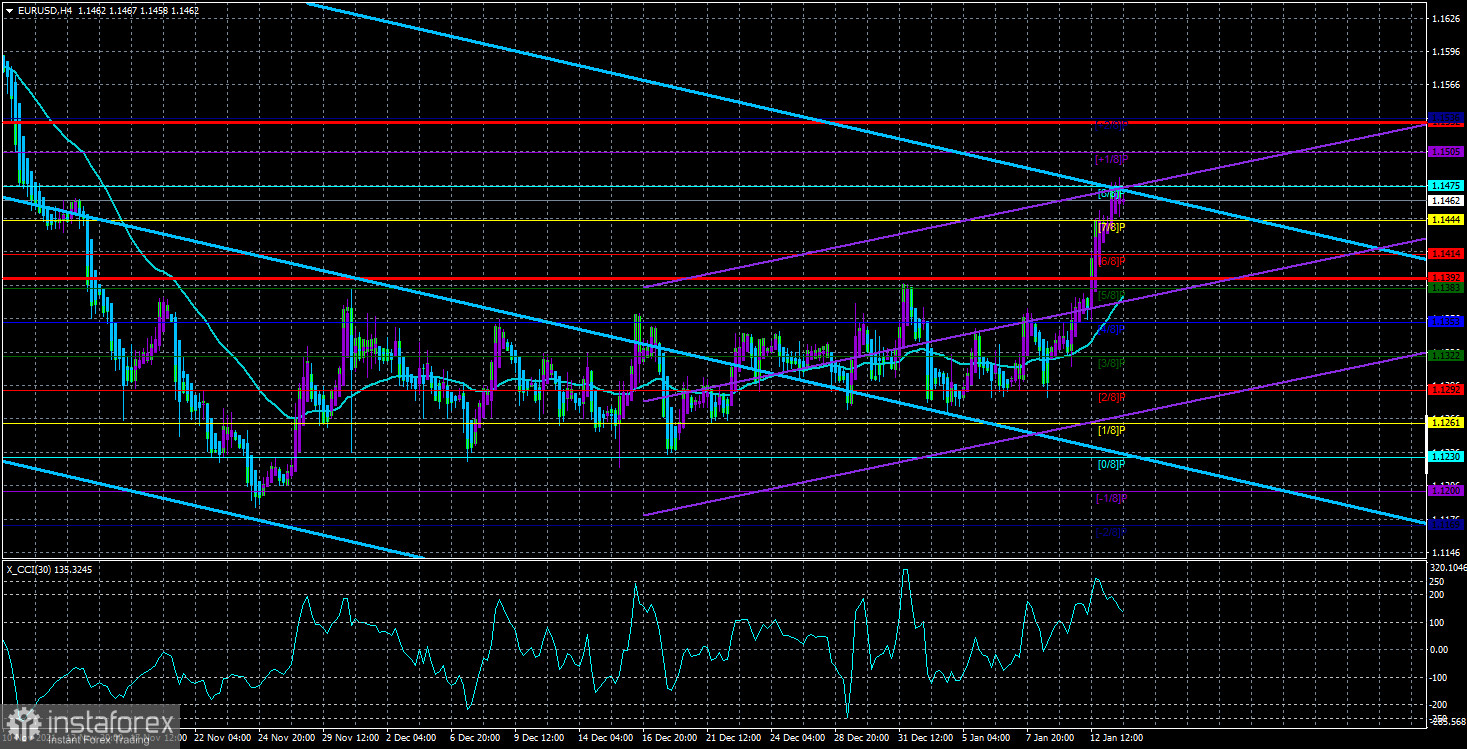

The EUR/USD currency pair was trading higher on Thursday for the second day in a row. In just a day, the pair grew by more than 100 points, and this is after it left the side channel in which it had been trading for a month and a half. The illustration of the 4-hour timeframe clearly shows how strong the movement is now. And we need to take into account the fact that the fundamental background of recent days was not just to prevent the euro from growing, it was supposed to lead to the growth of the US dollar. However, we will talk about this below. In the meantime, let's look at the technical picture. Recall that in the second half of last year we expected the beginning of the formation of a new upward trend, considering the entire movement of 2021 as a correction against the global upward trend. However, this downward correction was delayed, as the markets were happy to buy the US currency amid the growing likelihood of tightening monetary policy in the US. At first, there was talk of curtailing the quantitative stimulus program, and towards the end of the year, there was talk of raising the rate. Thus, since September, the dollar has experienced a new surge of strength, which led to a prolonged fall of the pair. However, now for the second day in a row, traders simply ignore the American fundamental background, which speaks in favor of the continued growth of the dollar. And, from our point of view, this suggests that the trend has changed to an upward one, and the markets have already fully and repeatedly worked out both the completion of the QE program and two or three Fed rate hikes this year. Consequently, now the dollar is no longer attractive to traders.

Several representatives of the Fed noted aggressive "hawkish" rhetoric.

Jerome Powell has already given a speech in the US Senate this week. During this speech, Powell confirmed that the quantitative stimulus program will be completed this year, and the rate will be raised several times. Let's not repeat ourselves. However, the next day, several more FOMC members made a speech, who not only confirmed Powell's words, but also admitted that rates would begin to rise in March since inflation had risen to completely exorbitant values, and there might be four increases in 2022, not two or three. Thus, the "hawkish" rhetoric of the FOMC representatives has intensified even more, which should have supported the US currency. But instead, the US currency falls after exiting the side channel. From a technical point of view, this is logical, since at least an upward correction is required before continuing the (possibly) downward trend of 2021. Therefore, if in a few months we see the pair again near the levels of 1.12-1.13, then it will still be more logical since the European Union does not supply any reasons to buy the euro currency now. Thus, we can assume that it is not the euro that is growing, it is the dollar that is declining. We also want to note the report on American inflation, which has repeatedly caused the dollar to rise, because again it increased the likelihood of tightening monetary policy at the next Fed meeting. But this time, although inflation has risen again, traders have started selling off the US currency. Thus, from a fundamental point of view, a paradox. With technical – everything is fine. We also want to note that the coronavirus pandemic, the next wave of which is now "covering" both Europe and America, is not the reason for such a movement of the pair. Both in the States and the European Union, the situation with Omicron is serious. According to WHO assurances, up to 50% of the EU population may be infected with a new strain in the coming months. In America, all sorts of anti-records of morbidity are being beaten, and hospitals are overcrowded, because, despite the lighter course of the disease, the transmissivity of the strain is many times greater than that of the same "delta". Thus, we can only watch the growth of the European currency and hope that omicron will not cause serious economic consequences.

The volatility of the euro/dollar currency pair as of January 14 is 70 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1392 and 1.1532. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.1444

S2 – 1.1414

S3 – 1.1383

Nearest resistance levels:

R1 – 1.1475

R2 – 1.1505

R3 – 1.1536

Trading recommendations:

The EUR/USD pair finally got out of the side channel, as the level of 1.1353 was overcome. Thus, now it is possible to stay in long positions opened on the signal of overcoming this level, with targets of 1,1505 and 1,1532, which should be kept open until the Heiken Ashi indicator turns down. Short positions should be opened after the price is fixed below the moving average with targets of 1.1322 and 1.1292.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română