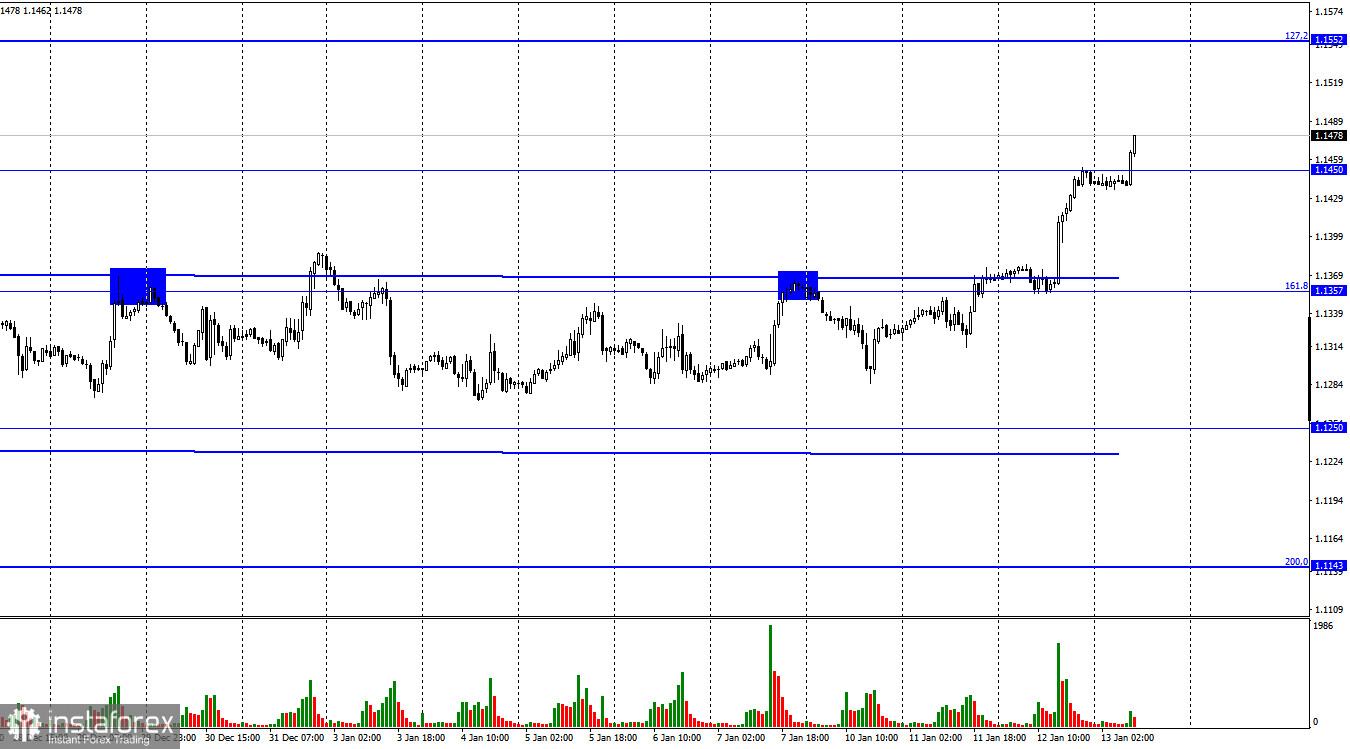

The EUR/USD pair performed a new reversal in favor of the European currency on Wednesday and, on the nth attempt, still completed closure over the sideways trend corridor. Thus, at this time, the mood of traders has changed to "bullish", and the US dollar fell by 80 points yesterday and by 30 today. As I expected, traders at some point got tired of being in a side corridor and made their choice between two currencies. The choice fell on the euro currency, as the US dollar has been actively growing in the last months of 2021. It is noteworthy that the information background did not have any effect on the mood of traders. Although according to all the canons of fundamental analysis, it was the dollar that should have shown growth yesterday. This week, there were important speeches by a whole team of members of the Fed board, as well as Jerome Powell personally. The Fed President spoke in the Senate on the occasion of his re-election to a second term. He noted high inflation and assured senators that the Fed will take all necessary measures to stop the strong price growth. He also noted that several increases in the key rate should be expected this year and "perhaps they will begin earlier than expected."

From my point of view, this is a "hawkish" message, although it should be noted that Powell's rhetoric, as always, was of a cautious "quiet" nature. But his "colleagues in the shop" were less modest in their statements. For example, the president of the Federal Reserve Bank of Atlanta, Rafael Bostic, said that he is ready to support four rate hikes this year. Most of the other board members supported three increases and are ready to vote for the first increase in March. Thus, the probability that in March the Fed will fully complete the QE program and raise the interest rate for the first time is now almost 100%. It's all the fault of inflation, which continues to grow in America and significantly hits the pockets of the middle and lower classes, because they most painfully feel and experience price increases, especially for the most necessary goods and products. However, the dollar did not react with growth to this news.

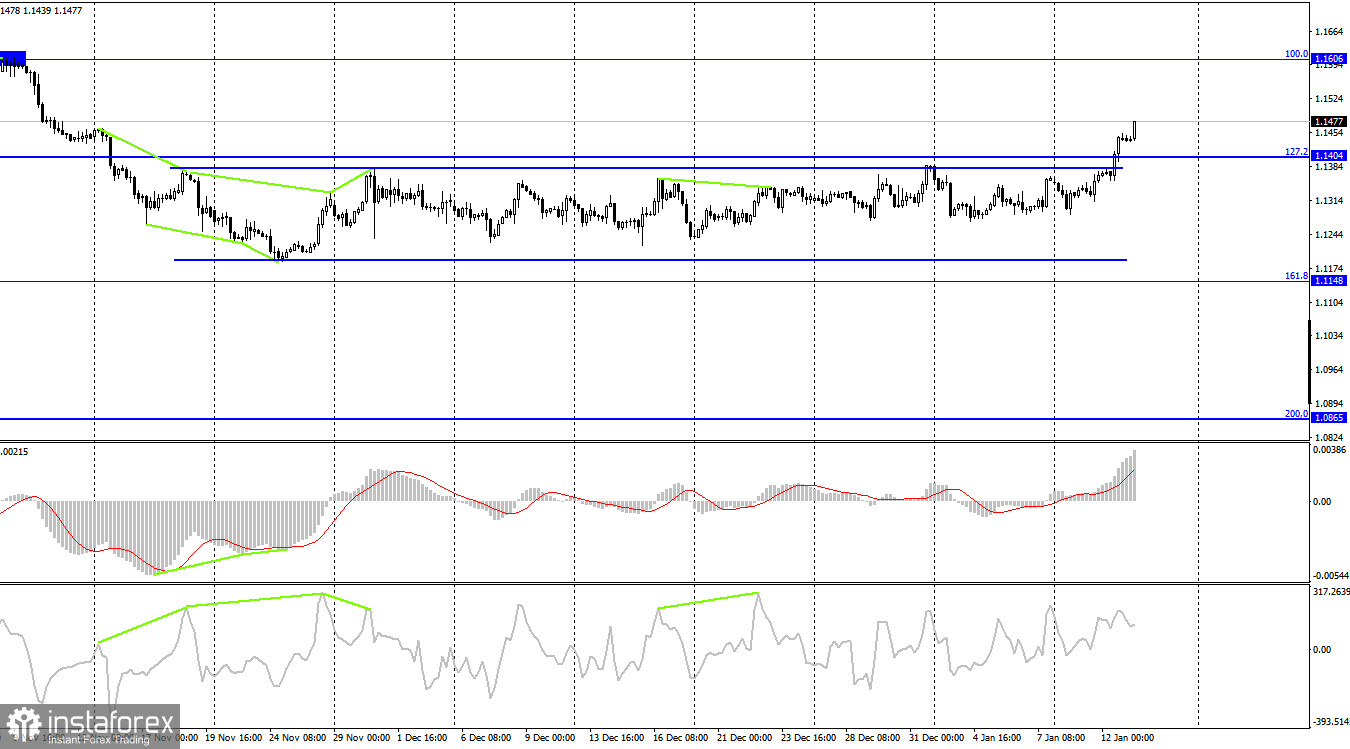

On the 4-hour chart, after yesterday, the pair performed a closure over a side corridor that was slightly different from the one on the hourly chart. The pair's quotes also closed above the corrective level of 127.2% (1.1404). Thus, the growth process can be continued in the direction of the next corrective level of 100.0% (1.1606). Emerging divergences are not observed in any indicator today.

News calendar for the USA and the European Union:

US - producer price index (13:30 UTC).

US - number of initial and repeated applications for unemployment benefits (13:30 UTC).

On January 13, the calendar of economic events of the European Union is empty, and two, not the most important reports will be released in the USA, which is listed above. I believe that today the information background will have almost no effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I do not recommend considering new sales of the pair yet, since it has just left the side corridor and may show growth for several days. I recommended buying the pair if it closes above the level of 1.1404 on the 4-hour chart, with targets of 1.1450 and 1.1552. Now, these deals can be kept open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română