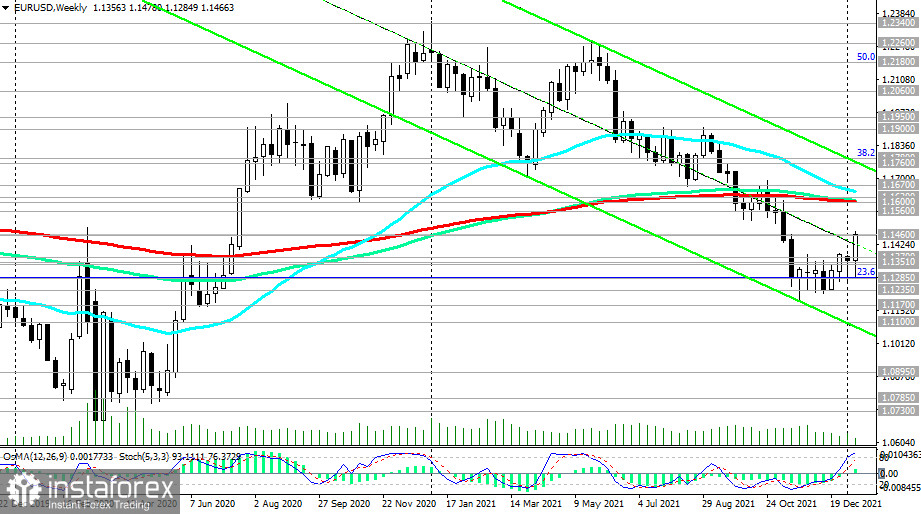

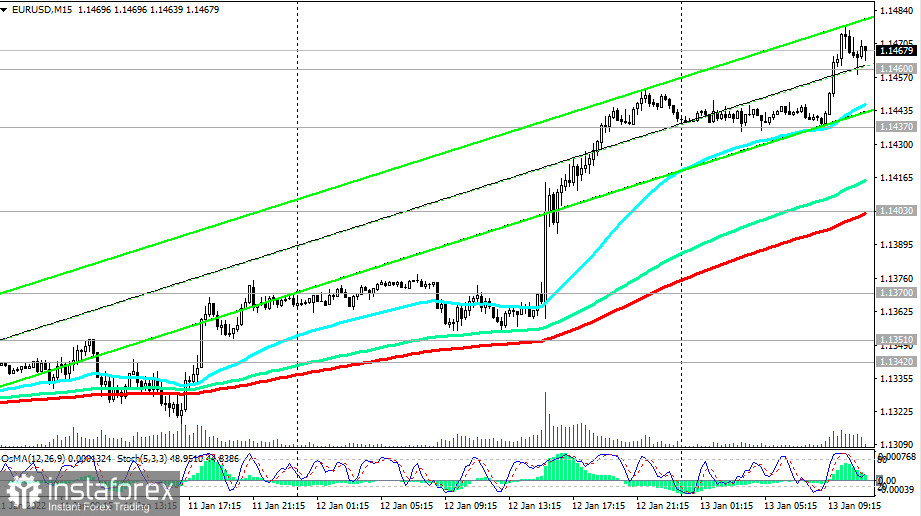

The euro is strengthening against the US dollar, despite ECB's more restrained position to its monetary policy than the FRS. As noted in the previous review (01/11/2022), an alternative scenario for the EUR/USD pair was breaking through the upper border of the range and the resistance level of 1.1370, and continuing the upward correction towards the strong resistance zone of 1.1560, 1.1600 - 200 EMA on the weekly chart, and 1.1620 - 200 EMA on the daily chart.

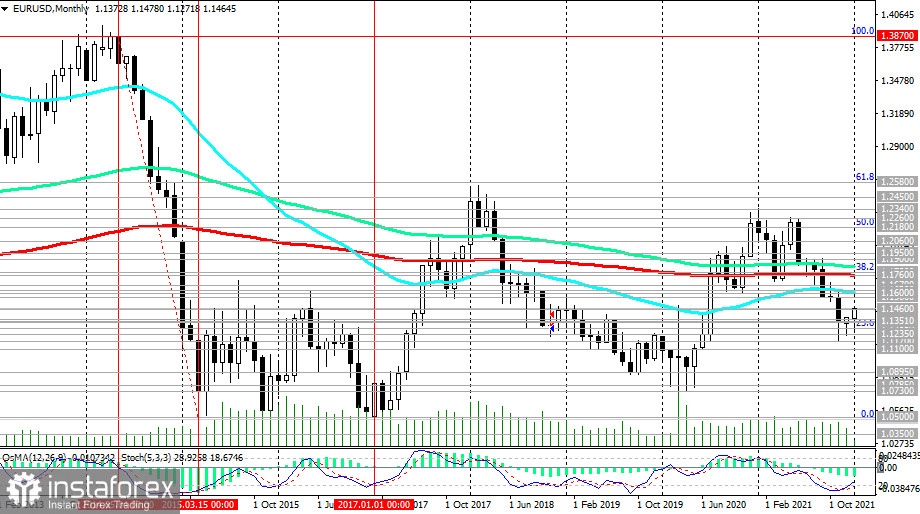

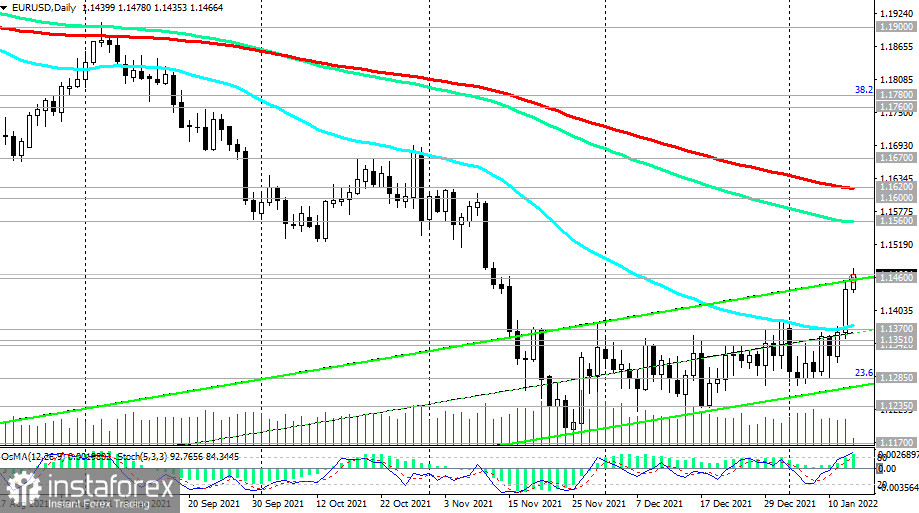

Analyzing the situation, the events are developing according to an alternative scenario: the EUR/USD pair has broken through the resistance level of 1.1370 and continues to develop an upward correction today, heading towards the nearest strong resistance level of 1.1560 - 144 EMA on the daily chart. If the US dollar does not weaken in the coming days of the reversal, then the breakdown of the long-term resistance level of 1.1760 - 200 EMA on the monthly chart will return the pair to the long-term bullish market zone.

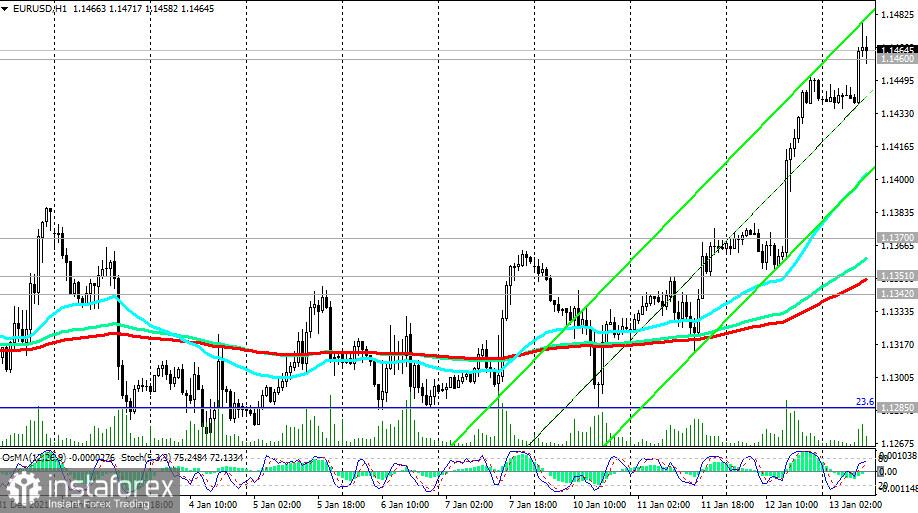

Earlier, the EUR/USD pair is trying to break through the local resistance level of 1.1460. It is worth noting that the upper border of the ascending channel on the daily chart also passes through this level.

The breakdown of the local support levels of 1.1437 (today's low) and 1.1403 - 200 EMA on the fifteen-minute chart will signal the resumption of selling EUR/USD. The continuation of the bearish trend will be indicated by a return to the zone below the support level of 1.1370.

Important data on the US retail sector and consumer confidence will be released on Friday. The US dollar may receive temporary support at the start of today's US trading session if the weekly US labor data, which is scheduled at 13:30 (GMT), show a low number of applications for unemployment. Although the number of jobs in the US economy is still 3.6 million fewer than before the pandemic, the number of initial applications for unemployment benefits remains at the lowest level in several decades – about 200 thousand. This is a positive factor for the US dollar after it became clear from the US Department of Labor report that unemployment in the country is at a minimum and multi-year level of 3.9%.

At the same time, consumer sentiment in the US remains generally positive despite the increase in coronavirus cases and high inflation rates. Here, the final consumer sentiment index in December was 70.6, which is higher than the preliminary value of 70.4 and the November value of 67.4. In January, this index is also expected to remain at a relatively high level near 70.0.

Support levels: 1.1437, 1.1403, 1.1370, 1.1351, 1.1342, 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.0900, 1.0800, 1.0700

Resistance levels: 1.1460, 1.1500, 1.1560, 1.1600, 1.1620, 1.1670, 1.1700, 1.1760, 1.1780

Trading tips:

Sell Stop 1.1430. Stop-Loss 1.1485. Take-Profit 1.1400, 1.1370, 1.1351, 1.1342, 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.0900, 1.0800, 1.0700

Buy Stop 1.1485. Stop-Loss 1.1430. Take-Profit 1.1500, 1.1560, 1.1600, 1.1620, 1.1670, 1.1700, 1.1760, 1.1780

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română