EUR/USD

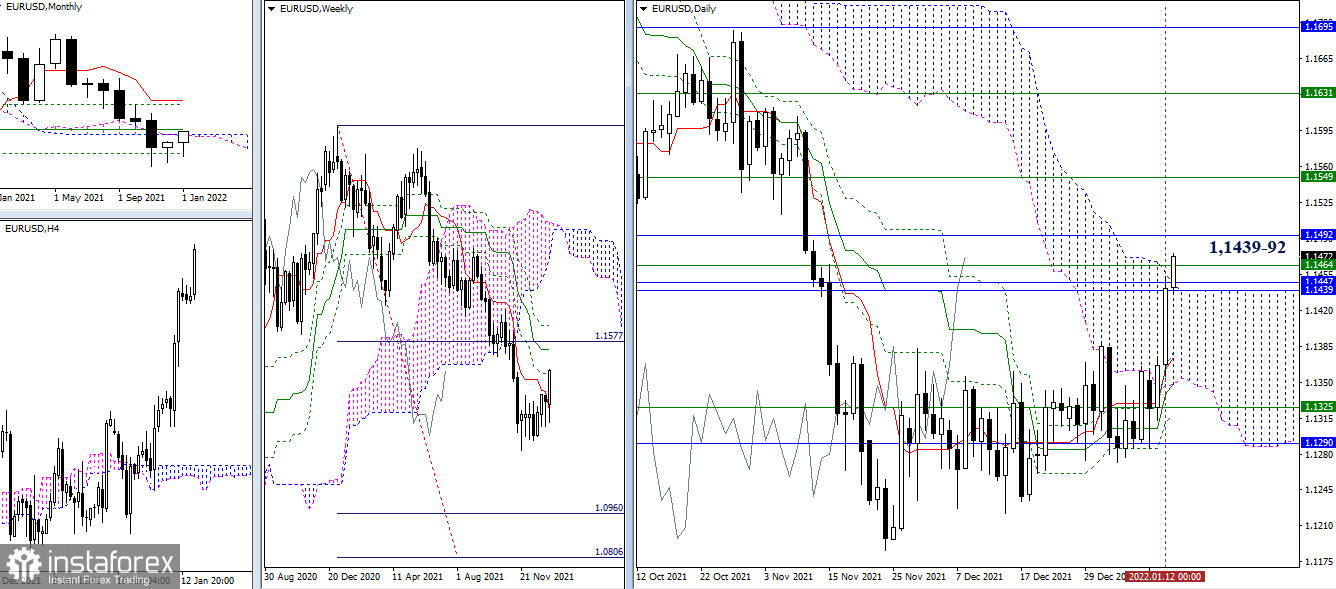

The bulls went on the offensive after staying in the upper part of the consolidation zone, transferring the consolidation center to the area of supports, and entering the daily cloud. At the moment, they are testing the upward pivot points, indicated earlier in the area of 1.1439-92 (monthly levels + weekly Fibo Kijun + upper border of the daily cloud). The result of interaction with the met resistance zone will determine further opportunities for the development of the situation.

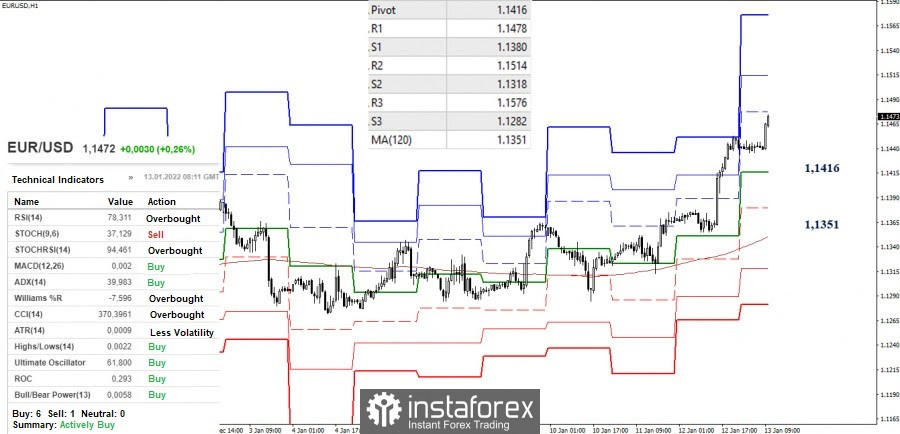

With the development of growth, there is no doubt the bulls currently have the advantage in the smaller timeframes. They are now testing the first resistance of the classic pivot levels (1.1478). The subsequent pivot points are R2 (1.1514) and R3 (1.1576). The key levels here act as support levels and are located at 1.1416 (central pivot level) and 1.1351 (weekly long-term trend). The nearest support between them is at 1.1380 (S1). Based on the distance between the key levels, it can be stated that the chances to develop a correction without changing priorities are now enough.

GBP/USD

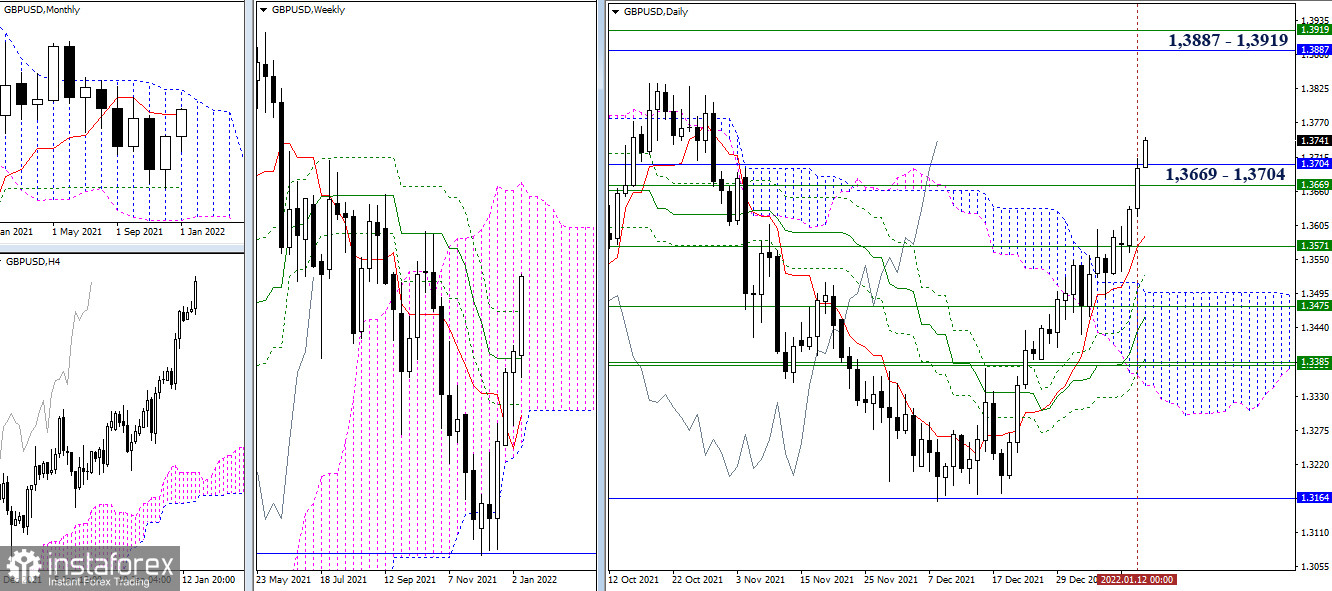

Bullish traders are trying to break through the encountered resistances at 1.3669 (weekly Fibo Kijun) - 1.3704 (monthly Tenkan). The breakdown of which and consolidation above will allow us to consider new upward targets. However, it should be noted that the daily Chinkou line has reached the maximum zone from the price chart. In the near future, this circumstance will serve as a factor that increases the probability of the formation of a slowdown or downward correction.

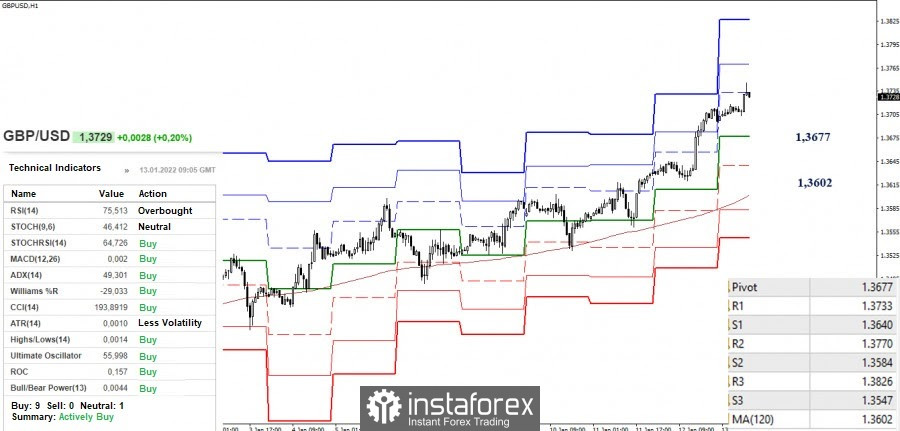

The development of the upward trend from the smaller timeframes led to the testing of the first resistance of the classic pivot levels (1.3733). If growth continues, the next task will be to overcome the next resistance levels, such as R2 (1.3770) and R3 (1.3826). The key levels here are forming support today, which can be considered at 1.3677 (central pivot level) and 1.3602 (weekly long-term trend) in the event of a downward correction.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română