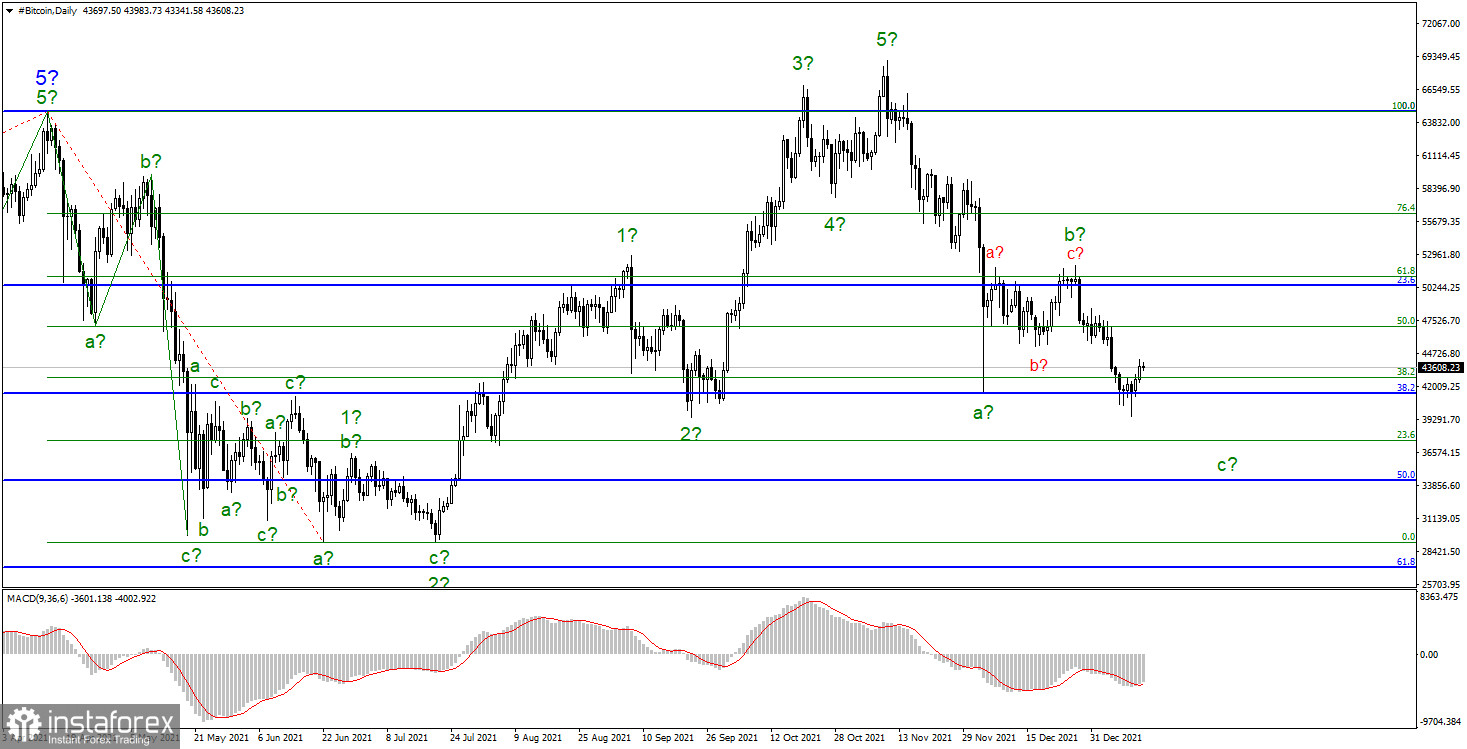

On Wednesday, Bitcoin still found strength and stayed above the level of $ 41,515, which equates to 38.2% Fibonacci. The market tried to lower the cryptocurrency rate below this level for five consecutive days, but nothing happened. Throughout the past two days, Bitcoin has risen by about $ 2.5 thousand. A failed attempt to break through $ 41,515 indicates a departure of quotes from the lows reached. However, the current wave pattern still allows the first cryptocurrency to further fall. The instrument managed to update the December 4th low, so wave c can be completed. At the same time, it has taken a too shortened form, so a new attempt to break through the $ 41,515 level can be expected after the quotes' slight growth. There is not a single correction wave visible inside the proposed wave, so it should start forming now.

- Bitcoin's "Death Cross" signal

New forecasts began to appear immediately after Bitcoin failed to break through an important level. For example, Bloomberg writes about the "death cross" signal, which may form as early as this week. This signal is nothing more than the intersection of two moving averages, 50-day and 200-day. The bank notes that this is such a strong signal and after its formation, the cryptocurrency will most likely decline. However, this signal has not formed yet due to the recent growth. At the same time, many analysts point out that market factors are more important for Bitcoin. For example, many of them said that the main digital asset would find strong support or "bottom" around the level of $ 40,000, from which large investors would start buying back all the coins being sold. So far, this forecast is coming true, although the wave markup and the news background allow for a new decline in bitcoin quotes.

- JPMorgan customers believe in Bitcoin's renewed growth

There was information from the investment bank JPMorgan, which conducted a survey among its clients. It became known that the majority of investors believe that Bitcoin will grow by 50% of its current value, which means it will exceed $ 60,000 by the end of this year. However, those are not the absolute majority, but only 40%. On the other hand, 23% believe that Bitcoin will drop to $ 20,000, while the other 20% expects it to $ 40,000.

In general, if we start from the current levels, then about 50% of the bank's clients expect growth this year, and 50% expect a fall. JPMorgan chief strategist Nikolaos Panigirtzoglou believes that the fair price for Bitcoin fluctuates between $ 35,000 and $ 73,000. So far, the 2022 news background speaks of a more likely decline in Bitcoin during the year. The main factors for this may be the increase in rates by central banks, the completion of stimulus programs, and the sale of the Fed's assets.

A new downward trend section continues to form. At this time, wave b is considered completed, which has taken a noticeable three-wave form. The instrument declined to the previous low, around $ 41,500, in the expected wave c, and broke it. Around this level, the downward trend may end, but such a shortened third wave is rare. The instrument can be expected below this mark. The news background is not on Bitcoin's side right now, so the expectations of a strong wave c are not unfounded. A successful attempt to break the low of wave a, as well as the level of $ 41,515, which equates to 38.2% Fibonacci, is very important. In this case, the decline may resume around the targets levels of $ 37552 and $ 34322, which equates to 23.6% and 50.0% Fibonacci.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română