The GBP/USD currency pair continued its upward movement on Wednesday. There were no reasons for this, just like the day before, when Jerome Powell spoke in the Senate. We have already said that the Fed chairman's speech was completely "hawkish" and he just didn't have enough to say that the key rate would be raised "tomorrow." Of course, the markets could interpret the statements made by Powell in their way. However, there is usually little ambiguity in them. This time it wasn't there at all. Nevertheless, in the afternoon, another inflation report was published in the States, for December. This time, the consumer price index rose from 6.8% y/y to 7.0% y/y. However, the forecasts spoke in favor of just such an acceleration, so instead of the growth of the dollar, we saw its downfall. Recall that the US dollar has repeatedly strengthened its position on the acceleration of US inflation, but not this time. And, from our point of view, this is a very remarkable moment. Simply put, earlier the growth of inflation was associated by the market with an increase in the likelihood of tightening the Fed's monetary policy. Now, this probability is already the maximum, as representatives of the regulator have repeatedly stated, as well as Jerome Powell himself a day earlier. Therefore, traders have already responded to the next increase in inflation by selling off the dollar. And we believe that this is the moment when traders stop reacting to "hawkish" factors. In other words, the market has already won back all future rate hikes (at least in 2022), as well as the fact of complete rejection of monetary stimulus. The dollar grew on these expectations throughout the second half of 2022. Now, perhaps, there is a period of decline in the US currency. At least for the sake of a banal upward correction. The pound has been in this correction for several weeks now, thanks to the Bank of England, which raised the rate at the end of last year. The euro currency can start its correction only now.

Boris Johnson belatedly apologized for the party during the "lockdown".

There has been absolutely no macroeconomic news in the UK lately. There is talk only about the figure of Boris Johnson, who again found himself involved in several scandals. The loudest of them is a party with the participation of Johnson himself and many other high-ranking government officials during the lockdown at the end of 2020. It became known about this "celebration of life" only at the end of last year, and at first, Johnson did his best to deny the accusations. However, at the beginning of the new year, he still apologized to the public. Recall that this is not the first case when someone from the UK government violates the quarantine rules. Previously, several officials have already left their posts because of such cases. However, this time 50 representatives of the Conservative Party will have to resign at once, who walked at that Christmas party, information about which became public. Under the pressure not of evidence, but under the pressure of social indignation, Johnson nevertheless went public and apologized. "I want to apologize. I know that millions of people have made huge sacrifices. I know what suffering they went through. I know what kind of rage they are experiencing," the British Prime Minister said, although he did not say what kind of punishment he and all the participants of that party would be punished. Political analysts note that Johnson would most likely have tried to "hush up" this story if not for the frequent talk in recent weeks about the resignation of the entire government in 2022. Recall that, according to YouGov, the Prime Minister's political ratings have suffered greatly recently. And with them, the ratings of the Conservative Party, which now risks losing its majority in Parliament at the next election. This state of affairs even gave rise to conversations within the party itself about the need to change the leader. The story of the discovery of cocaine residues in the UK Parliament looks very wild. Of the 12 places being checked, drug residues were found in 11. In particular, not far from the toilet next to Johnson's office.

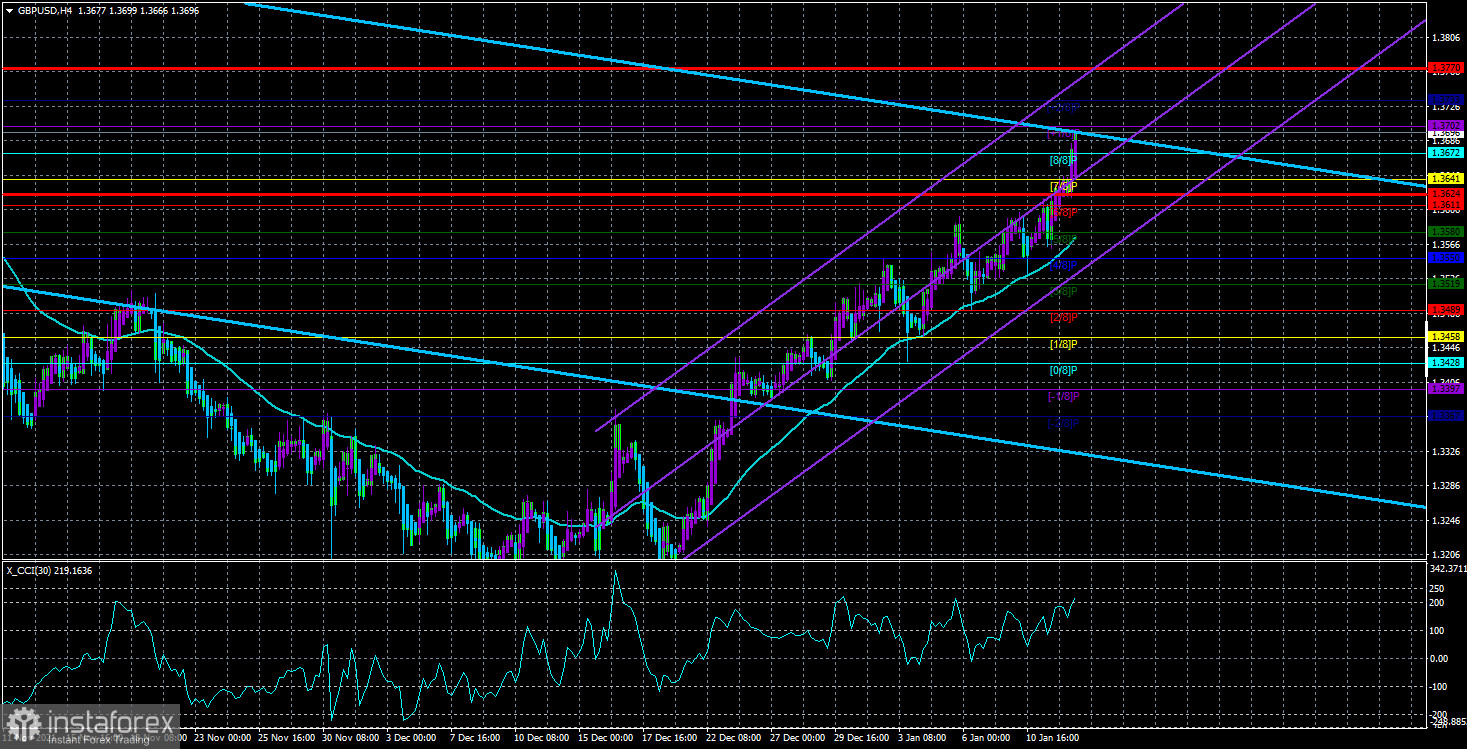

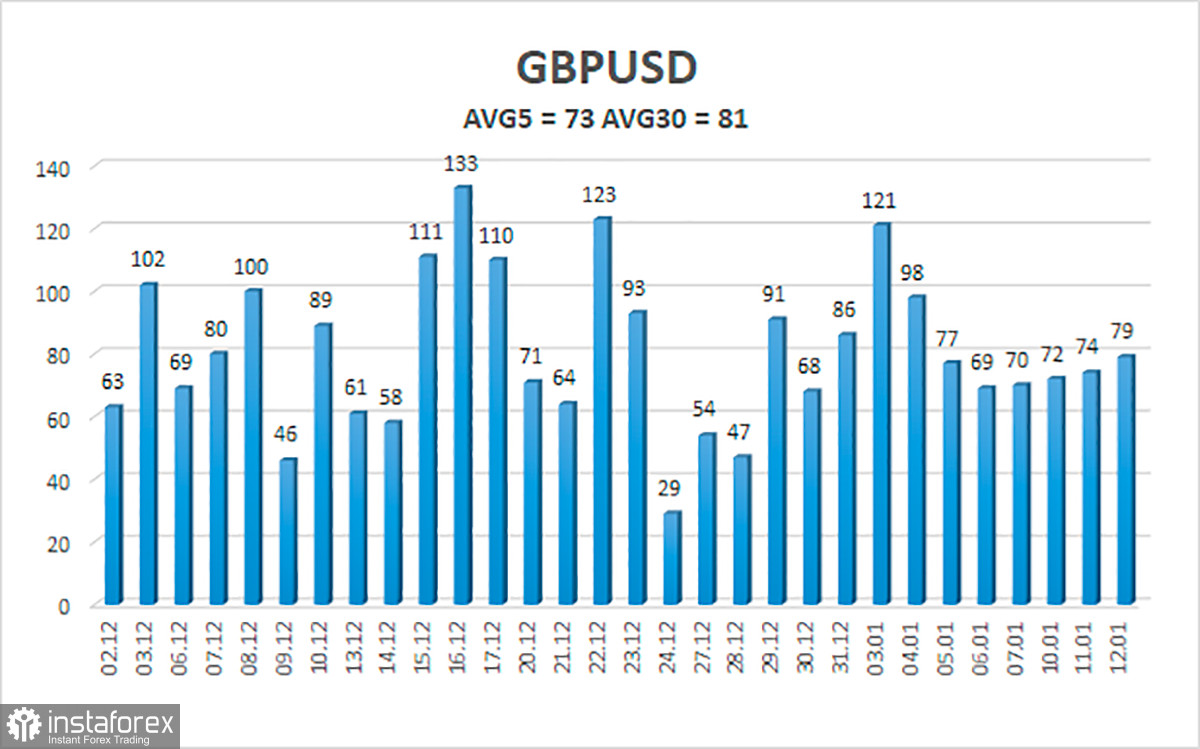

The average volatility of the GBP/USD pair is currently 73 points per day. For the pound/dollar pair, this value is "average". On Thursday, January 13, thus, we expect movement inside the channel, limited by the levels of 1.3624 and 1.3770. The reversal of the Heiken Ashi indicator downwards signals a possible new round of downward correction.

Nearest support levels:

S1 – 1.3672

S2 – 1.3641

S3 – 1.3611

Nearest resistance levels:

R1 – 1.3702

R2 – 1.3733

Trading recommendations:

The GBP/USD pair continues a strong upward movement on the 4-hour timeframe. Thus, at this time it is recommended to stay in the longs with targets of 1.3733 and 1.3770, as the price is still located above the moving average line. It is recommended to consider short positions if the pair is fixed below the moving average with targets of 1.3519 and 1.3489, and keep them open until the Heiken Ashi indicator turns upwards.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română