In today's GBP/USD review, the most attention will be paid to the technical picture of this trading instrument. Now let us quickly recap Jerome Powell's speech to the US Senate yesterday and discuss the most important macroeconomic report. As expected, Jerome Powell's speech before a US Senate committee was focused on rising inflation in the country. At the end of last year, the US Federal Reserve abandoned the term temporary inflation. Nevertheless, Powell assured the senators that the Fed would do its best to curb inflationary growth. The most important thing any major global central bank can do to deal with high inflation is to tighten monetary policy. Notably, such measures have already been announced by the Fed. However, if inflation continues to accelerate, the US central bank may start to raise interest rates sooner. It seems that investors were not satisfied with the rhetoric of yesterday's speech by the re-elected Fed chairman. This will become clear when we look at the GBP/USD charts. The US consumer price index will be released today.

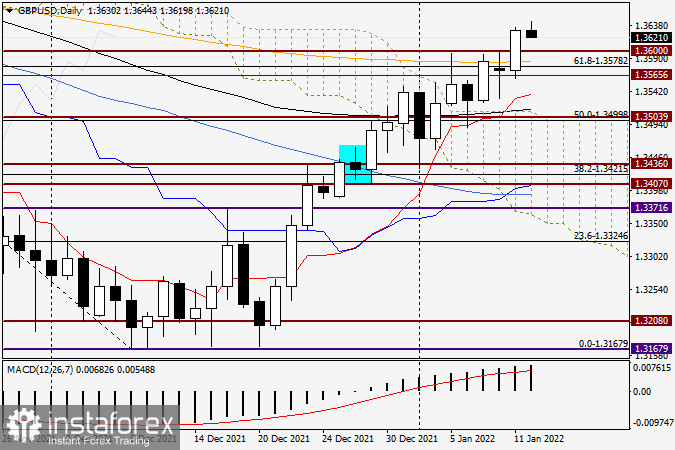

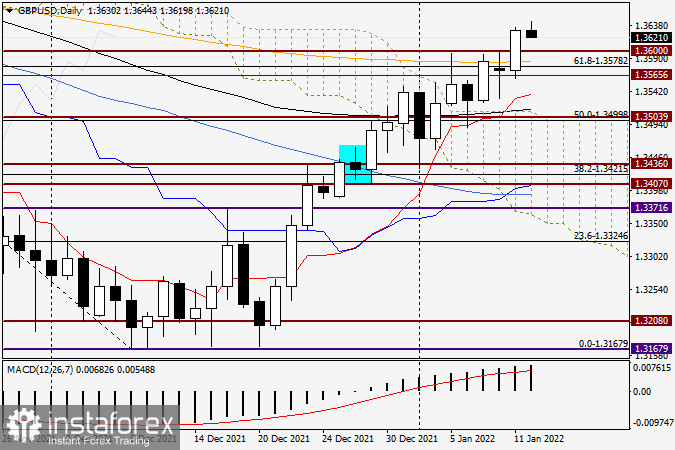

Daily

Despite the Fed chairman's assurances to fight rising inflation, the market was not inspired by his words. As a result, the GBP/USD rose significantly in yesterday's trading and closed Tuesday's session at 1.3630. Thus, a strong breakdown of the orange 200 exponential moving average as well as the landmark technical level of 1.3600 can be observed. Despite the fact that only one daily candlestick has closed above the moving and level, there is a strong bullish mood, which means that a true break-up of the 200 EMA and 1.3600 is highly probable. On the technical side, a pullback to the broken 200 exponent and the level of 1.3600 may be possible, after which I recommend considering options to open long positions in GBP/USD. If the pair goes back under 1.3600, 200-MMA and closes below that, the break-down will have to be considered as a false-break, and you will have to get ready to open short position in the British currency.

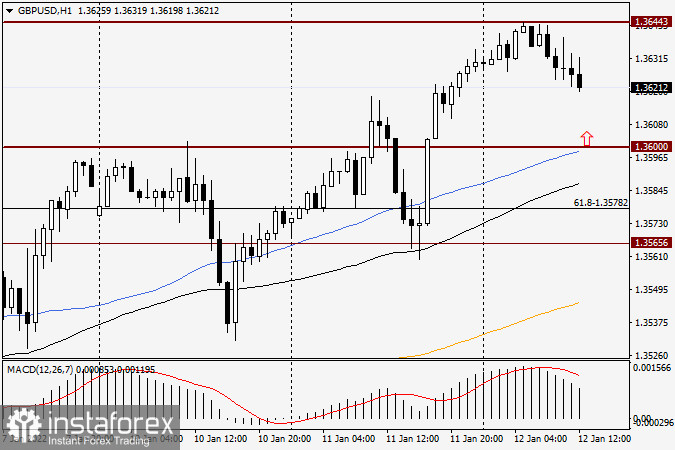

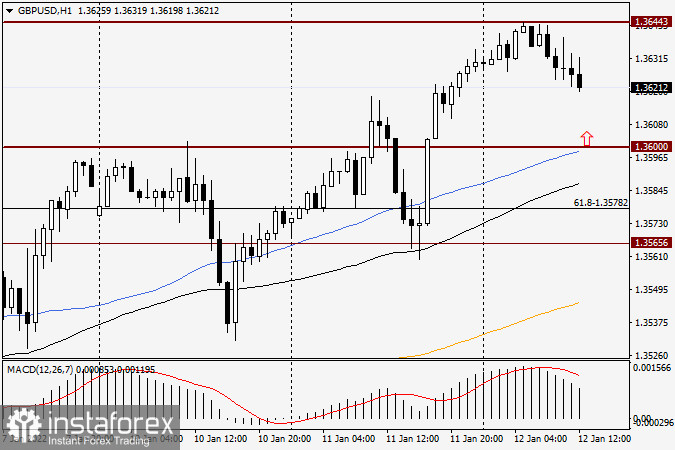

H1

As can be seen on the hour chart, during the Asian session the pound bulls tried to repeat yesterday's success, but after reaching the 1.3644 level the pair started to decline. The quote is likely to fall to the area of 1.3610-1.3600 and thus provide the opportunity for those who want to buy the GBP/USD pair. Another option for opening long positions, but at higher prices, could be a renewal of today's Asian highs, shown at 1.3644. In order to open short positions, it is necessary to wait for confirmation signals from Japanese candlesticks on the daily, four-hour or hourly charts. Currently, opening buy positions remains the main trading idea.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română