The markets reacted calmly on Monday despite the political news regarding global security issues. There was no growth in demand for protective assets, indicating that political risks are still viewed as neutral by investors. On Wednesday and Thursday, negotiations will continue at other venues, while consultations within the OSCE will take place in Vienna also on Thursday. Any positive news can cause a surge of enthusiasm in the markets, but everyone has been ready for negative news for a long time since they do not expect any breakthroughs from the negotiations.

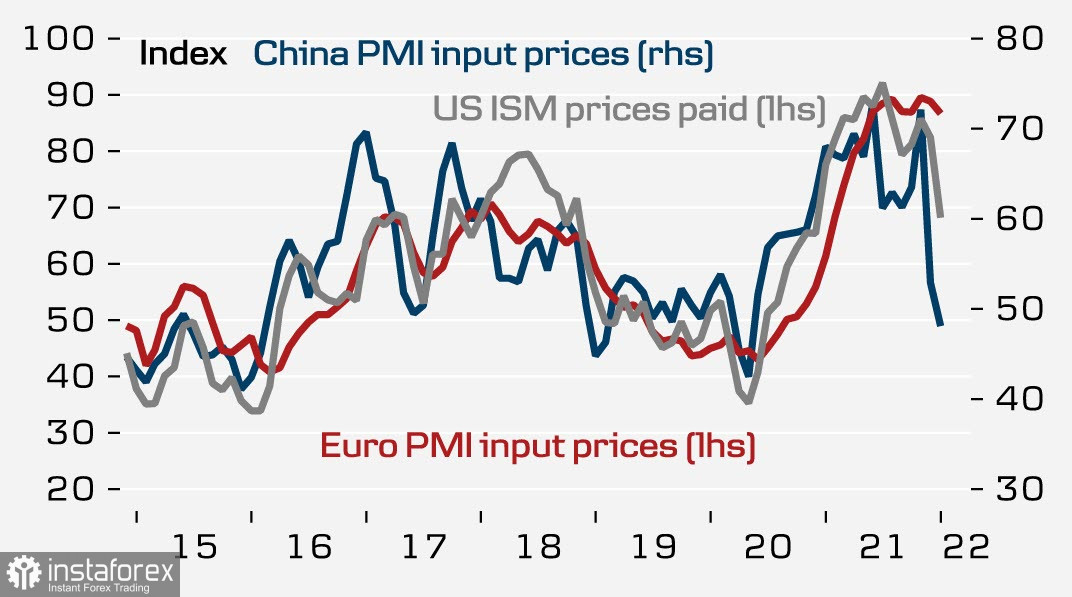

Today, the NFIB report on business activity in small businesses is also certainly interesting, primarily the employment and price pressure sub-indices, since it is prices that are now under the closest attention of central banks. While investors adhere to optimistic estimates, which assume a gradual decrease in inflationary pressures in the coming year, studies of business activity in the United States, China, and the EU suggest that the peak in prices has already been reached.

For today, the focus will be on the consideration in the US Senate Banking Committee of the re-nomination of J. Powell for the post of Fed chairman. Surprises are unlikely as Powell enjoys bipartisan support, but his comments on the current economic situation could provide new insights and thus provoke market moves.

As for financial markets, the main trend in January is that global yields have resumed their growth. 10-year UST approached 1.8%, the German bonds came to zero for the first time since May 2019, and 10-year Swiss treasury bills rose for the first time since November 2028. Such solidarity is explained by the fact that investors are preparing for the implementation of the Fed's hawkish plans.

The growing demand for risk shows signs of weakness. It can be assumed that the prevailing demand in the next 2-3 weeks will be for protective assets, primarily the US dollar and the Japanese yen.

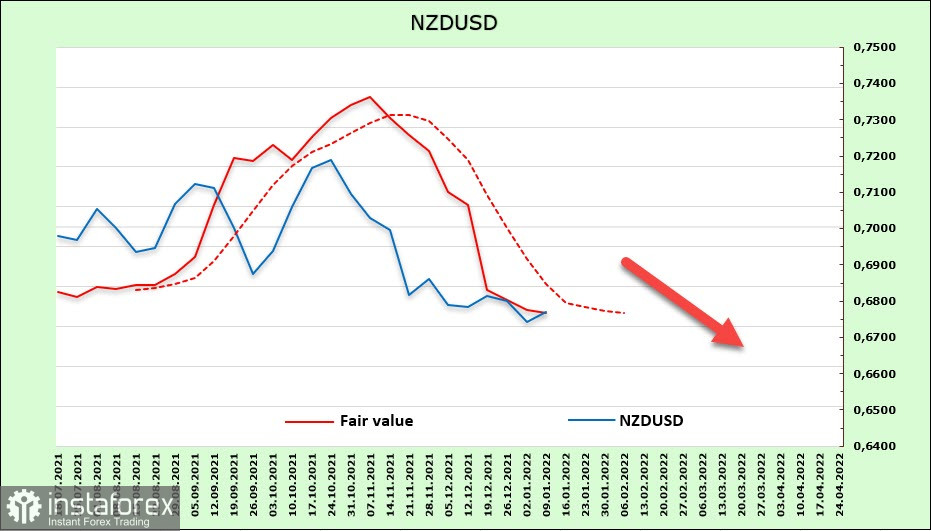

NZD/USD

Absolutely no new macroeconomic data has appeared. January is traditionally a holiday season in the southern hemisphere, so banks work only in critical areas. There are also no new analytical studies on the state of the economy or the Central Bank's plans, which means that one has to focus only on data from the stock exchanges.

As follows from the CFTC report, the net short position in the New Zealand dollar changed insignificantly (from -573 million to -602 million). The target price is clearly below the long-term average since the restoration of investors' optimism regarding the RBNZ plans did not happen. The two-week risk demand did not affect the NZD in any way, which could not form even a weak correction.

The New Zealand dollar is trading in a bearish channel, and so, there is a high probability of continued decline. Here, the nearest target is 0.6695. The lower border of the channel is located at 0.6630/40. A return to the middle of the 0.6870/90 channel is unlikely and will be immediately used to further sell.

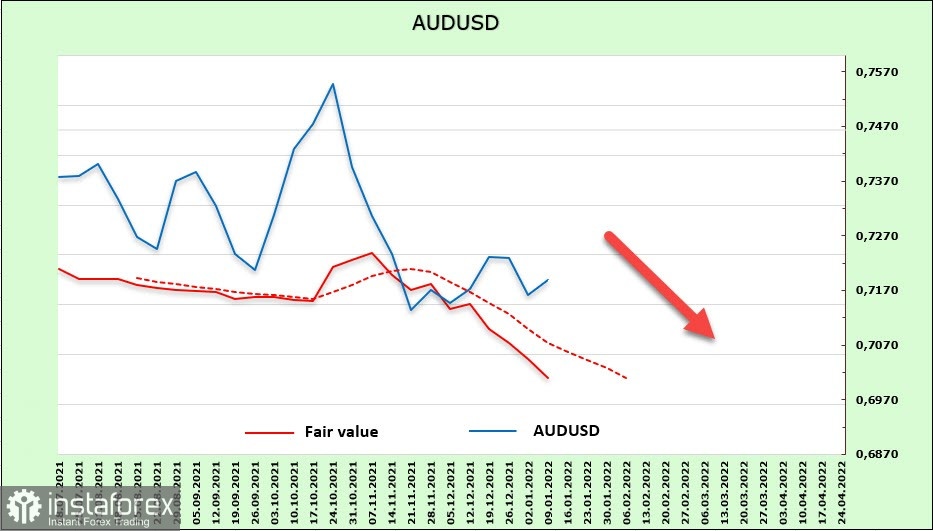

AUD/USD

The first data in the new year does not give a clear picture of the economic state of Australia. There is inflation, but the growth rate is still low – according to TD Securities, prices in December rose by 0.2%, or 2.8% yoy, which is significantly less than in the US or Europe, and therefore, it is not necessary to count on any proactive steps on the part of the RBA. The December PMI indices in the expansion zone do not show any dynamics.

According to the CFTC report, the Australian dollar lost 557 million during the reporting week, with the net-short position increasing to -6.467 billion. The advantage is more than serious, so speculators see no reason for a reversal of the bearish trend.

The upper border of the channel is 0.7350/70. A rise to this resistance is unlikely since it is more possible for the Australian dollar to find resistance at current levels near the middle of the channel and decline again to retest the low of 0.6993, then to 06890/6910.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română