The ICE dollar index remains in a narrow range, around 96.00 points since the end of November 2021. Now, it can only be taken out of this state by the Fed's decisiveness on the already inevitable increase in interest rates.

The reason for this behavior of the US currency against major currencies is the uncertainty factor provoked by the Fed last year when Fed Chairman J. Powell announced the start of an interest rate hike, starting this year and extending over the next two years. But at the same time, he did not make it clear when the first rate hike would take place.

We have repeatedly pointed out this reason as the main one that led to high volatility in the currency markets, which was accompanied by an abrupt growth and an equally sudden drop in the yield of US Treasuries. In turn, the American stock market and others also continue to react nervously to the uncertainty factor, showing a significant increase in volatility.

On Monday, massive profit-taking took place on the US stock market without any reason, but there were purchases as the shares declined. The dramatic shift in the mood of the market is yet another confirmation of the fateful impact of US inflation data, which will be released tomorrow. It is worth noting that inflation growth is expected to decrease in December in monthly terms with a significant increase in annual terms. The markets will take full account of the monthly data, as they are interested in the dynamics of inflation by month in order to understand when the first rate hike should be expected.

Markets will focus their attention today on the speech of Fed Chairman J. Powell, which is expected to begin at 15:00 Universal time. It is not yet clear whether it will be preceded by the release of tomorrow's inflation figures with any important comments, but if he allows himself to speak in the tone of high concern about inflation and the need for a prompt response, then this may cause another sell-off in the US stock market, which will affect other financial markets. In this case, the US dollar can receive support.

However, it seems that he can try not to talk about this topic or even somehow mix it up so as not to cause a negative wave in the markets. If this is really the case, then the main events should already be expected tomorrow on Wednesday amid the release of these inflation indicators.

We believe that if the monthly values of consumer inflation show a slightly larger decrease, this will lead to a rally in the stock markets and to a limited decline of the US dollar in the wake of a drop in the yield of treasuries. At the same time, its growth above expectations will cause a resumption of correction in world markets, which will support the exchange rate of the US currency.

Forecast for the day:

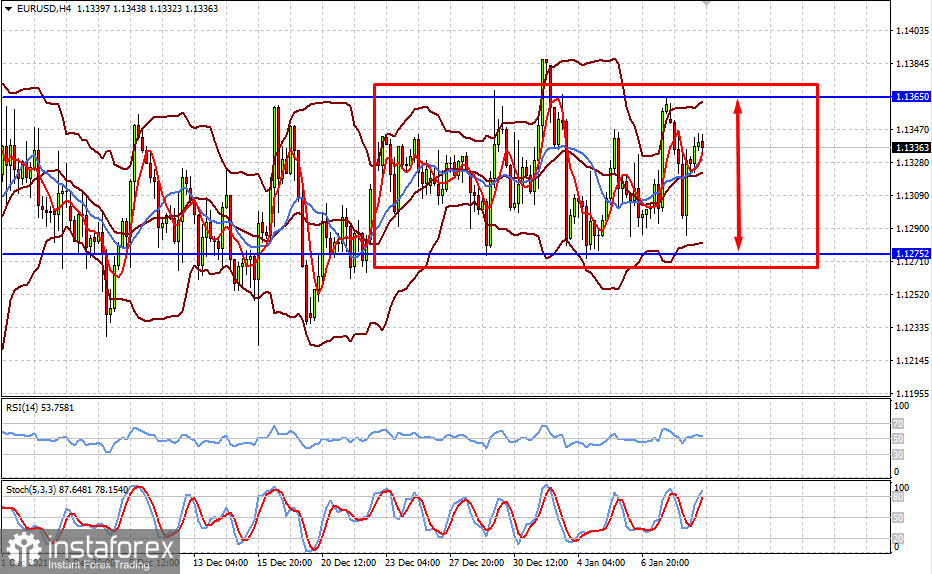

The EUR/USD pair is consolidating in a narrow range of 1.1275-1.1365 before the speeches of C. Lagarde and J. Powell today and the publication of new US inflation data tomorrow. Most likely, it will remain in this range until tomorrow, if neither Powell nor Lagarde informs the markets of something important regarding the prospects for the monetary policies of the Fed and the ECB.

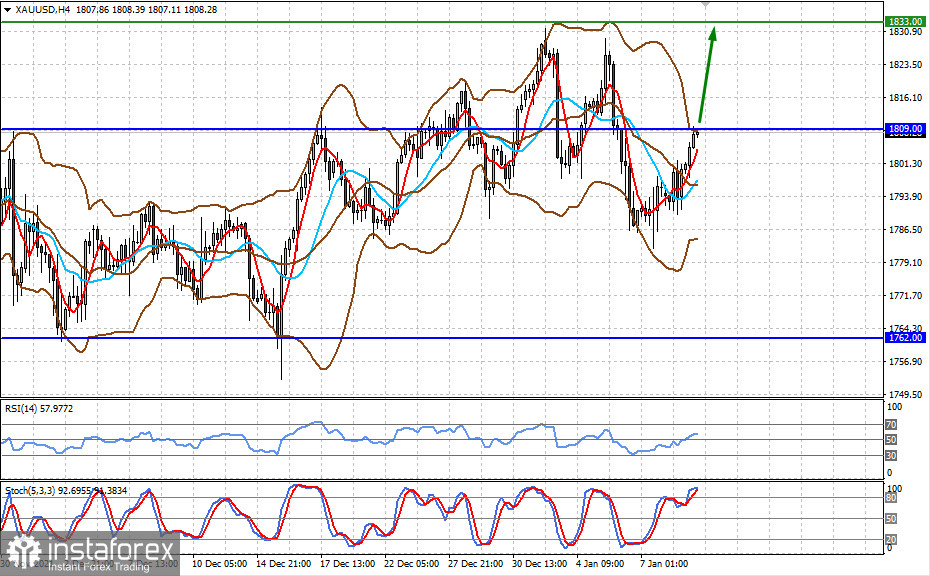

Spot gold is trying to recover after a local recovery amid a sharp decline in stock indices on Monday. The future of gold prices hinges on the Fed's resolve to raise interest rates earlier. Any rise in fears for the growth prospects of the US in particular and the global economy as a whole will lead to an increase in demand for "yellow metal". Locally, the price may rise to the level of 1833.00 after overcoming the level of 1809.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română