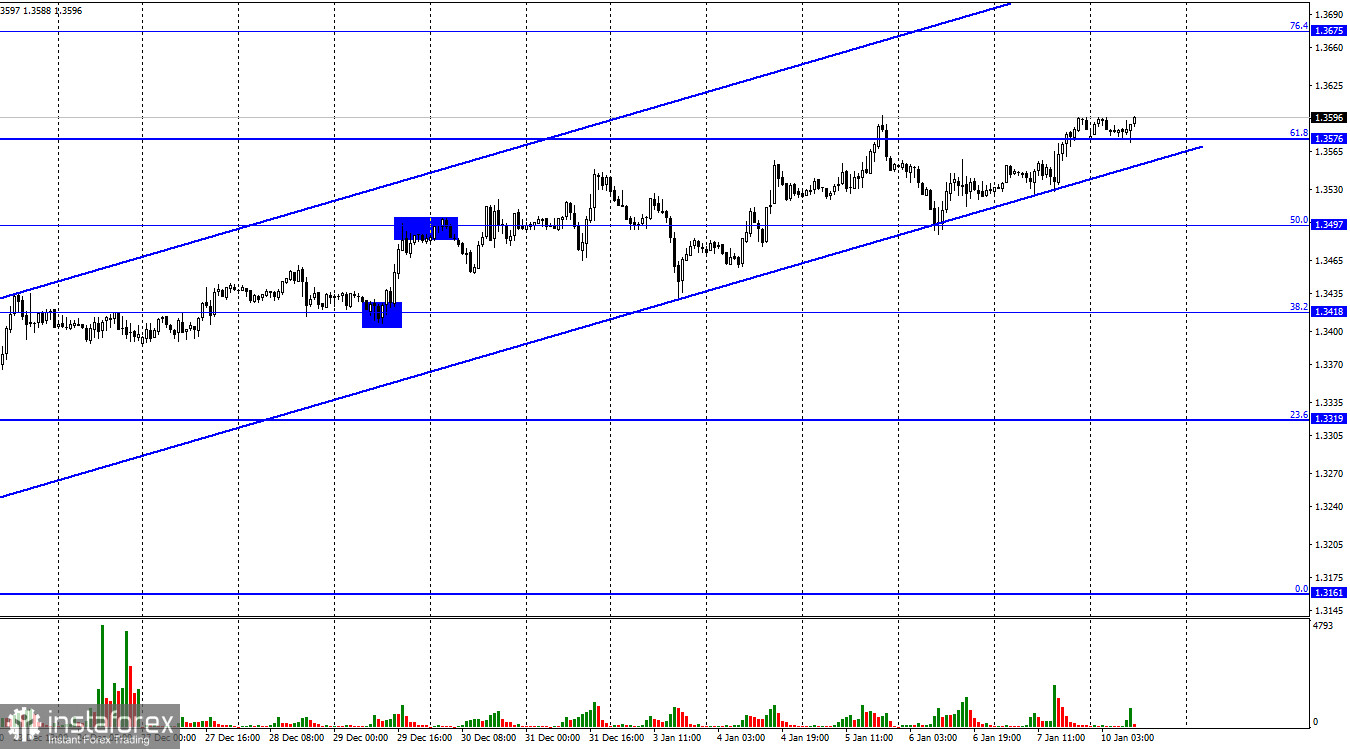

According to the hourly chart, the GBP/USD pair on Friday performed a rebound from the lower boundary of the ascending corridor and resumed the growth process in the direction of the corrective level of 76.4% (1.3675), also completing a close above the Fibo level of 61.8% (1.3576). Thus, the growth process can be continued this week. The euro and the pound are now trading completely differently, so the pound may well continue to grow while the European has been standing in one place for a month and a half. At the same time, fixing the pair's exchange rate under the ascending corridor will work in favor of the US currency and the beginning of a new, possibly long-term fall towards the levels of 1.3497 and 1.3418. The information background on Friday was almost completely identical with the euro/dollar pair. There was only no report on inflation in the UK. But in any case, traders only looked at the US data, so the dollar grew in the same way based on weak payrolls in America. All other reports, although they were also quite important, were ignored.

I also want to note that the pound is growing calmly during a period when omicron diseases continue to grow in the UK. The average daily value of infections over the past 7 days is almost 180 thousand per day. This is three times higher than at the height of the previous wave at the beginning of last year. The number of diseases is so great that Boris Johnson had to resort to the help of the military, who were sent to some hospitals in those regions and districts where most patients and most medical personnel went to self-isolation. But, as we can see, this heavy news does not affect the British rate. Everything still largely depends on American news, as well as on the graphic picture. Therefore, I draw your attention once again to the upward trend corridor. This week, only on Friday, there will be an interesting fundamental background in the UK (reports on GDP and industrial production). For the rest of the week, traders will be reviewing the US inflation report, as well as Jerome Powell's speech to Congress.

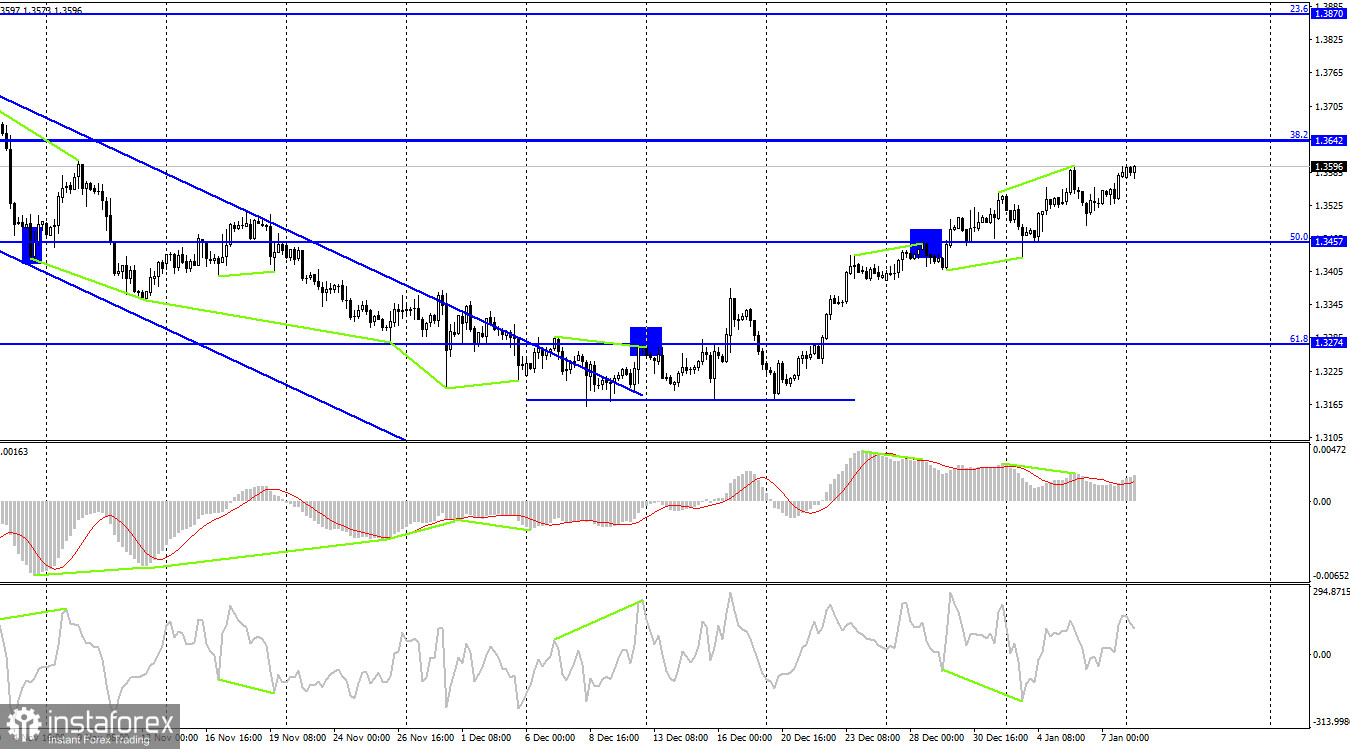

On the 4-hour chart, the pair performed a slight drop after the formation of a "bearish" divergence at the MACD indicator, after which a reversal in favor of the British and a resumption of growth in the direction of the corrective level of 38.2% (1.3642). There are no new emerging divergences in any indicator today. A rebound from the level of 1.3642 will work in favor of the US currency and some fall in the direction of the Fibo level of 50.0% (1.3457). Closing above the 38.2% level will increase the probability of further growth towards the next Fibo level of 23.6% (1.3870).

News calendar for the USA and the UK:

On Monday, there is not a single important economic event on the calendars of Great Britain and America. Thus, the information background will be absent today and will not have any effect on the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the pound if there is closure under the uptrend corridor on the hourly chart with a target of 1.3497. I recommended buying the British with a target of 1.3576, as the rebound from the level of 50.0% (1.3497) was performed. Since the level of 1.3576 has been overcome, it is possible to stay in purchases with a target of 1.3642.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română