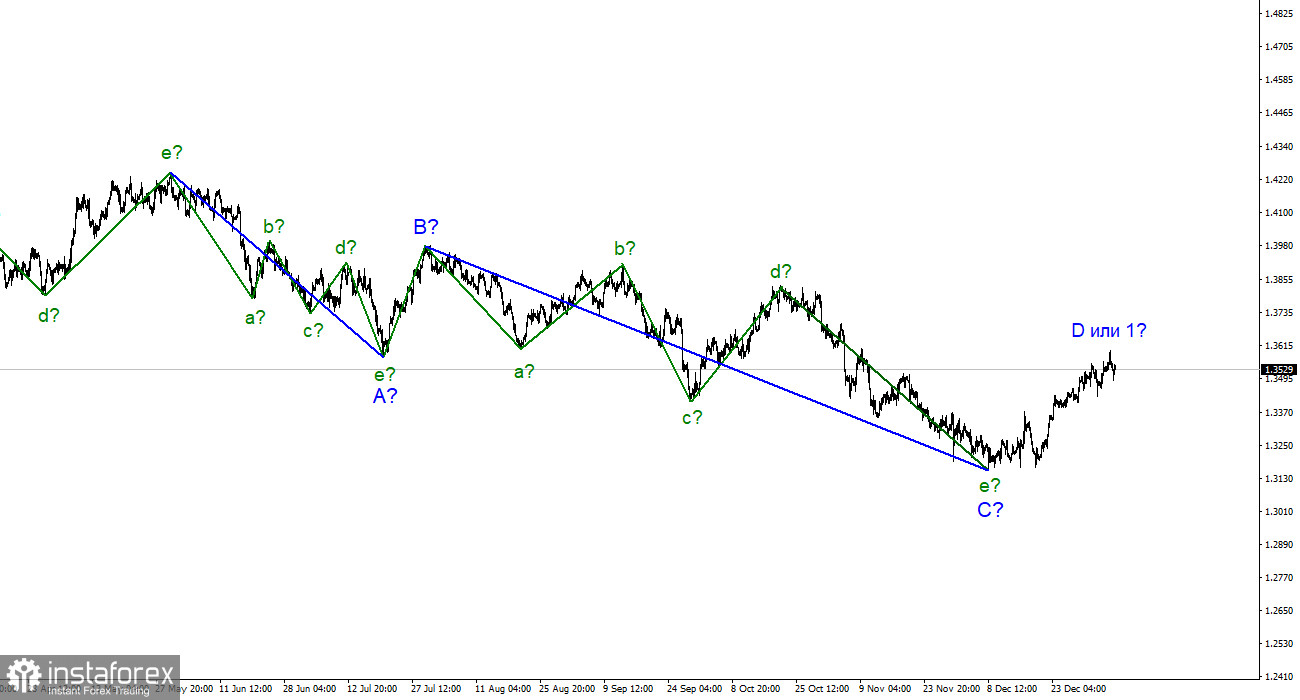

For the pound/dollar instrument, the wave markup continues to look quite convincing although it acquires a more structured appearance. In the last few weeks, the instrument has continued to build an upward wave, which is currently interpreted as wave D of the downward trend segment. If this assumption is correct, then the decline in quotes will resume after the completion of this wave, which may happen in the near future, given the size of the corrective wave B, which is visible in the picture below. Thus, the entire downward section of the trend may take on an even more extended form. However, at the moment, the increase in the quotes of the instrument continues, and wave D can take a five-wave form. If this happens, then it will need to be recognized as an impulse, and in this case, it will no longer be able to be a corrective wave D, and the entire wave pattern will require additions. Then an alternative option with the construction of a new upward section of the trend may come into force, and starting from December 8, in this case, we observe the construction of its first wave. An unsuccessful attempt to break through the 1.3456 mark, which equates to 50.0%, indirectly indicates the readiness of the market to continue buying the British.

The Fed minutes briefly returned interest in the dollar.

The exchange rate of the pound/dollar instrument during January 6 first decreased, and then increased. The decline in the British dollar was caused by the rather "hawkish" FOMC protocol, which came out late last night. According to this document, the Fed expects three rate hikes in 2022, three increases in 2023, and also believes that monetary policy should be tightened faster than previously planned. Such an initiative is supported by the majority of FOMC members. But at the same time, this protocol failed to radically turn the market against the British, which continues to remain at the stage of building an upward wave. In the UK, a report on business activity in the service sector in December has already been released today. This indicator rose from 53.2 basis points to 53.6 points in December. Thus, the Omicron strain epidemic did not affect the service sector. Meanwhile, the number of Omicron cases continues to increase in the UK. But the country's authorities are still silent and do not believe that a new wave of diseases requires the introduction of strict quarantine measures, because the number of complications is still small. One can only guess how many Britons will become infected with Omicron and what the government's actions will be if a new strain discovered in France the other day gets spread. Or any new strain. Since scientists and doctors have not yet figured out how to stop the virus, it can continue to mutate and evolve, throwing humanity more and more new strains. The British and other currencies almost do not react to this news in any way. Thus, I believe that wave marking continues to be in the first place now.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the completion of the construction of the proposed wave D in the near future. Since this wave has not yet taken a five-wave form, I expect that a new descending wave E will be built. And it should begin in the very near future. Therefore, I advise you to sell the instrument with targets located near the calculated marks of 1.3271 and 1.3043, which corresponds to 61.8% and 76.4% by Fibonacci, if a successful attempt to break through the 1.3456 mark is made. Or an unsuccessful attempt to break through the 1.3639 mark, which corresponds to 38.2% Fibonacci.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română