Analysis of transactions in the GBP/USD pair

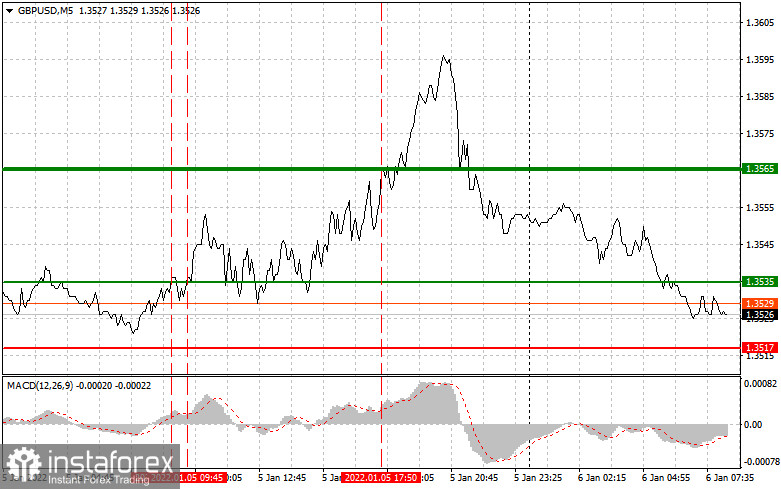

GBP/USD hit 1.3535 at a time when the MACD line was already far enough up from zero, which was limiting the upside potential of the pair. After a while, we could see a renewed update of this level. At that moment the MACD line was already in the overbought area, which led to a sell signal for the pound. Unfortunately, it brought losses as the bulls made further gains in the pair. The price moves of 1.3565 in the afternoon also did not bring a good result, as no major move downwards took place after the sell signal.

Yesterday's services PMI and US composite PMI reports, as well as the ADP employment change data for December were much better than economists' forecast. However, dollar buyers only reacted to the Fed meeting minutes from the December meeting. It reported on a more aggressive interest rate policy by the Federal Reserve's management to combat inflationary pressures.

UK services activity data will be released today. December's UK service sector PMI and composite PMI will be important as their decline could slow down the pace of economic growth at the end of last year. This will be a bad signal for the British pound which has just started to recover from the bear market. In the afternoon, reports on the foreign trade balance and initial jobless claims in the US could add pressure on the pair. However, yesterday's reports did little to help the dollar. Therefore, one should not expect a serious market reaction even with a very good result. However, the ISM Services Business Activity Index could really support the dollar, as an improvement in this indicator would have a positive effect on the economy. This would be a signal to sell the GBP/USD pair.

For long positions:

It is possible to buy the pound today when the entry point is reached around 1.3538 (green line on the chart) with the growth target to the level of 1.3586 (thicker green line on the chart). The pound can be expected to rise further along the trend, but a break of the December highs and good service sector data are needed. Before buying, make sure that the MACD line is above zero, or is starting to rise from it.

It is also possible to buy at 1.3517, but the MACD line should be in the oversold area, as only by that will the market reverse to 1.3538 and 1.3586.

For short positions:

To sell the pound today is possible only after the level of 1.3517 will be reached (red line on the chart). It will lead to a rapid decline in the pair. A key target for the sellers will be the level of 1.3480. Pressure on the pound will be in case of weak UK service sector activity data. Before selling, make sure that the MACD line is below zero, or is starting to move down from it.

Pound could also be sold at 1.3538, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.3517 and 1.3480.

What's on the chart:

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română