The skyrocketing U.S. Treasury yields on the first trading day of 2022 made gold a whipping boy. However, the bulls on XAUUSD quickly recovered, taking advantage of the information about the reduction in inflationary pressures. Despite the fact that the precious metal is usually perceived as a hedge against inflationary risks, the slowdown in CPI and the spread of Omicron reduce the likelihood of aggressive monetary restriction by the Fed, which is good news for gold.

The rally in stock indices and U.S. Treasury yields look odd at first glance. The United States has updated the daily anti-record of COVID-19 infections, which now amounts to almost 1 million. The number of hospitalizations for the week increased by 50% and for the first time since last year's winter surge exceeded the 100,000 mark. Nevertheless, the Dow Jones index marks new all-time highs, and investors are dumping such a safe-haven asset as Treasury yields. Has the world has gone mad?

Investor optimism stems from the low deaths and hospitalizations from Omicron compared to the Delta variant. The version that the new strain will replace the previous one and become a kind of analogue of seasonal flu dominates the market, increasing the demand for risk. At the same time, the Fed's monetary normalization leaves vulnerable assets that thrived during the pandemic - tech stocks and bitcoin.

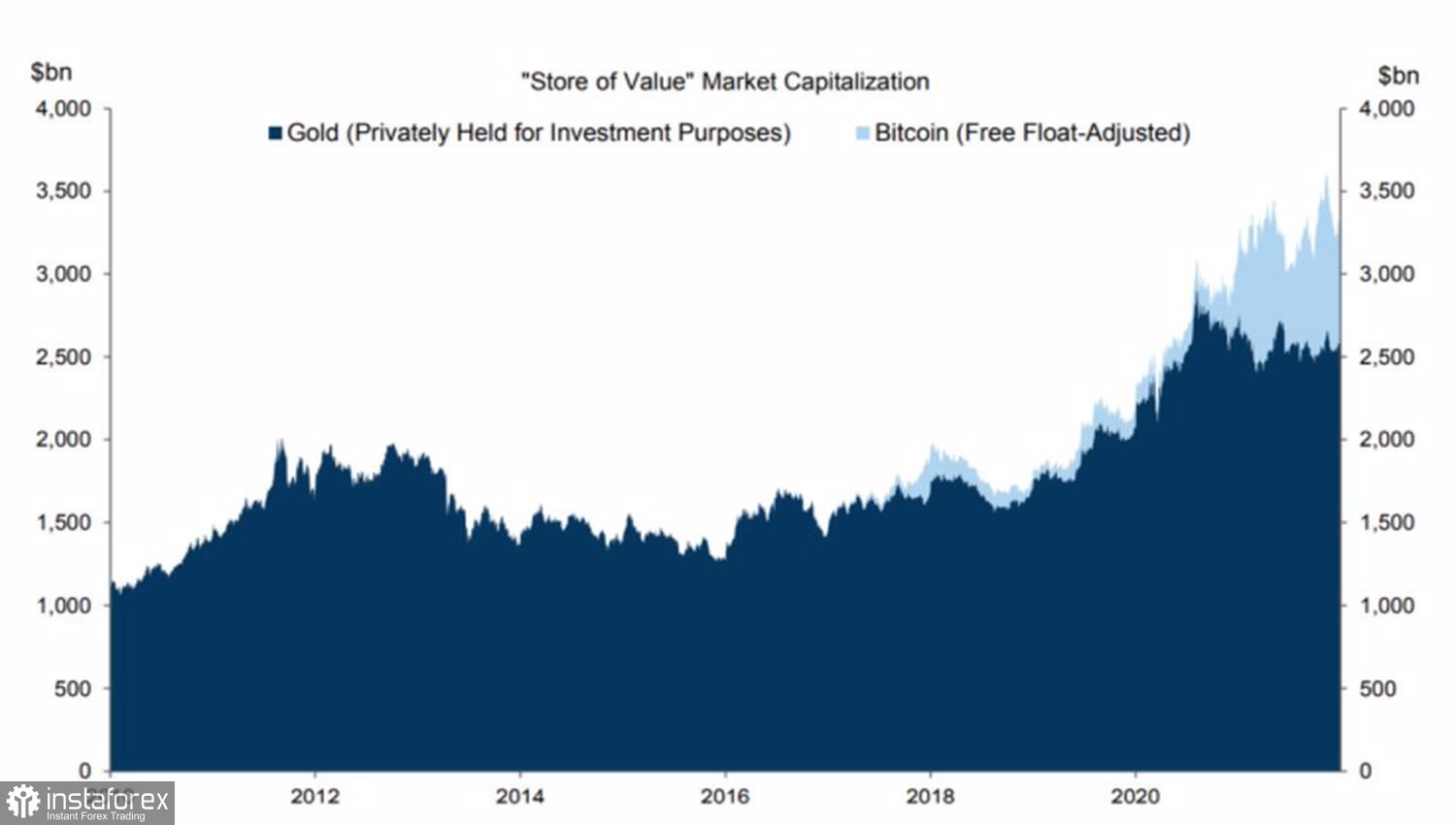

According to Goldman Sachs, an increase in the latter's share in the savings market, which also includes precious metals, from the current $700 billion, which is equivalent to 20%, will lead to an increase in BTCUSD in the direction of 100,000 and a simultaneous drop in XAUUSD quotes. While bitcoin is pouring in, gold is in demand.

Dynamics and structure of the savings market

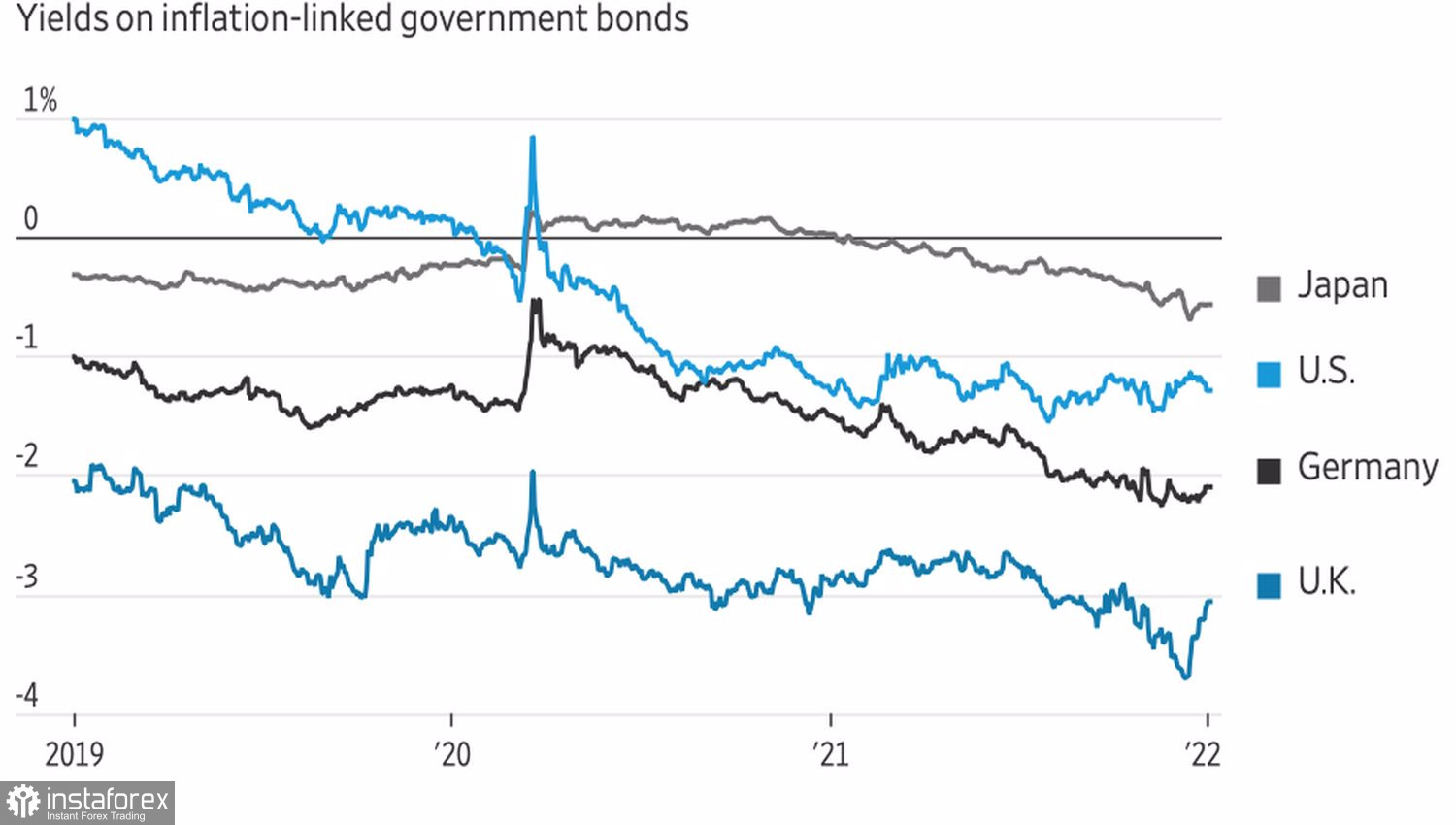

The precious metal is supported by the U.S. dollar, which started uncertainly in 2022, signs of a decline in inflationary pressure around the world, as well as the real bond yield, which continues to be in the area of a record bottom.

Dynamics of real bond yields

Inflation expectations are falling in the UK. In France, consumer prices stabilized at the same level in November and December, which allowed Bank of France Governor Francois Villeroy de Galhau to say that inflation in the country and in the eurozone had peaked. Data from the U.S. Institute for Supply Management shows that prices paid for materials have fallen to their lowest level in nearly a year.

Signs of cooling inflation could make the Fed less aggressive than the market anticipates. They expect a federal funds rate hike in March with a 66% probability. If this does not happen, the U.S. dollar will weaken and the XAUUSD quotes will rise. In my opinion, the Fed needs a whole picture. And strong statistics on employment for December will support the U.S. currency, contributing to the sale of precious metals.

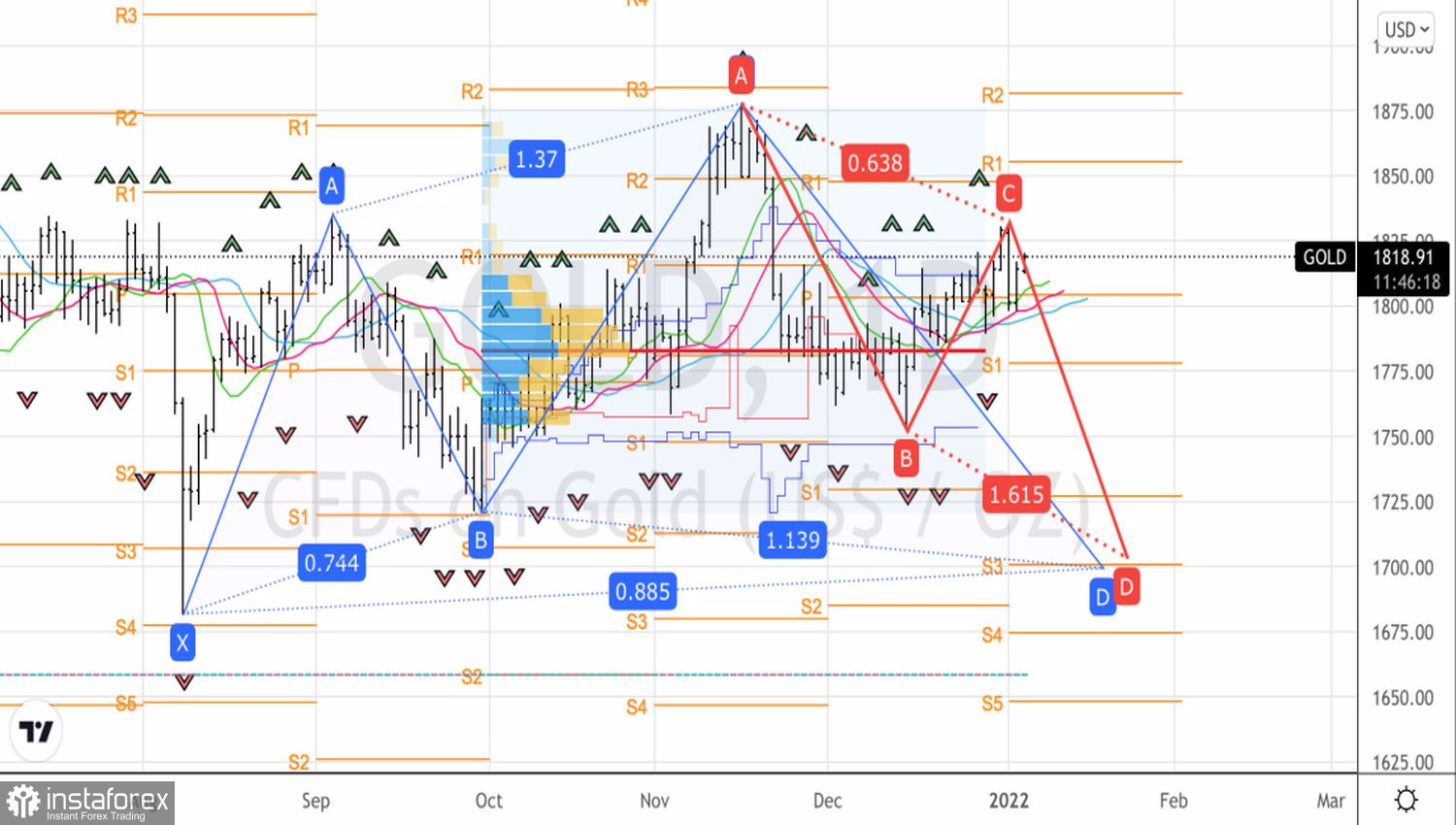

Technically, it makes sense to use the fall of gold below the support at $1,798 or the rebound from the resistances at $1,828 and $1,844 per ounce to sell in the direction of targets at 161.8% and 88.6% according to the AB=CD and Shark patterns.

Gold, daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română