In the previous two reviews on EUR/USD, which were posted this week, the main event was called data on the US labor market, which will be published on Friday, January 7. At the same time, it was noted that in the first week of the new year 2022, we are waiting for several more very important events, which will be mentioned directly on the day of their release. Perhaps, in second place after Nonfarm Payrolls, you can safely put the minutes of the last meeting of the Open Market Committee (FOMC) of the US Federal Reserve, which will be published today at 19:00 London time. I would like to remind you that this document shows the economic situation in the United States in the most profound and detailed way to help identify the approximate number of "doves" and "hawks" among the voting members of the FOMC. The minutes may also provide a clearer understanding of the Fed's next steps in monetary policy. Another detail that should be paid attention to is that the minutes are published three weeks after each meeting of the Open Market Committee. What can we expect from the protocols published tonight? I guess that's nothing new. The Fed is increasingly showing "hawkish" rhetoric and is preparing to complete the economic stimulus program by about the middle of the coming year, after which it will proceed to the process of starting to raise interest rates. All this has been well known to market participants for a long time.

So, another example of the replenishment of the ranks of the "hawks" can be considered the statements of the head of the Federal Reserve Bank (FRB) of Minneapolis and a member of the FOMC Kashkari, who, like many of his colleagues, is seriously concerned about strong inflationary growth in the United States. In this regard, the head of the Federal Reserve Bank of Minneapolis made it clear that the publication of April inflation reports could be the basis for raising the main interest rate in May. Let me remind you that earlier this monetary official, who is traditionally considered (or was considered) a "dove", spoke in favor of raising the rate only in 2024. Do you feel the difference? In my personal opinion, the market knows all this, understands it, already taking into account to a greater extent the events related to the tightening of monetary policy in the coming year in the price of the US dollar. I dare to assume that if softer notes appear in today's protocols, the US dollar risks falling under selling pressure. If the "hawkish" rhetoric persists, the "American" can strengthen its position against the single European currency, but I don't think that significantly, since the upcoming tightening of the Fed's monetary policy has already been taken into account in the USD price for the most part.

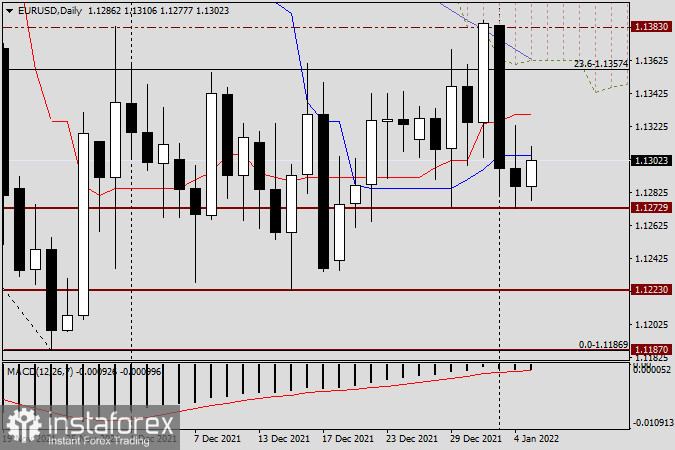

Daily

Despite yesterday's positive statistics on the German labor market and weaker than predicted data from the United States on the level of vacancies and labor turnover, as well as the report on the production index of the Institute of Supply Management (ISM), the pair continued its downward trend. Thus, we can once again admit that macroeconomic reports of varying degrees of importance are not always taken into account and are won back by bidders. According to the technical picture, it should be noted that yesterday's trading ended under the red Tenkan line and the blue Kijun line of the Ichimoku indicator, which previously provided strong support to the quote, and now can change their status to no less serious resistance. Actually, at the moment of completion of this article, we see that the blue Kijun line, passing at 1.1305, is holding back growth attempts so far. However, the euro bulls do not intend to give up, and right now they are making every effort to return the quote first above Kijun, and then Tenkan. If this happens, we can count on continued growth. I believe that much will depend on the content of the FOMC protocols and the reaction of market participants to them.

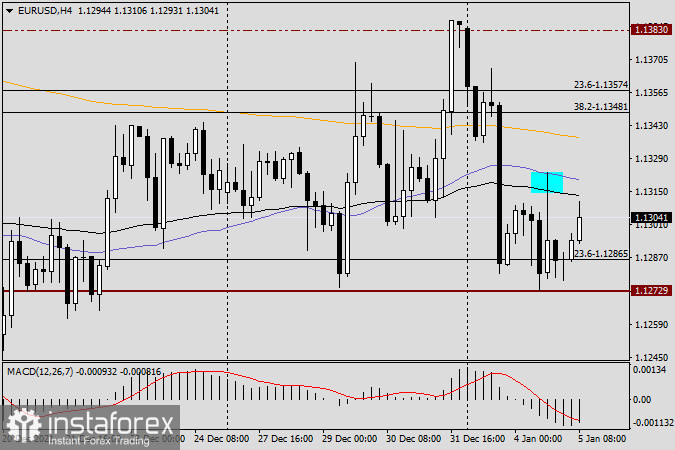

H4

The four-hour chart clearly shows how the moving averages used have an impact on the price. It is not for nothing that they are mentioned in virtually every euro/dollar review, and not only for this currency pair. At yesterday's trading, EUR/USD bulls made every effort to return the quote to growth, however, the blue 50 simple and black 89 exponential moving averages acted as an insurmountable obstacle to the quote's path in the north direction. But above, at 1.1338, there is also an orange 200 exponent, which is also able to provide very strong resistance and turn the pair down.

Trading recommendations for EUR/USD

Given that the hawkish rhetoric will remain in the FOMC protocols, as well as the fact that for two days in a row the trades have been closed under the significant technical level of 1.1300, I assume that at this stage of time, sales look like the main trading idea for EUR/USD. I recommend taking a closer look at the opening of short positions on attempts to break up the indicated moves and the appearance of reversal patterns of candle analysis under them. At the same time, I do not exclude growth, which will become most relevant after the pair's consolidation above the 1.1313 level and a rollback to this mark. Once again, I would like to draw your attention to the fact that the evening publication of the FOMC protocols may significantly affect the price movement of EUR/USD and change this forecast.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română