Yesterday, the EUR/USD pair approached the lower border of the range 1.1260-1.1360, within which it has been traded since the end of November 2020. For the last five weeks, both sellers and buyers of this pair have tried to leave this range several times, but they come back every time, continuing to hover around the level of 1.1300.

At the start of the new trading week, the bears took the initiative again. They did not allow the EUR/USD bulls to approach the borders of 1.14: the pair fell by more than a hundred points in just two days. However, sellers also failed to continue their success. As soon as the price approached the lower limit of the above range, the downward impulse faded. This was facilitated by the published macroeconomic statistics in the US.

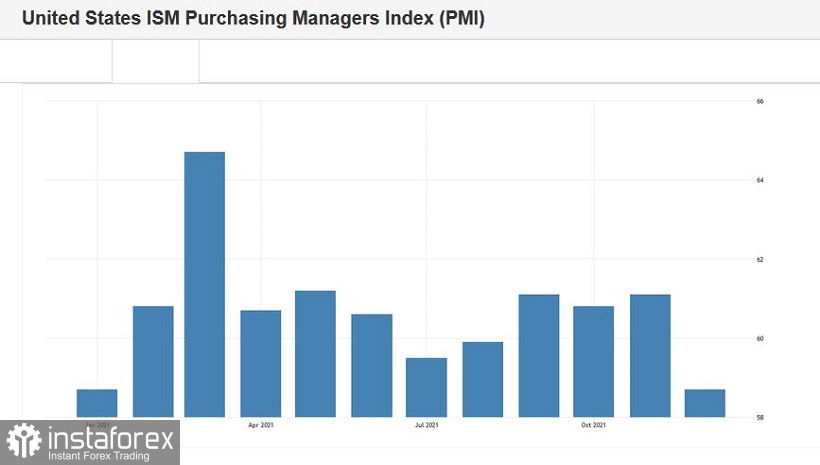

In particular, the ISM manufacturing index came out at around 58.7 points, which is the weakest result since January last year. Compared to the previous month, other components of the release also decreased (the rate of new orders, production volume). The price component of the ISM index (an indicator of the dynamics of the growth of prices for commodities) was at 68.2 against the expected growth of 79.3. This is the weakest result since November 2020.

The news that more than 1 million new cases of coronavirus were detected in the United States per day also exerted additional pressure on the US dollar. According to the country's chief virologist, the curve of new infections in the United States is practically vertical. This rate of daily growth is a record not only for the United States but for the whole world. The previous record was recorded in India, where 414 thousand people were infected on May 7 last year in 24 hours.

Despite the fact that the recorded COVID-19 cases put background pressure on the US dollar, it did not become a hindrance for the US dollar. On the one hand, Omicron has disrupted the normal rhythm of life of many US residents – flights are being massively canceled in the country, thousands of American schools have postponed the return of students to classes after the holidays, or have switched back to distance learning. On the other hand, the authorities still reject the option of introducing a nationwide lockdown. According to relevant officials, the seriousness of the situation now needs to be assessed not by the number of infections, but by the number of hospitalizations. So, despite the millionth increase in infected people per day (with 323 million people in the country), the proportion of those admitted to the hospital is relatively small. This suggests that Omicron is much less likely to lead to a severe course of the disease. This is also proven by the example of Great Britain, where the new strain came earlier. There, the rate of those infected is also rising (the day before yesterday, the daily increase was 200 thousand with a population of 67 million), but the number of people admitted to the hospital remains small. Less than 2% of those infected get to the hospital, whereas last year (January-February) up to 10% of those who became ill were in a hospital bed.

Given this disposition, the "coronavirus factor" did not let the US currency sunk. Of course, the millionth daily increase was surprising, but nothing more. The US authorities are not going to close the country for a new lockdown, and this fact is decisive in the context of the prospects of dollar pairs including the EUR/USD pair.

Meanwhile, the rhetoric of the representatives of the Fed and the ECB suggests that the divergence of the positions of these Central banks will be brighter this year. On Tuesday, the head of the Central Bank of France, Francois Villeroy, said that Eurozone's inflation is already "close to its peak values", as the first signs of stabilization appeared last month. In this context, he reiterated that the European Central Bank should not make hasty decisions. At the same time, Fed representative Neel Kashkari said that two rounds of interest rate increases are expected this year. He also made it clear that the decision on the first increase will be made based on the results of the first quarter of 2022 – that is, already at the April meeting. According to Kashkari, the problems of high inflation growth are much more significant than the problems of low inflation.

Such a fundamental background suggests that buyers of the EUR/USD pair do not have enough arguments for an upward breakthrough. In the medium term, the pair will either settle within the range of 1.1260-1.1360 or decline if the minutes of the last Fed meeting, which will be published tonight, turn out to be in favor of the US dollar. A more hawkish attitude of the regulator will help the EUR/USD bears to go to the level of 1.1240 (the lower line of the Bollinger Bands indicator on D1) and further to the base of 1.12. It is too early to talk about lower price values, but at the same time, any upward surge can still be used as an excuse to open short positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română