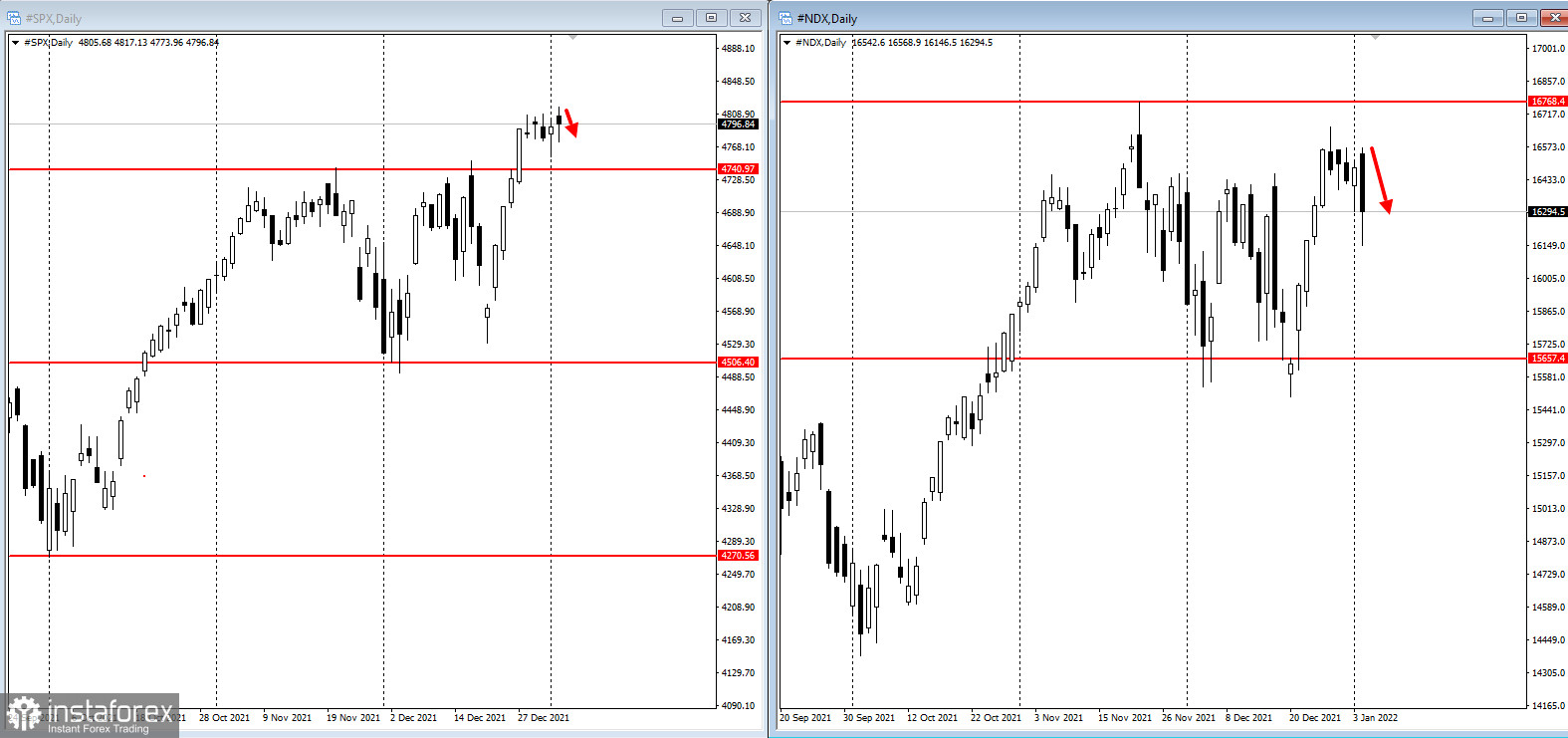

The S&P 500 dipped on Tuesday as latest data showed mixed signals on US inflation ahead of three expected rate hikes by the Federal Reserve this year. Prices paid by manufacturers turned out much lower than expected in December, indicating that inflationary pressures may have peaked in some areas. In addition, data showing massive layoffs in the United States heightened concerns over wage inflation.

Tech-heavy Nasdaq also fell by 2%.

According to reports, Zoom lost 5.1%, Apple shed 4.5% and Tesla shares dropped by 4.7%.

The losses came as US bonds continued to crash on Tuesday, with the 10-year Treasury yield rising four basis points to 1.67%, after rising 12 basis points on Monday.

FBB Capital Partners research director Mike Bailey said: "The 10-year Treasury yield is on fire and that could be weighing on sentiment for growth stocks, especially expensive ones, such as tech and semis."

Matt Maley, chief market strategist at Miller Tabak + Co, added that the downgrade looked like a delayed response to the rise in long-term interest rates. "Yesterday's big bounce in the 10-year yield did not seem to have a definitive catalyst, so some investors thought it might not hold," he said. "Since the rise is holding today, even extending, stock investors are finally reacting to it," he added.

Markets are anticipating a surge in volatility as Omicron continues to spread, supply chain disruptions persist and central banks wind down incentives. On Monday, over a million people in the US were diagnosed with Covid-19, a new daily record.

Luke Hickmore, investment director at Standard Life Investments, said: "With bond yields moving higher, the market is adjusting tech lower. Tech is suffering from the long duration nature of these assets -- i.e. it is generally a long time until the current valuation is supported by earnings in a normal multiple."

Investors are expecting the Fed to tighten policy to boost yields and revalue stocks. The upcoming US wage data and FOMC minutes will shed more light on the pace of such a shift.

Other important events for this week are:

- FOMC minutes (Wednesday);

- James Bullard's discussion on US economy and monetary policy (Thursday);

- Mary Daly's speech on monetary policy (Friday);

- Isabel Schnabel's speech (Saturday).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română